International geopolitical risks continue to increase, but Paisie expects the oil market will stay steady unless conflicts create a material impact on oil flows. (Source: Shutterstock)

The price of Brent crude ended the week at $78.56 after closing the previous week at $78.29. The price of WTI ended the week at $73.71 after closing the previous week at $72.68. The price of DME Oman crude ended the week at $78.11.

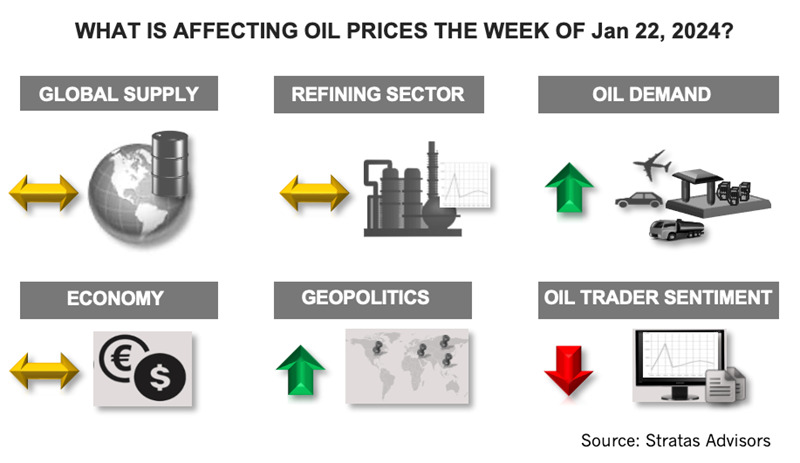

The price of Brent crude remains below its 200-day moving average, although the price has drifted upward since falling to $73.24 on Dec. 12, 2023. The sentiment of oil traders continues to be negative. The net long positions of Brent traders remain at a low level, as do the net long positions of WTI traders. The net long positions remain at depressed level and near the level seen in July 2023 before the announcement of the voluntary cut of 1 MMbbl/d by Saudi Arabia. Since late September, traders of WTI have reduced their net long positions by more than 70%.

Meanwhile, the scope of geopolitical risks continues to expand with the following recent developments:

An apparent airstrike by Israel killed five Iranian officers in Damascus, Syria. Iran has vowed to respond. Additionally, Russia military aircraft has started to patrol the border between Israel and Syria.

There are also reports that Israel employed a missile strike in Lebanon, which resulted in a member of Hezbollah being killed.

Militants in Iraq, supported by Iran, launched missiles at the U.S. forces at al-Asad air base on Jan. 20. Since mid-October there has been 140 attacks on U.S. forces in Iraq and Syria. The recent, however, is being considered an escalation since the attack included the use of ballistic missiles.

The Houthis have continued with drone and missile attacks on shipping through the Red Sea. In response, the U.S. has been patrolling the Red Sea with warships and employing missile strikes in Yemen against the Houthis.

Iran and Pakistan exchanged airstrikes last week with Iran attacking bases for the Sunni separatist group Jaish al-Adl in southwestern Pakistan on Jan. 16. Pakistan responded by attacking training camps of Baluch insurgents on southeaster Iran. On Jan. 19, Iran And Pakistan promised to deescalate.

Besides the above developments, the Russia-Ukraine conflict continues and concerns about China and Taiwan remain. There are also the tensions between Venezuela and Guyana over control over the Essequibo region.

While the geopolitical risks are increasing, we are expecting the oil market will continue discounting the geopolitical risks unless there is a material impact on oil flows. Without such an impact on oil flows, we are expecting that during the first quarter of 2024, oil prices will bounce upwards with negative geopolitical news, but the price increase will quickly fade once the market sees that oil is still flowing.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Targa Pipeline Helps Spark US NGL Production High in 2024

2025-01-23 - Analysts said Targa Resources’ Daytona line released a Permian Basin bottleneck as NGLs continued to grow.

Phillips 66 Makes EPIC Move to Strengthen South Texas Position

2025-01-09 - Phillips 66’s $2.2 billion deal with EPIC allows for further integration of its South Texas NGL network.

Natural Gas Prices Shoot Past $4

2025-02-19 - The market has responded to an oncoming cold snap, sending natural gas prices at the Henry Hub over $4/MMBtu.

NatGas Prices Jump on Forecast of Widespread Freeze

2024-12-30 - The National Weather Service predicts a mid-month, lingering cold snap for much of the U.S., prompting natural gas prices to increase by roughly $0.50 per MMBtu.

EIA: NatGas Storage Withdrawal Eclipses 300 Bcf

2025-01-30 - The U.S. Energy Information Administration’s storage report failed to lift natural gas prices, which have spent the week on a downturn.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.