The price of Brent crude ended the week at $79.79 after closing the previous week at $76.70. The price of WTI ended the week at $76.57 after closing the previous week at $74.02. The price of DME Oman crude ended the week at $80.01 after closing the previous week at $76.94. With last week’s increase in prices, oil prices have moved above their 200-day moving average for the first time since July 2024.

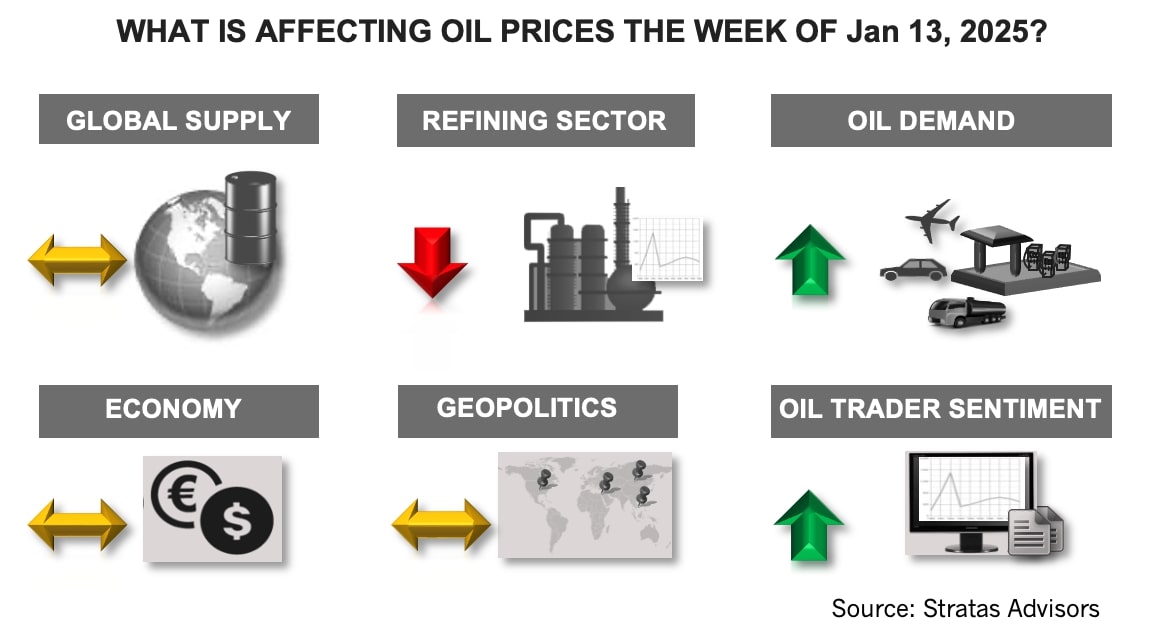

At the beginning of last week, we expected that oil prices would increase because of the optimism associated with China’s announced intent to move forward with future interest rate cuts and additional fiscal stimulus to boost economic growth, coupled with the rhetoric heating up between Iran and Israel.

The fundamentals also provided some support for crude prices, with crude inventories in the U.S. being drawn down in recent weeks. Further support was expected from the forecasted cold weather in the U.S., the associated increase in demand for heating oil, and the potential impact on upstream production. Another blast of cold weather is forecasted for the U.S. during this week.

Further support for oil prices came at the end of the week with the announcement of new sanctions being placed on Russia by the U.S. and Japan. The sanctions are focused on Russia’s energy sector and military capabilities. The energy-related sanctions encompass more than 200 entities and individuals, including Gazprom Neft and Surgutneftegas, as well as traders, oil service providers and government officials. Additionally, Russia’s tanker fleet is targeted.

For the upcoming week, we are expecting that there will be some moderation of oil prices, in part from the latest jobs report released by the Bureau of Labor Statistics that showed the U.S. added 256,000 jobs in December. In conjunction, the U.S. Dollar Index increased, finishing the week at 109.65 from the previous week of 108.92, and is at its highest level since October 2022 and up from 100.42 on Sept. 22, 2024. The strong U.S. dollar makes oil more expensive for those non-USD countries that are importing oil. The U.S. 10-Year Treasury ended the week at 4.769%, up from 4.151% on December 6, 2024, and from 3.621% on Sept. 16, 2024. The increasing 10-year rate makes it more difficult for the Federal Reserve to cut interest rates, which in turn is leading to a stronger dollar.

There is also some negative news associated with China’s economy, with reports that corporate profits have decreased for a third consecutive year. Additionally, China’s economy continues to experience extremely low inflation, with inflation being close to zero since April 2023. Consumer prices (CPI) increased by only 0.1% in December from the previous year, which is the lowest rate in nine months. Producer prices (PPI) have been declining, with prices decreasing in December by 2.3% from the previous year after decreasing by 2.4% in November. For the entire 2024, consumer prices increased by only 0.1%, and producer prices decreased by 2.0%.

Furthermore, we have our doubts about the ultimate effectiveness of the additional sanctions, China remains the largest customer for Russian oil exports, including crude oil. India is another major customer of Russian crude oil and has recently signed a major contract to continue importing Russian crude oil for their refineries. We do not expect that China will change its behavior with respect to Russia’s oil, especially since China does not recognize the current U.S. sanctions. We expect the same from India with the caveat that India could be more susceptible to pressure from the incoming Trump administration to reduce its oil imports from Russia. As such, we think the market’s immediate reaction to the announcement of the new sanctions is likely an overreaction.

With consideration of all the factors, we expect that there is still some room for oil prices to move higher this week, but the price of Brent crude oil will struggle to breakthrough $82.50.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

ArcLight Completes $865MM Deal for Phillips 66’s Stake in NatGas Line

2025-02-03 - Kinder Morgan will continue to operate the Gulf Coast Express as a project to increase the line’s capacity moves ahead.

Kinder Morgan to Build $1.7B Texas Pipeline to Serve LNG Sector

2025-01-22 - Kinder Morgan said the 216-mile project will originate in Katy, Texas, and move gas volumes to the Gulf Coast’s LNG and industrial corridor beginning in 2027.

Entergy, KMI Agree to Supply Golden Pass LNG with NatGas

2025-02-12 - Gas utility company Entergy will tie into Kinder Morgan’s Trident pipeline project to supply LNG terminal Golden Pass LNG.

Apollo Acquires BP’s Gas Pipeline Stake for $1B

2025-03-23 - BP Pipelines holds a 12% interest in the Trans-Anatolian Natural Gas Pipeline (TANAP), which transports natural gas from Azerbaijan across Turkey.

Kinder Morgan Acquires Bakken NatGas G&P in $640MM Deal

2025-01-13 - The $640 million deal increases Kinder Morgan subsidiary Hiland Partners Holdings’ market access to North Dakota supply.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.