The price of Brent crude ended the week at $71.07 after closing the previous week at $71.84. The price of WTI ended the week at $67.15 after closing the previous week at $68. The price of DME Oman crude ended the week at $70.78 after closing the previous week at $71.39.

Two weeks ago, we stated that a key resistance level for the price of Brent crude was $76. If the price of Brent crude could break above this level, we thought that Brent crude could move towards $80. Otherwise, we expected that the price of Brent crude would likely drift downwards to $72. The price of Brent crude did not break through $76 and subsequently drifted downwards.

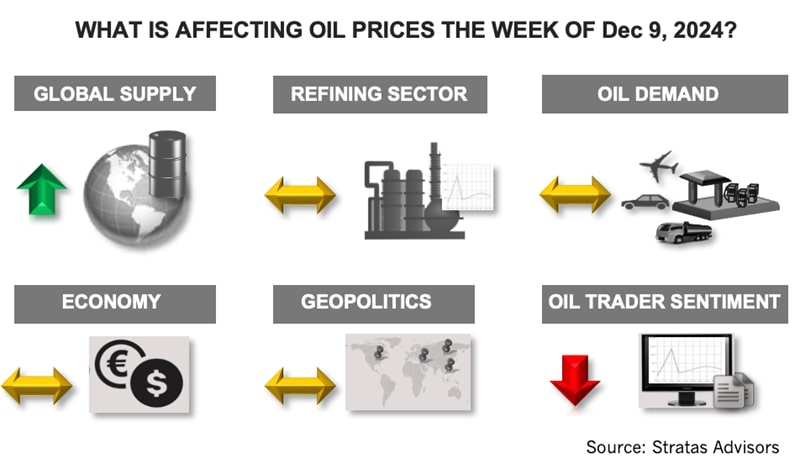

As we have been highlighting and expecting, OPEC+ announced at its meeting at the end of last week that its members will continue to delay the unwinding of supply cuts. Given the current level of oil prices and the supply/demand dynamics, OPEC+ has plenty of incentive and supporting rationale to delay any change to its supply until the beginning of 2Q of 2025. As we previously indicated, the delay will provide time for OPEC+ to learn more about the intentions of the reelected President Trump, who has discussed policies that are positive and negative for oil prices. From a positive perspective, Trump has indicated that he will place sanctions on the Iranian oil sector and Venezuelan oil sector – and reduce support for alternatives. From a negative perspective, he is supporting an increase in domestic oil production. With the latest delay, the unwinding of production cuts will take until Dec. 31, 2026.

While the delay by OPEC+ will help establish a floor under oil prices, the delay is unlikely to be sufficient to overcome the uncertainties that are weighing on oil prices, including the following:

- Concerns about China’s economy and associated oil demand. China’s economic growth is under pressure from the threat of additional tariffs from the U.S. In response, it is expected that China will provide for additional stimulus in attempt to offset the impact of the tariffs and to maintain GDP growth rate of around 5%. Last year, China’s economy, based on official data, grew at 5.2%. Recently, a former official at China’s central bank raised doubts about the official growth rate, pointing out the discrepancy between GDP growth and employment – “if the employment data is credible, then economic growth is too high”. He also highlighted that the reported economic growth is higher than the growth in consumption (and investment), which was not the case before COVID-19. He stated that a growth rate of 2% is more in line with the other factors.

- Concerns about oil supply with respect to the level of spare capacity stemming from the shut-in production associated with members of OPEC+, which is around 6.0 MMbbl/d. The concerns are heightened by the incoming Trump administration which has expressed a goal of U.S. producers increasing production by 3 MMbbl/d. We think this concern is overhyped, in part, because while OPEC+ has significant shut-in capacity, the bulk of spare capacity is under the control of Saudi Arabia (3.2 MMbbl/d), UAE (1 MMbbl/d) and Kuwait (0.40 MMbbl/d) – which collectively have been disciplined in aligning supply with demand. Additionally, we expect that U.S. producers will continue to focus on delivering returns for their shareholders and less so on outsized production increases.

With respect to geopolitics, while the rapid downfall of Assad was unexpected, in the immediate, the situation in Syria will have limited, if any, impact on the oil market; however, it has the potential to lead to more instability in the Middle East, which ultimately could have an impact.

- With the diminishment of its proxies (Hamas, Hezbollah and to a lesser extent, the Houthis), coupled with the downfall of Assad, Iran may feel inclined to accelerate efforts to develop its nuclear capabilities;

- It is expected that Russia will take steps to secure its air and navy bases in Syria, especially since these are Russia’s only Mediterranean bases;

- Israel is likely to move to establish control along the southern border of Syria to prevent future attacks on Israel; and

- Turkey will be interested in ensuring that the Kurds in Syria do not make any strategic gains, as well as providing support for the Sunni factions.

Additionally, there are uncertainties surrounding the future level of interest and involvement of the US. Will the US provide support for the Kurds – as well as the other minorities in Syria? Will involvement of the US or disengagement provoke or subdue responses from other actors – including Turkey, Iran and Russia?

For the upcoming week, we think the announced delay by OPEC+ will keep the price of Brent crude above $70, but we do not think the price of Brent crude oil will reach $73.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Permian to Drive Output Growth as Other Basins Flatten, Decline–EIA

2025-01-14 - Lower 48 oil production from outside the Permian Basin—namely, the Bakken and Eagle Ford shales—is expected to flatten and decline in coming years, per new EIA forecasts.

Shale Outlook Permian: The Once and Future King Keeps Delivering

2025-01-11 - The Permian Basin’s core is in full-scale manufacturing mode, with smaller intrepid operators pushing the basin’s boundaries further and deeper.

Jefferies: With Permian Locked Up, E&Ps Hunt for New L48 Runway

2024-11-26 - With the core of the Permian Basin largely locked up, “intrepid operators” are hunting for runway in more nascent Lower 48 basins and in less developed Permian benches.

Back to the Future: US Shale is Growing Up

2025-01-07 - The Patch’s maturity will be tested in 2025 amid ongoing consolidation and geopolitical dissonance.

Shale Outlook Eagle Ford: Sustaining the Long Plateau in South Texas

2025-01-08 - The Eagle Ford lacks the growth profile of the Permian Basin, but thoughtful M&A and refrac projects are extending operator inventories.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.