In the week since our last edition of What’s Affecting Oil Prices, Brent prices softened slightly to average $69.15/bbl.

For the upcoming week, Stratas Advisors expect Brent prices to continue to pull back and average $68/bbl. This week the analysts expect the Brent-West Texas Intermediate differential to remain steady around $4/bbl.

Geopolitical: Neutral

Geopolitics will be a neutral factor in the week ahead with little news on the geopolitical front that is likely to influence prices.

Dollar: Positive

After brief strength due to better than expected jobs data, the dollar will likely continue to fall. With the stronger relationship between crude and the dollar, the dollar weakening will lend support to crude.

Trader Sentiment: Positive

Still strong long positions are reflecting positive trader sentiment, despite the risk of a correction in such overbought territory.

Supply: Negative

Supply will be a negative factor in the week ahead as U.S. rigs and production continue to increase.

Demand: Neutral

Demand remains generally strong although fluctuating weather throughout the U.S. continues to temporarily impact flows.

Refining: Neutral

Refining margins rose slightly again last week, but are likely not high enough to incentivize additional increased runs.

Recommended Reading

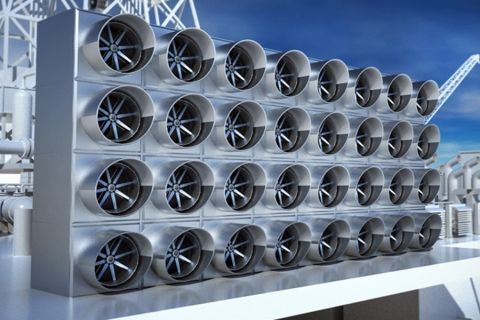

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Oxy’s Hollub Drills Down on CrownRock Deal, More M&A, Net-zero Oil

2024-11-01 - Vicki Hollub is leading Occidental Petroleum through the M&A wave while pioneering oil and gas in EOR and DAC towards the goal of net-zero oil.

Woodside Reports Record Q3 Production, Narrows Guidance for 2024

2024-10-17 - Australia’s Woodside Energy reported record production of 577,000 boe/d in the third quarter of 2024, an 18% increase due to the start of the Sangomar project offshore Senegal. The Aussie company has narrowed its production guidance for 2024 as a result.

Investor Returns Keep Aethon IPO-ready

2024-10-08 - Haynesville producer Aethon Energy is focused on investor returns, additional bolt-on acquisitions and mainly staying “IPO ready,” the company’s Senior Vice President of Finance said Oct. 3 at Hart Energy’s Energy Capital Conference (ECC) in Dallas.

Carbon Removal Company Equatic Appoints New CEO

2024-11-18 - Equatic appointed a new CEO in preparation to launch the world’s largest ocean-based carbon removal plant.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.