The price of Brent crude ended the week at $73.84 after closing the previous week at $74.57. (Source: Shutterstock)

The price of Brent crude ended the week at $73.84 after closing the previous week at $74.57. The price of WTI ended the week at $70.22 after closing the previous week at $70.57. The price of DME Oman crude ended the week at $76.91.

At the beginning of last week, we expressed the view that the price of Brent crude would move sideways. In fact, the price of Brent crude finished the week lower after reaching $76.48 on Feb. 20 and decreasing sharply at the end of the week.

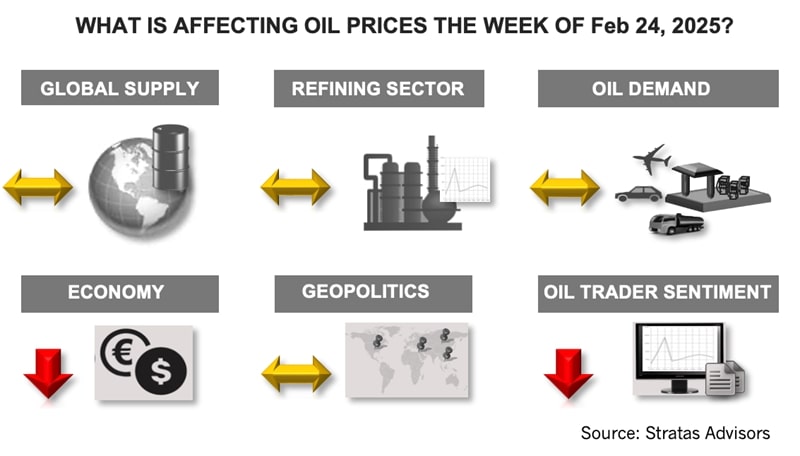

Looking forward, the dynamics driving oil prices remain the same for the last couple of weeks.

- Geopolitics is not having much impact on oil prices. The Trump Administration is putting pressure on Ukraine to reach a negotiated settlement with Russia. Last week, officials from the U.S. and Russia held discussions in Saudi Arabia and a second meeting is to be held within the next two weeks. The Trump Administration is also pushing for a deal with Ukraine that includes the U.S. initial demand for 50% of Ukraine’s mineral and natural resources revenues – encompassing revenues from rare earth along with revenues from uranium, lithium, oil, gas and some port-related revenues. Zelensky has pushed back on the proposed arrangement because the agreement does not include any security guarantees. While tensions have been increasing between Iran and Israel with both sides threatening attacks and destruction, the Trump Administration has expressed a willingness to initiate negotiations with Iran for a nuclear peace agreement.

- Economic news associated with the major economies continues to be worrisome. Credit card delinquencies in the U.S. are increasing with the share of credit card balances more than 90 days overdue increasing by some 11%. Additionally, overall consumer debt in delinquency has reached its highest level since 2020. Europe is facing the challenge of weak economic growth while seeking to increase military spending. China’s weak domestic demand coupled with excess production capacity is leading to a growing trade surplus in goods, which is putting pressure on the manufacturing sectors of other countries, including the U.S., Germany and other Asian countries. During 2024, China’s trade surplus in terms of goods reached $992.2 billion, which is about 5.6% of China’s GDP. In comparison, during 2019, China’s trade surplus was only $421.07 billion.

- While there has been plenty of talk about sanctions on several oil-producing countries – Russia, Iran, and Venezuela – the impact has yet to be felt. Russia’s oil production in January increased slightly to 9.2 MMbbl/d and Russia’s revenues from the sales of crude oil and oil products increased by $900 million in comparison to December 2024. We still have doubts with respect to the lasting effectiveness of sanctions on the oil exports of the sanctioned countries (especially sanctions on Russian oil) for several reasons. One reason is that it will be difficult for China and India to move forward without access to crude oil from the sanctioned countries – unless OPEC+ is willing to fill the gap. While OPEC has a spare capacity of around 5.3 million b/d we do not think OPEC, including Saudi Arabia, will increase production because of the need to maintain long-term cooperation with other major oil producers (including Russia) to allow for aligning supply with demand throughout economic cycles. If OPEC members do not fill the gap, it is likely that India and China will not recognize the sanctions.

These dynamics have resulted in the sentiment of oil traders turning bearish. Last week, traders of WTI crude, for the fourth consecutive week, decreased their net long positions by reducing their long positions while adding to their short positions. Net long positions of WTI have decreased by 59% since Jan. 21 and are 61% below the level seen on July 16, 2024, when the price of WTI was $80.76.

Taking into consideration the above factors and the fundamentals, for the upcoming week, we think it will be difficult for the price of Brent crude to break through $76.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

NextDecade Plans 3 More Trains at Rio Grande LNG

2025-02-28 - Houston-based NextDecade continues to build the Rio Grande LNG Center in Brownsville, Texas, as its permits filed with the Federal Energy Regulatory Commission continue to go through the legal process.

Canadian Government to Fund Portion of Cedar LNG’s $5.96B Development Cost

2025-03-24 - The Government of Canada has pledged to contribute up to $200 million to help the Haisla Nation and Pembina Pipeline Corp. develop the $5.96 billion Cedar LNG Project

DOE Approves Venture Global’s CP2 LNG to Export to Non-FTA Countries

2025-03-20 - The U.S. Department of Energy approved Venture Global’s Calcasieu Pass 2 LNG project in Cameron Parish, Louisiana, to export LNG to non-FTA countries.

Tamboran, Santos Agree to Study Possible Darwin LNG Expansion

2025-01-23 - Tamboran Resources Corp. and Santos Ltd. entered a memorandum of understanding for technical studies, which could lead to a 6 mtpa expansion of Darwin LNG.

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.