Prices actually rose throughout the week after last week’s sharp correction.

Due to the President’s Day holiday in the U.S., today’s edition of What’s Affecting Oil has been abbreviated. In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged around $63.68/bbl last week, within the expected range. Prices actually rose throughout the week after last week’s sharp correction.

Prices will likely average $65/bbl in the week ahead.

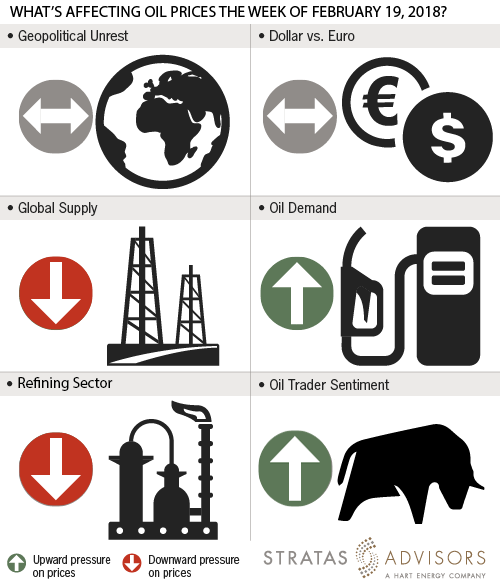

Geopolitical: Neutral

There is minimal news on the geopolitical front that is likely to influence prices this week. While perennial issues remain, such as the decline in Venezuela and unrest in Libya, Stratas Advisors do not expect them to become more impactful in the short term.

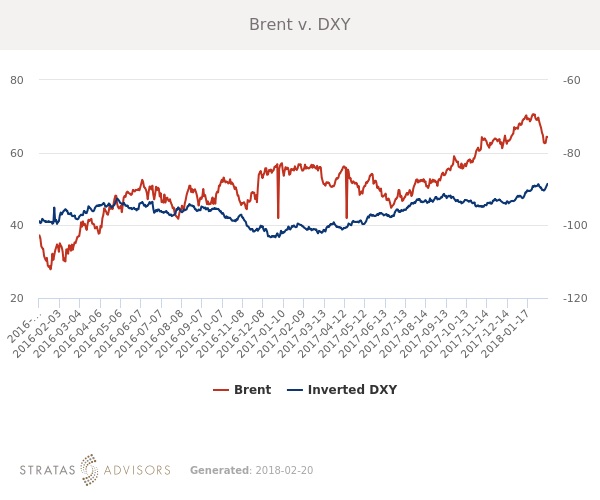

Dollar: Neutral

While the dollar declined throughout the week, potentially lending some support, fundamental and sentiment-related drivers continue to have more impact on crude oil prices.

Trader Sentiment: Positive

While trader sentiment has soured slightly over the last two weeks, technical indicate that there is now room to move to the upside. While some market participants will be understandably wary of the potential for U.S. crude to again overwhelm balances, there remain plenty of bulls out there to support prices in the near-term.

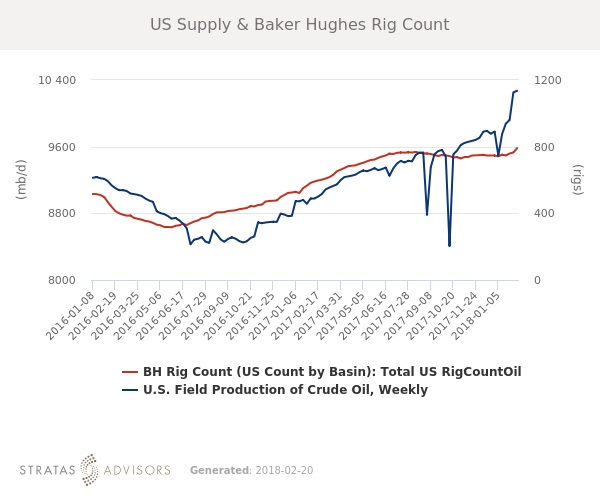

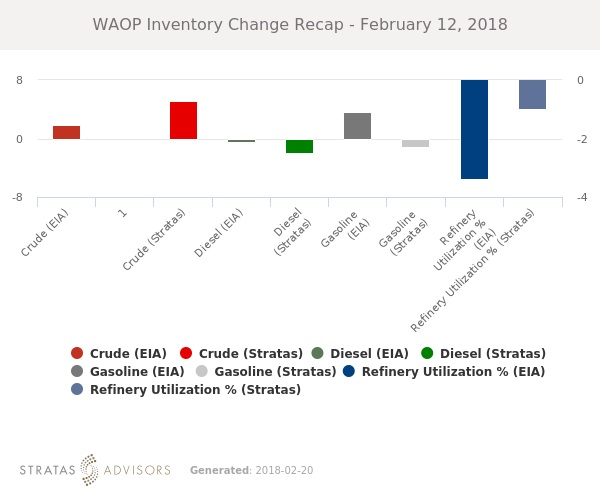

Supply: Negative

Supply will continue to weigh on prices in the weeks ahead, especially after last week’s report from the IEA in which the Agency warned that growth in U.S. supply could outstrip growth in demand this year.

