The price of Brent crude oil ended the week at $74.73 after closing the previous week at $76.48. (Source: Shutterstock)

The price of Brent crude oil ended the week at $74.73 after closing the previous week at $76.48. The price of WTI ended the week at $71.06 after closing the previous week at $73.68. The price of DME Oman crude ended the week at $76.63.

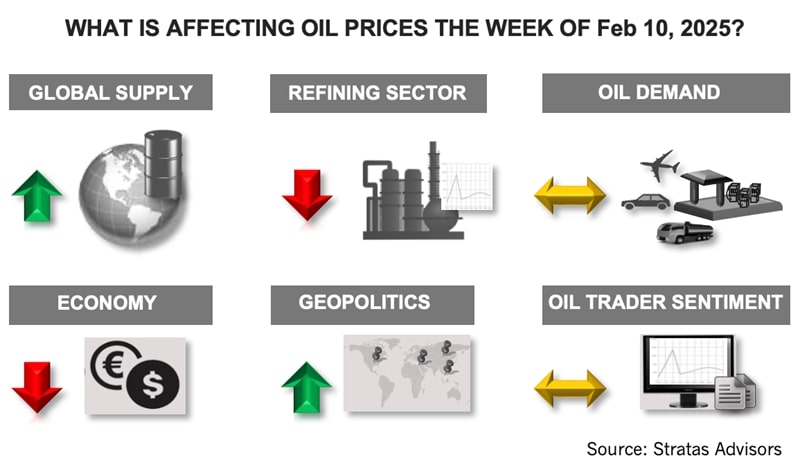

At the beginning of last week, we expressed the view that the price of Brent crude could move upwards and test $78 because of the supply uncertainties associated with the tariffs proposed by President Trump on Canada and Mexico. Once the threat of these tariffs was removed early in the week, oil prices moved downward. The increase in U.S crude inventories of 8.66 MMbbl didn’t help the situation.

While the tariffs were removed, at least for one month on Canada and Mexico, there has been plenty of discussions pertaining to other tariffs – as well as sanctions on oil producers – coupled with calls from President Trump for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl. While these statements and announcements provide some uncertainty, for the most part, we do not think they will have much material effect on supply.

Last week, members of OPEC+ agreed to maintain its policy of initiating a gradual increase in oil supply in April. While it has been reported that the members discussed Trump’s request for an increased oil supply, it did not appear to have any bearing on the final decision of OPEC+. While there are some members of OPEC+ that would like to increase production, it seems that Russia and Saudi Arabia are committed to managing supply to support oil prices. Despite reduced oil volumes, Russia’s oil and gas revenue increased by 26% in 2024 in comparison to 2023. Although Russia increased its natural gas production by 7.6%, the main reason for the increased revenue stemmed from higher prices for Russian crude oil. Saudi Arabia is not eager to see lower oil prices since it needs oil at around $90 to balance its budget.

Saudi Arabia may be more open to adding supply if the U.S. is successful in reducing Iran’s oil exports. It has been reported that the Trump administration believes that Iran’s exports can be reduced by 500,000 bbl/d to 750,000 bbl/d by imposing sanctions on Iran. We think this might be ambitious for reasons we highlight in the Geopolitical section of this report, including the relationship that Iran has with China and with Russia. Unless the U.S. is willing to sanction Chinese entities, it will be difficult for the U.S. to prevent Iranian exports from going to China. Even with the sanctions on Chinese entities, it will be challenging since the trade between China and Iran is done with the use of Chinese currency and non-Western shipping services.

It is unlikely that President Trump will have any better luck with U.S. shale producers. Our upstream team recently updated its assessment of the top independent sale operators in the U.S. One key takeaway from the assessment is that most of the companies have switched their strategy from production growth towards maximizing returns and free cash flow generation while maintaining their production. The result was that these operators reduced their tight oil well completion count in 2024. During 2025, we are forecasting that U.S. oil production will slowly increase.

On Feb. 7, Trump stated that during the upcoming week, new tariffs will be announced that will match the tariffs of other countries – so-called reciprocal tariffs. One potential result is that some of the U.S.’ trading partners will try to diversify away from the U.S. In the case of Mexico and Canada, this will be a difficult proposition, given the economic and logistical ties with the U.S. and the scale and scope of the U.S. market compared to other markets. With respect to China and the EU, there is the possibility of the two entities expanding their relationship. This approach, however, would be challenging for the EU. While China represents about 9% of the EU’s goods exports, China represents 20% of the EU’s goods imports. Additionally, further expansion of trade with China would require a rethink of the EU’s intent to de-risk its economy by reducing its reliance on Chinese imports. Such expansion would also be at odds with the EU’s approach to military security, which remains heavily dependent on NATO and the U.S.

The impending tariffs are creating some uncertainty about the US economy. The U.S. consumer sentiment, provided by the University of Michigan, decreased to 67.7 from 71.1, which is the lowest in seven months. Moreover, inflation expectations for the next year increased to 4.3%, which is the highest level since November 2023. The inflation expectations for the next five years increased to 3.3%, which is the highest level since June 2008. The current inflation rate, which is still well above the 2% target, coupled with expectations for higher inflation, already creates a dilemma for the Federal Reserve – and the pending tariffs add another layer of complexity. While tariffs could cause higher prices, the higher prices have little to do with monetary policy since tariffs are a supply-side factor. As such, the more appropriate reaction to tariffs would be to cut interest rates (instead of increasing rates) to offset the impact of the supply shock.

Taking into consideration the above factors and the fundamentals, for the upcoming week, we think the price of Brent crude could move upwards and test $77.50.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.