(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

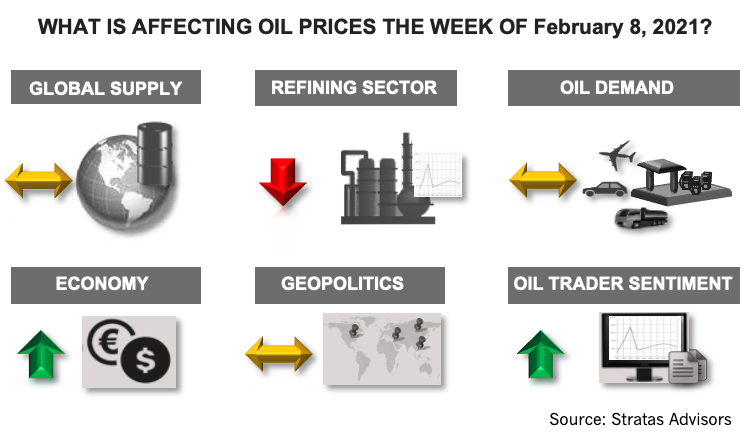

The price of Brent crude oil closed last week at $59.34 after closing the previous week at $55.88. In similar fashion, the price of WTI closed at $56.85 after closing the previous week at $52.20. The significant uptick in prices broke the recent trend of the last several weeks, during which prices were slowly creeping upwards. Oil prices are now back at a level last seen in January 2020. In comparison, the price of Brent crude hit a low of $19.33 on April 21, 2020 and was still only at $37.94 on Oct. 30, 2020.

The increase in prices was supported by reports that OPEC increased production by only 160,000 bbl/d in January, which is less than OPEC’s share (300,000 bbl/d) of the agreed production increase of 500,000 bbl/d that was to occur in January. Another factor was indications that the Biden Administration will be moving forward with the $1.9 trillion stimulus/recovery package with or without Republican support—which pushed up equity markets and commodities, in general.

In addition to the above factors, there are several other factors that support the view that oil prices will continue to go higher:

- Besides the $1.9 trillion stimulus/recovery package coming on the back of the $900 billion stimulus/recovery package that was passed at the end of the last year, the Federal Reserve is expected to continue with its easy-money policies.

- There has been some positive news pertaining to COVID-19 in that the number of cases in the U.S. (and in other countries, such as India) has been declined significantly since early in January, and that there is another vaccine on the verge of entering the market.

- While the above two factors will encourage increased demand, there are factors that are discouraging additional supply, including the 60-day moratorium pertaining to new leases and drilling on federal lands in the U.S.

- Other factors that will hinder future supply include increased regulatory pressures, and the effort to push divestment of positions held in the oil and gas sector, which is being led by major financial entities, such as Blackrock Inc., the world’s largest asset manager.

There are risks associated with oil prices continuing to increase, including that the refining sector—the only consumer of crude oil continues to struggle with product inventories that are still elevated, and demand still well below pre-pandemic level. Another risk is that the price recovery relies heavily on the ongoing existence of the OPEC+ framework—and is a risk that Stratas Advisors has been highlighting for a while. With increasing prices, the pressure on the OPEC+ framework will only continue to grow with many of the producers already pushing to increase production. The framework has only held in place this long because of the willingness of Saudi Arabia to reduce its production to around 8.1 million bbl/d. The risk is further amplified by the apparent shift in U.S. policies pertaining to the Middle East with the arrival of the Biden Administration. The Saudis may not be so open to reducing its own production unilaterally and giving up market share to prop up prices, in the face of a less-friendly U.S. administration.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Exxon Seeks Permit for its Eighth Oil, Gas Project in Guyana as Output Rises

2025-02-12 - A consortium led by Exxon Mobil has requested environmental permits from Guyana for its eighth project, the first that will generate gas not linked to oil production.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

Chevron Delivers First Oil from Kazakhstan Project

2025-01-24 - Chevron Corp.’s newest plant at Kazakhstan’s Tengiz Field is expected to ramp up output to 1 MMboe/d.

E&P Highlights: March 17, 2025

2025-03-17 - Here’s a roundup of the latest E&P headlines, from Shell’s divestment to refocus its Nigeria strategy to a new sustainability designation for Exxon Mobil’s first FPSO off Guyana.

E&P Highlights: Jan. 13, 2025

2025-01-13 - Here’s a roundup of the latest E&P headlines, including Chevron starting production from a platform in the Gulf of Mexico and several new products for pipelines.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.