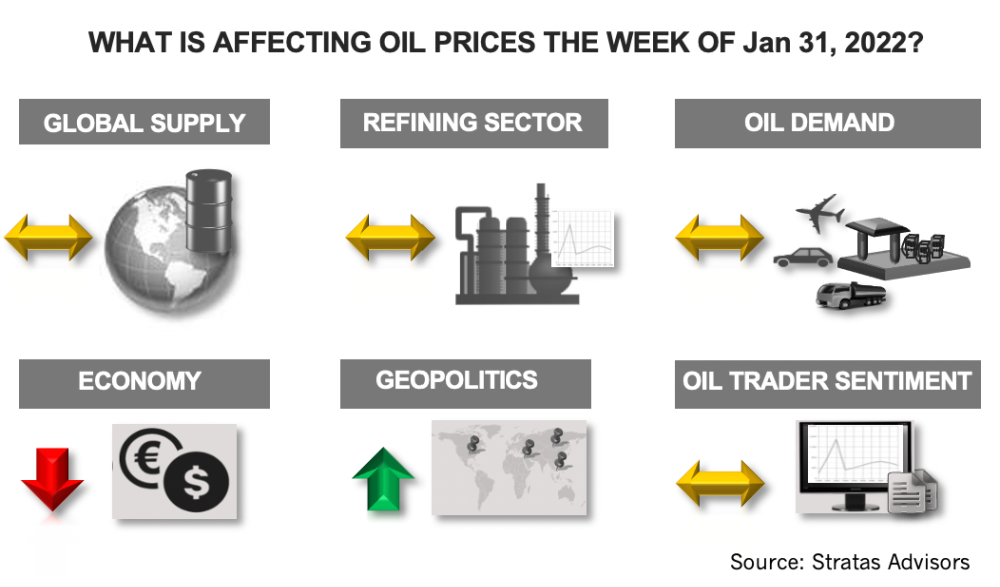

For the upcoming week, Stratas Advisors expects geopolitical concerns will outweigh macroeconomic concerns, and that there will be upward support for oil prices. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $88.17 after closing the previous week at $87.90. The price of WTI ended the week at $87.29 after closing the previous week at $84.83.

The Brent-WTI differential has now narrowed significantly, in part, because of lower inventory levels. In comparison to the same period during 2020, crude inventories are lower by 70.37 million barrels, and are 11.92 million barrels below the level of 2019. Since 2015, the lowest U.S. crude inventories were 394 million barrels, which was reached in September of 2018. Currently, U.S. crude inventories are 416 million barrels. Product inventories are also relatively low. Gasoline inventories increased by 1.30 million barrels but are 11.7 million less than for the same period in 2019. Diesel inventories decreased by 2.80 million barrels and are now 17.24 million barrels less than for the same period in 2019. Jet fuel inventories increased by 2.3 million bbl/d and are now about 4.21 million less than for the same period in 2019. The relatively low level of product inventories stems not from just the rebound in demand, but also because of the reduced refinery crude runs resulting from refinery closures that occurred during the midst of COVID-19. Based on the 4-week average, crude inputs are running about 1.80 million bbl/d less than in 2019.

Looking forward to the upcoming week, geopolitics will continue to be supportive of oil prices. The situation involving Russia and the U.S. and NATO pertaining to Ukraine continues to be in the forefront. The latest round of diplomatic meetings did not result in any breakthroughs, but, at least, both the U.S. and Russia have indicated that there is still a basis for future discussions. There is almost no possibility that the U.S. will agree to Russia’s demands that the NATO pullback from Eastern Europe, or that Ukraine will never be a member of NATO. Additionally, it appears that there is consensus within NATO that Nord Stream 2 will be stopped if Russia moves forward with aggressions against Ukraine. However, there remains the potential for some common ground pertaining to the extent and type of weapons that will be deployed in Eastern Europe.

We are still holding to our view that Russia will not move forward with full-fledge invasion, and therefore, we do not expect any disruption to the supply of oil and gas. However, the elevated tensions are providing for a risk premium, and an invasion cannot be ruled out because Russia may hold the view that it will not be that affected by sanctions, in part, because it could increase its linkages with China, including increases sales of oil and gas, which will provide funds outside of SWIFT (Society for Worldwide Interbank Financial Telecommunication) that supports financial transactions between banks globally. Furthermore, Russia might view that an invasion, coupled with an ineffective response from NATO will severely damage the credibility of NATO—and ultimately result in the breakup of NATO with the existing cracks between France, the U.K., Germany, and the U.S. fracturing wide open.