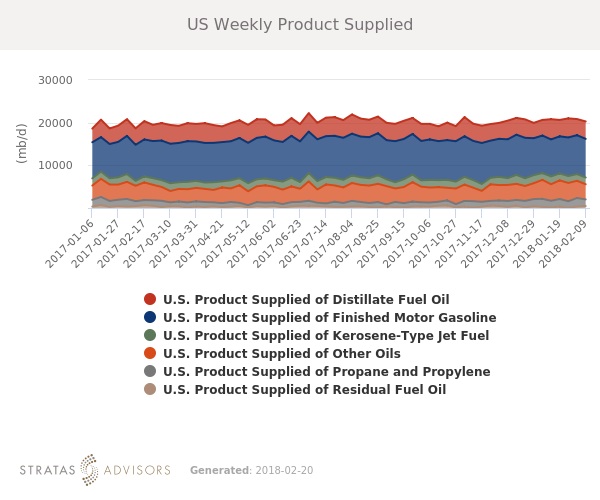

Demand: Positive

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products except fuel oil.

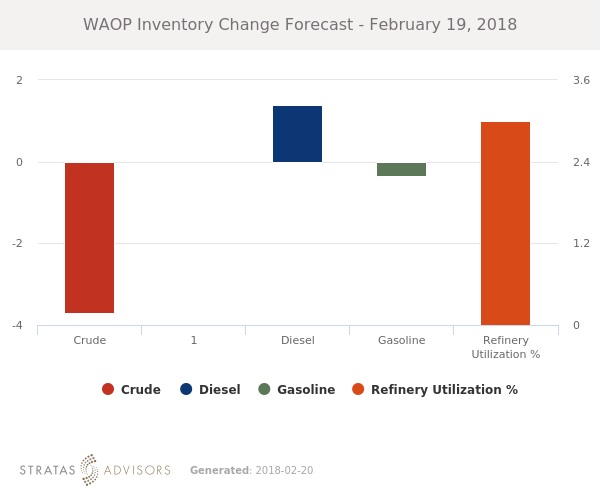

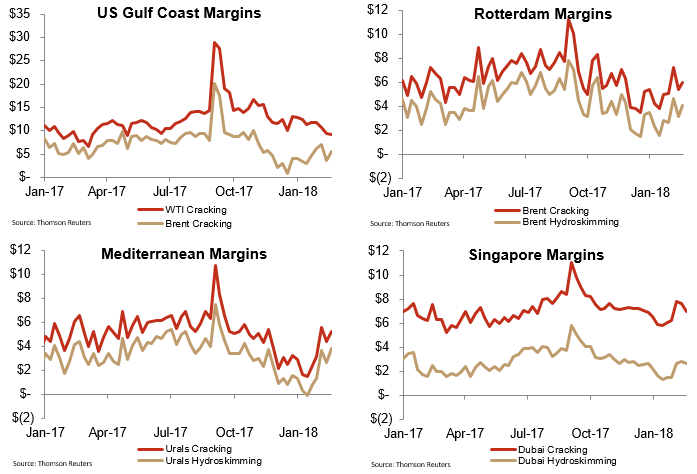

Refining: Negative

Global refining margins fell last week, and all enclaves outside of Europe are generally at or below the 5-year seasonal average. Slightly below average margins despite steady demand are likely to weigh on run rates and crude prices if they persist. However, falling prices could lend support to margins in future months as seasonal demand ramps up.

How We Did

How We Did

Recommended Reading

FERC Gives KMI Approval on $72MM Gulf Coast Expansion Project

2024-11-27 - Kinder Morgan’s Texas-Louisiana upgrade will add 467 MMcf/d in natural gas capacity.

Vivakor Expands Crude Gathering Network in Oklahoma STACK

2024-11-25 - Midstream company Vivakor is building its network following the October acquisition of Endeavor Crude.

EQT, Blackstone Credit Enter $3.5 Billion Midstream Joint Venture

2024-11-25 - Blackstone Credit & Insurance entered a joint venture with EQT Corp. to take a non-controlling interest in the Mountain Valley Pipeline and other infrastructure from the Equitrans transactions for $3.5 billion.

Exclusive: MPLX's Liquid Lines Support Growing NGL Exports

2024-11-19 - MPLX Executive Vice President and COO Greg Floerke delves into the company evolution in Appalachia and the increase in its liquids exports and production scale, in this Hart Energy Exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.