In the weeks since the last edition of What’s Affecting Oil Prices, Brent and WTI price changes have started to stagnate, lending some much needed stability to prices. Brent rose $0.66/bbl last week and WTI increased $0.84/bbl. Concerns around the economy and potential demand continue to weigh heavily on markets. For the week ahead, we expect prices to improve slowly. Brent will average $63/bbl and WTI could touch $55/bbl.

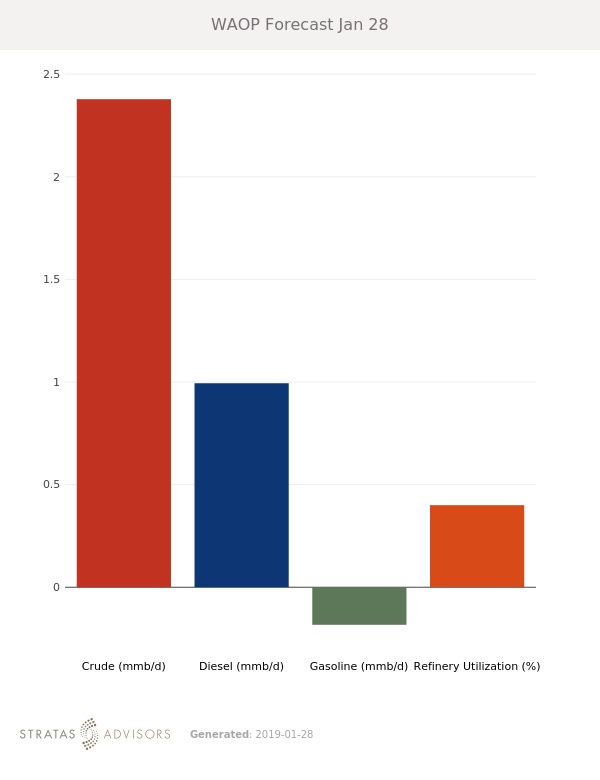

In the U.S., crude runs are likely to continue declining seasonally, leading to stock builds and potentially weighing on prices. However, the temporary resolution of the government shutdown could provide some short-term support. The resumption of CFTC data publications will give insight into how U.S. traders have been positioning themselves. At the same time, ICE managed money net longs have increased in a signal that traders are more optimistic about future prices.

On the supply side, it looks like the risk of a larger Venezuelan disruption has temporarily subsided. President Maduro backed off his threats to remove U.S. diplomats, thus lowering the risk that the U.S. would apply direct crude oil sanctions. However, this quickly evolving situation could escalate as Maduro attempts to stay in power in the face of an organized and internationally supported opposition. Elsewhere, OPEC+ continues to adhere to its production agreement, also helping to mitigate oversupply.

