The price of Brent crude ended the week at $77.46 after closing the previous week at $80.79. The price of WTI ended the week at $74.58 after closing the previous week at $77.58. The price of DME Oman crude ended the week at $76.03. With last week’s decrease in prices, oil prices have fallen back below their 200-day moving average.

In our previous note, we put forth the view that there was some room for oil prices to move higher, but the price of Brent crude oil would struggle to break through $82.50. And that is what happened with the price of Brent crude oil reaching $82.03 on Jan. 15 before decreasing. The decrease in oil prices last week was the result, in part, of recent statements that President Trump made at the World Economic Forum, which included a call for OPEC to lower oil prices by increasing production along with executive orders that encourage further production from the U.S. oil and gas sector.

We do not expect that Trump’s recent statements will have much influence on the strategy of the members of OPEC+. Instead, we expect that OPEC+ will remain cautious with increasing supply while assessing the strength of oil demand growth and the impact of the energy policies of the Trump administration. OPEC+ will need to balance these factors with the need to maintain cooperation between its members – including with those members pushing for more production – notably UAE and Iraq. That said, if Trump is successful in reducing the production of sanctioned producers, Iran and Venezuela, the spare capacity of OPEC+ members (around 5.90 MMbbl/d) would be available to make up for the lost production. As we have stated before, we think there is a much higher probability of the Trump Administration being able to affect Venezuela’s production than Iran’s production (see the Geopolitical Section for further explanation).

With respect to U.S. production, our upstream team recently updated its assessment of the top independent shale operators in the U.S. One key takeaway from the assessment is that most of the companies have switched their strategy from production growth towards maximizing returns and free cash flow generation while maintaining their production. The result was that these operators reduced their tight oil well completion count in 2024. During 2025, we are forecasting that U.S. oil production will slowly increase.

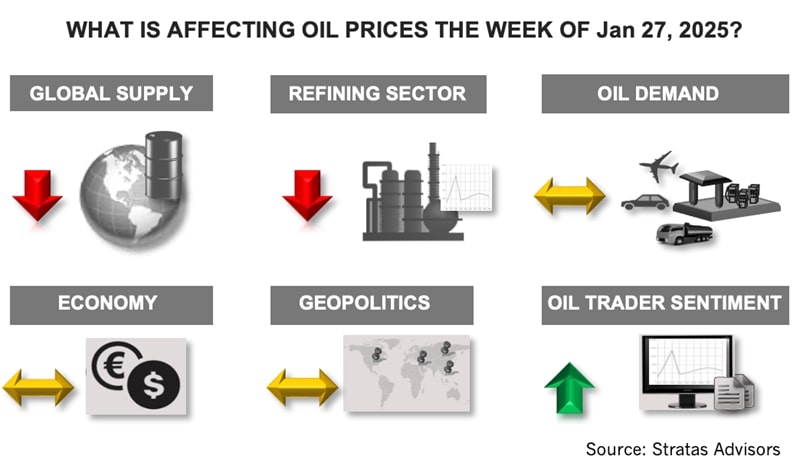

For the time being, the macro-level factors – economics and geopolitics – are neutral factors with respect to their influence on oil prices. The U.S. economy remained relatively strong during 4Q, while China’s economic data was better in 4Q than in 3Q. However, both economies, along with Europe, could be facing challenges during this year. The current conflicts – Russia-Ukraine, Israel-Iran, and Syria – have been relatively quiet, with some signs of positive progress. Each of these conflicts, however, is still far from being settled – and future negotiating efforts to reach more permanent solutions are expected to be difficult with plenty of uncertainty.

For the upcoming week, we think the price of Brent crude will threaten $75.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Williams to Invest $1.6B for On-Site Power Project with Mystery Company

2025-03-07 - Williams Cos. did not name the customer or the location of the power project in a regulatory filing.

Energy Transition in Motion (Week of March 7, 2025)

2025-03-07 - Here is a look at some of this week’s renewable energy news, including Tesla’s plans to build a battery storage megafactory near Houston.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-03-07 - Baker Hughes said this week's decline puts the total rig count down 30, or 5% below this time last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.