In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged $65.52/bbl last week, falling steeply through the week, a risk we have been highlighting.

For the week ahead Stratas Advisors expect crude prices to continue to fall slightly, barring a surprisingly bullish report from the IEA. Brent prices will average $63/bbl as the Brent-West Texas Intermediate (WTI) differential averages $3.50/bbl, with Brent and WTI being driven by roughly the same dynamics.

Geopolitical: Neutral

There is minimal news on the geopolitical front that is likely to influence prices this week. While perennial issues, such as the decline in Venezuela and unrest in Libya, remain analysts do not expect them to become more impactful in the short term.

Dollar: Neutral

Despite the dollar losing strength through the week as expected, the fundamental and sentiment-related drivers impacting crude will outweigh any positive impacts from a weaker dollar.

Trader Sentiment: Positive

While trader sentiment has moderated over the last two weeks technicals continue to indicate that further moves to the downside are likely. Managed money net longs remain generally elevated, further evidence of the possibility of a continuing pullback in prices. Markets will likely react strongly to this week’s IEA report in absence of other major fundamental information.

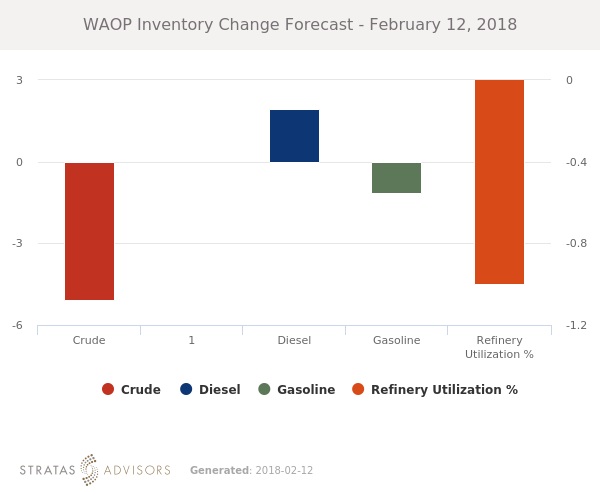

Supply: Negative

Signs of a rapid increase in U.S. drilling activity continue to develop. Last week the number of operating oil rigs in the U.S. jumped by 26. U.S. oil rigs now stand at 791 compared to 591 a year ago. Weekly data from the EIA also indicates that U.S. production has indeed achieved a new record at 10.25 MMbbl/d. In the week ahead, the knowledge that U.S. producers are at more than 10 MMbbl/d and are still adding rigs will weigh on prices.

Demand: Positive

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products except fuel oil. This week’s IEA report will likely show healthy, though not extraordinary, demand through the rest of the world as well. While strong demand does serve as a counter-balance against rising supply in supporting crude prices, draining product stocks are weighing on margins and removing some potential support from crude.

Refining: Negative

Global refining margins fell last week, and all enclaves outside of Europe are generally at or below the 5-year seasonal average. Slightly below average margins despite steady demand are likely to weigh on run rates and crude prices if they persist. However, falling prices could lend support to margins in future months as seasonal demand ramps up.

How We Did

Recommended Reading

Sheffield: E&Ps’ Capital Starvation Not All Bad, But M&A Needs Work

2024-10-04 - Bryan Sheffield, managing partner of Formentera Partners and founder of Parsley Energy, discussed E&P capital, M&A barriers and how longer laterals could spur a “growth mode” at Hart Energy’s Energy Capital Conference.

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Investor Returns Keep Aethon IPO-ready

2024-10-08 - Haynesville producer Aethon Energy is focused on investor returns, additional bolt-on acquisitions and mainly staying “IPO ready,” the company’s Senior Vice President of Finance said Oct. 3 at Hart Energy’s Energy Capital Conference (ECC) in Dallas.

Private Equity Gears Up for Big Opportunities

2024-10-04 - The private equity sector is having a moment in the upstream space.

ConocoPhillips Hits Permian, Eagle Ford Records as Marathon Closing Nears

2024-11-01 - ConocoPhillips anticipates closing its $17.1 billion acquisition of Marathon Oil before year-end, adding assets in the Eagle Ford, the Bakken and the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.