(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude oil closed last week at $55.88, which continues the recent trend of the price of Brent crude oil slowly creeping upwards. In contrast, the price of WTI closed at $52.20, which was slightly down from the prior week’s close of $52.27.

With respect to fundamentals there was some positive news pertaining to inventories of crude oil in the U.S., which, as reported by EIA, fell by nearly 10 million barrels during the previous week. The impact was partially offset by an increase in inventories of gasoline by some 2.5 million bbl/d, while inventories of diesel fuel fell by 815,000 bbl/d.

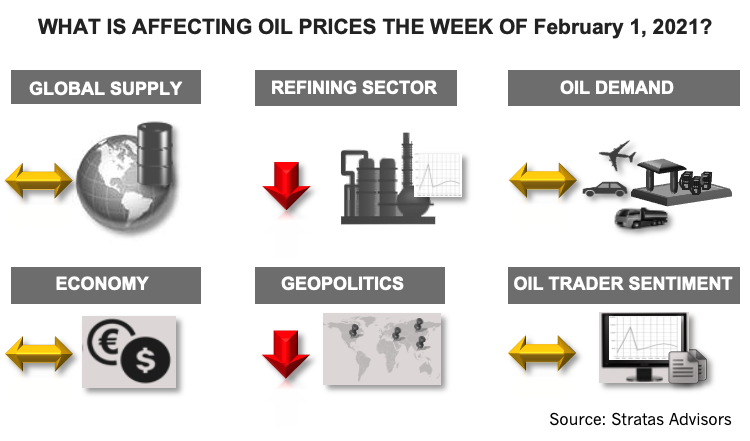

Other factors that affected oil prices include the following:

- Signs that the U.S. economy is still struggling to move back to full recovery, including another disappointing jobless claims report, which indicated that another 847,000 workers in the U.S. lost their jobs

- Struggles with the rollout of vaccines continues in the U.S., as well as in Europe—but there is some positive news in that the Johnson & Johnson vaccine will soon be available to the market. While the test data is not quite as impressive as the Moderna and Pfizer vaccines, the Johnson & Johnson vaccine is easier to ship and handle and requires only one shot.

- The pace of new COVID-19 cases in the U.S. has been declining since Jan. 8 and are now at the lowest level since mid-November of last year. Additionally, there is the possibility that India is moving past COVID-19 with cases in India falling to an average of around 13,000 new infections per day, which is a significant reduction when compared to 100,000 that was occurring during September of last year.

Another factor to watch out for is the impact of the disruption in the U.S. equity markets because of the difficulties faced by some hedge funds, which were caught in a “short squeeze” led by retail investors. While this development would not appear to be sufficient to cause a systemic issue for the financial markets, it is forcing the selling of some long positions to provide funds to cover short positions—and putting some downward pressure on the equity markets. Furthermore, a similar dynamic is now appearing in the silver market.

While more of long-term factor, another development to keep in in mind is the announcement by GM to produce only zero-emission vehicles by 2035. While there remains uncertainty of the ability of GM to achieve this objective, the announcement by GM highlights the growing momentum of the desire of major consumers to move away from oil.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

RWE Slashes Investment Upon Uncertainties in US Market

2025-03-20 - RWE introduced stricter investment criteria in the U.S. and cut planned investments by about 25% through 2030, citing regulatory uncertainties and supply chain constraints as some of the reason for the pullback.

TXO Partners CEO Bob R. Simpson to Retire

2025-03-20 - Gary D. Simpson and Brent W. Clum will serve as co-CEOs, effective April 1. Bob R. Simpson will remain chairman of the board, TXO said.

US Oil Company APA Lays Off Nearly 15% of Staff, Bloomberg News Reports

2025-03-19 - The news comes days after APA and its partners announced a successful oil discovery on their shared acreage in Alaska's North Slope.

NextEra Energy Resources CEO Rebecca Kujawa to Retire

2025-03-18 - NextEra Energy CFO Brian Bolster will become CEO for NextEra Energy Resources, and NextEra Energy Treasurer Mike Dunne will become CFO, the company says.

Williams Cos. COO Dunn to Retire

2025-03-13 - Williams Cos. COO Micheal Dunn was crediting with helping the company focus on a natural gas strategy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.