While geopolitics are providing support for oil prices, macroeconomics are putting downward pressure on oil prices. China is still being affected by COVID-19 with its aggressive restrictions having a negative impact on its economy. The Purchasing Managers’ Index (PMI) for January declined to 49.1, which signifies a contraction. Furthermore, it is the lowest level since February 2020. Even more worrisome, is that new orders have declined, including export orders, which declined the most since May 2020. The downturn is also putting pressure on the job market. Additionally, China is dealing with property sector that is hampered by significant level of debt. In response to the slowdown, China appears to be ready to provide monetary support. China’s central bank has recently reduced interest rates, as part of the efforts to provide additional liquidity. In addition to the economic slowdown, China is facing the risk associated with being trapped by its zero-COVID policy. It is possible that China is still facing the worst of COVID-19, since COVID-19 does not appear to be going away. As such, China will need to continue with its aggressive restrictions, or face the possibility of increased level of cases and deaths.

The outlook for the U.S. economy is also murky. While it appears that the U.S. Federal Reserve is ready to reduce monetary support, the U.S. economy is showing signs of distress. Real personal income and spending fell in November and December of last year. Retail and wholesale inventories have been building and manufacturing indicators are trending downward. Additionally, the GDPNOW model from the Atlantic Fed is indicating that the U.S. GDP will only grow by 0.1% in the first quarter. While the GDPNOW is not an official forecast, it is described by the Atlantic Fed to be a running estimate of real GDP growth based on available economic data.

Last week, the U.S. Dollar Index increased to 97.22 from the previous week of 95.64. The future strength of the U.S. dollar will be dependent on the ability of the U.S. economy to continue to expand with a less accommodating monetary policy, and the robustness of the U.S. equity markets. We think there is a material risk that the Federal Reserve will tighten too fast, which will cause the U.S. economy to slow down, and the U.S. equity markets to turn downward—which in turn will result in a weaker U.S. dollar. We think this risk is especially heightened since much of the current inflation is not linked to monetary policy, but instead to supply chain issues, physical shortages, and higher energy costs.

While the outlook pertaining to geopolitics and macroeconomics are becoming less certain, the oil market is on the verge of going through a transition period. Since members of OPEC+ came together back in second-quarter 2020, the governing dynamics for the oil market has entailed the management of supply so that demand has continued to outpace supply and excess inventories have been drawn down. For 2022, expectations for demand growth and supply growth are essentially balanced, which means that there will be the risk of oversupply, especially if demand growth falters because of the weakening outlook for economic growth and the potential for policy errors, which could disrupt the global economy. Conversely, global oil demand is forecasted to exceed pre-COVID levels, while the U.S. and other producers are still producing less—so without an economic downturn it is likely that supply/demand conditions will be tighter than before COVID-19.

For the upcoming week, we are expecting that geopolitical concerns will outweigh macroeconomic concerns, and that there will be upward support for oil prices.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US Court Overturns Alaska Oil Lease Sale in a Win for Environmentalists

2024-07-17 - The ruling affects a lease sale held in December 2022 of offshore tracts for oil and gas development in the Cook Inlet in the northern Gulf of Alaska.

OPEC+ Brings Oil Overproduction Under Heel—Rystad

2024-07-15 - After years of noncompliance and underreporting of actual crude production, many OPEC+ members are voluntarily reducing output beyond set goals, according to analysis by Rystad Energy.

What's Affecting Oil Prices This Week? (July 15, 2024)

2024-07-15 - Stratas Advisors expects economic news to put some downward pressure on oil prices during the upcoming week.

Biden Administration Mulls More Alaska Drilling Protections

2024-07-15 - The BLM will take public comment on whether to update protected areas in the Western Arctic.

FTC Requests More Info on $17.1B ConocoPhillips, Marathon Oil Deal

2024-07-12 - The U.S. Federal Trade Commission’s request for additional information regarding ConocoPhillips’ $17.1 billion acquisition of rival Marathon Oil is likely to delay the transaction. Other recent energy M&A deals have faced similar “second requests” from the FTC.