Geopolitical: Positive

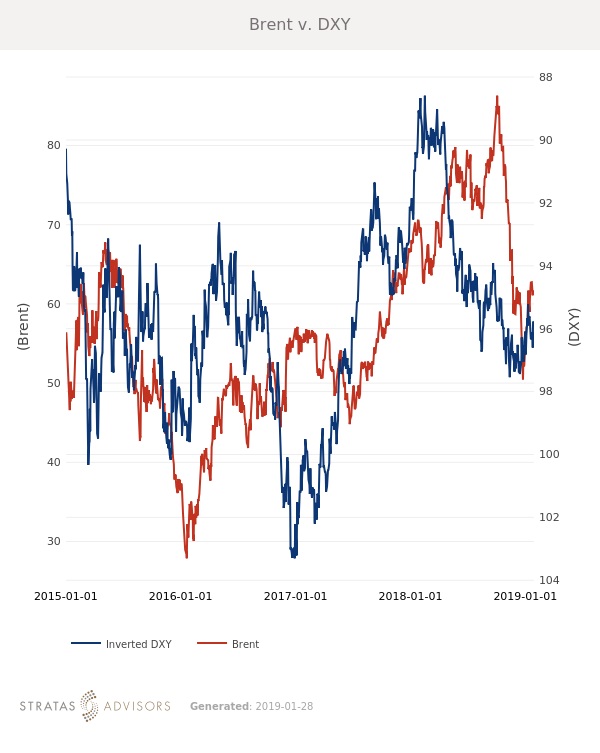

Dollar: Neutral

Trader Sentiment: Positive

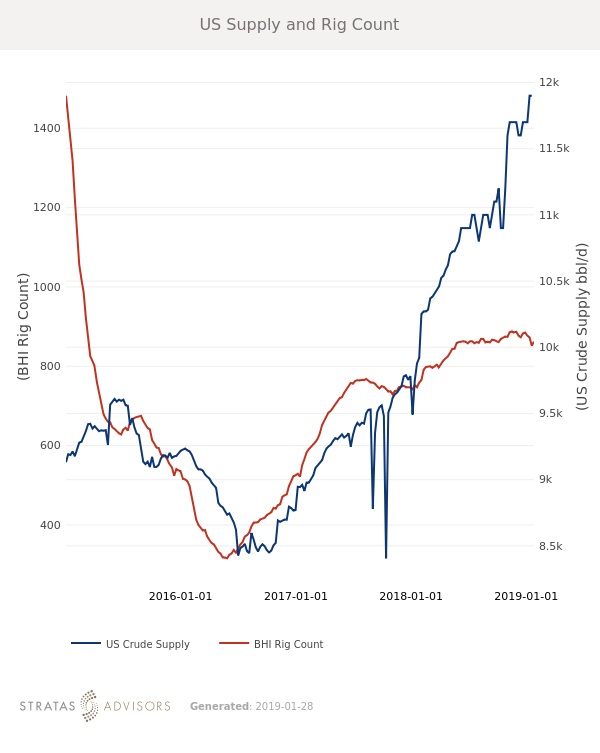

Supply: Positive

Demand: Neutral

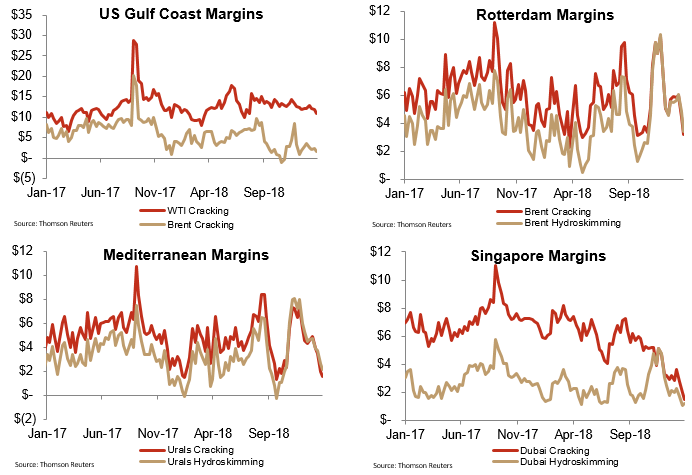

Refining Margins: Neutral

How We Did

Recommended Reading

EQT, Blackstone Credit Enter $3.5 Billion Midstream Joint Venture

2024-11-25 - Blackstone Credit & Insurance entered a joint venture with EQT Corp. to take a non-controlling interest in the Mountain Valley Pipeline and other infrastructure from the Equitrans transactions for $3.5 billion.

Midstreamers Say Need for More Permian NatGas Pipelines Inevitable

2024-11-26 - The Permian Basin’s associated gas output could outstrip the region’s planned capacity well before the end of the decade, pipeline company executives said.

Electricity and LNG Drive Midstream Growth as M&A Looms

2024-09-26 - The midstream sector sees surging global and domestic demand with fewer players left to offer ‘wellhead to water’ services.

Analysts: NatGas Price Will Drive Next Appalachian Pipeline

2024-11-13 - Infrastructure development in the Appalachia region could also benefit from greater legislative certainty.

Williams Files for Temporary Permit to Keep $950MM Project Online

2024-09-11 - A temporary emergency certificate is necessary for Williams to continue operating the Regional Energy Access Project after the Court of Appeals shot down an original FERC certificate in July.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.