The price of Brent crude oil ended the week at $74.57, after closing the previous week at $74.73. (Source: Shutterstock)

The price of Brent crude oil ended the week at $74.57, after closing the previous week at $74.73. The price of WTI ended the week at $70.57 after closing the previous week at $71.06. The price of DME Oman crude ended the week at $77.07.

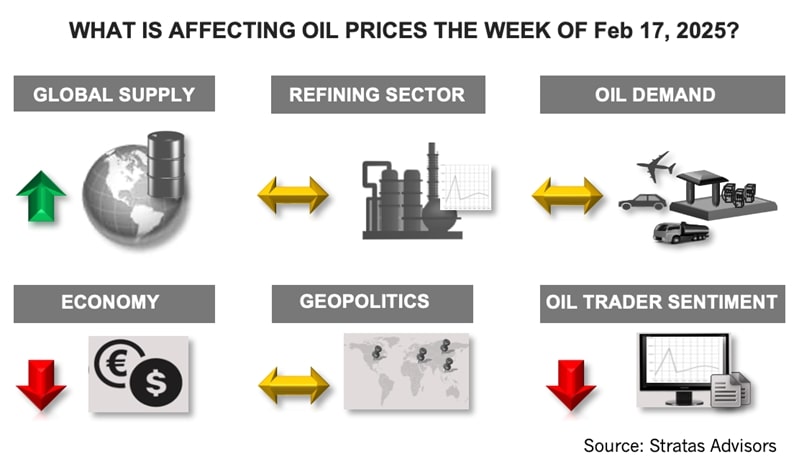

At the beginning of last week, we expressed the view that the price of Brent crude could move upwards and test $77.50, in part because of supply concerns stemming from the threat of additional sanctions on Russia and Iran. The price of Brent crude oil did reach $77 on Feb. 18 before falling back with news that members of the Trump Administration were holding talks with their Russian counterparts.

The Trump Administration is continuing to ramp up efforts to bring the conflict to a negotiated end. President Trump has met with Russian President Putin and other high-level officials, including the Vice President and the Secretary of State, and had discussions with the Russians. It has been reported by the AP that the Secretary of State, with a team of national security advisors, will be meeting with Russian officials during this week in Saudi Arabia. Concerns have been raised by President Zelensky as well as by European allies of the U.S. that any agreement needs to include Ukrainian input – and it is unclear at this time if Ukrainian officials will be involved in these talks. While progress appears to be taking place, reaching an agreement will still be challenging for the U.S., given the stated positions of Putin coupled with the pressure to address the concerns of Ukraine and its allies.

Another factor putting pressure on oil prices was the latest EIA report, which showed that U.S. crude inventories increased by 4.07 MMbbl¬ the third consecutive week of stock builds. Crude inventories, however, are on par with the level of the previous year (428 MMbbl vs. 427 MMbbl) and less than the inventory levels in 2019 (428 MMbbl vs. 447 MMbbl).

Mixed economic news is also putting downward pressure on oil prices.

- Last week, data released by the Bureau of Labor Statistics showed that inflation came in higher in January than in December and higher than expected. The Producers Price Index (PPI) came in at 3.5% on an annual basis. The Consumer Price Index (CPI) came in at 3.0% on an annual basis after prices increased by 0.5% from December. In contrast to the higher-than-expected inflation figures, retail sales decreased by 0.9% in January. Additionally, the jobs report for January showed that the U.S. added only 143,000 jobs. The latest view of U.S. consumer sentiment, provided by the University of Michigan, decreased to 67.7 from 71.1, which is the lowest in seven months – in part because of expectations for higher inflation. The current inflation rate of 3% and expectations for higher inflation are creating a dilemma for the Federal Reserve, and the pending tariffs add another layer of complexity. While tariffs could cause higher prices, the higher prices would have little to do with monetary policy since tariffs are a supply-side factor. As such, the more appropriate reaction to tariffs would be to cut interest rates – in comparison to increasing rates – to offset the impact of the supply shock. The U.S. 10-Year Treasury ended the week at 4.533%, down from 4.496% the previous week. In comparison, on September 16, 2024, the rate was 3.621%. The relatively high 10-year rate is a factor that makes it more difficult for the Federal Reserve to cut interest rates.

- Recent data indicate that China’s economy continues to face the challenge of deflation. While the Consumer Price Index (CPI) for January increased by 0.5% on an annual basis, the Producer Price Index (PPI) decreased by 2.3%. The downward trend of producer prices is the result of overcapacity coupled with weak domestic demand. The weak domestic demand is reflected in the weak consumer spending stemming from economic uncertainty. Another sign of weak domestic demand is the weakness associated with imports.

Taking into consideration the above factors and the fundamentals, for the upcoming week, we think the price of Brent crude will drift sideways.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

ArcLight Completes $865MM Deal for Phillips 66’s Stake in NatGas Line

2025-02-03 - Kinder Morgan will continue to operate the Gulf Coast Express as a project to increase the line’s capacity moves ahead.

Kinder Morgan to Build $1.7B Texas Pipeline to Serve LNG Sector

2025-01-22 - Kinder Morgan said the 216-mile project will originate in Katy, Texas, and move gas volumes to the Gulf Coast’s LNG and industrial corridor beginning in 2027.

Entergy, KMI Agree to Supply Golden Pass LNG with NatGas

2025-02-12 - Gas utility company Entergy will tie into Kinder Morgan’s Trident pipeline project to supply LNG terminal Golden Pass LNG.

Apollo Acquires BP’s Gas Pipeline Stake for $1B

2025-03-23 - BP Pipelines holds a 12% interest in the Trans-Anatolian Natural Gas Pipeline (TANAP), which transports natural gas from Azerbaijan across Turkey.

Kinder Morgan Acquires Bakken NatGas G&P in $640MM Deal

2025-01-13 - The $640 million deal increases Kinder Morgan subsidiary Hiland Partners Holdings’ market access to North Dakota supply.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.