The price of Brent crude ended the week at $76.70 after closing the previous week at $74.18. The price of WTI ended the week at $74.02 after closing the previous week at $70.65. The price of DME Oman crude ended the week at $76.94 after closing the previous week at $74.86.

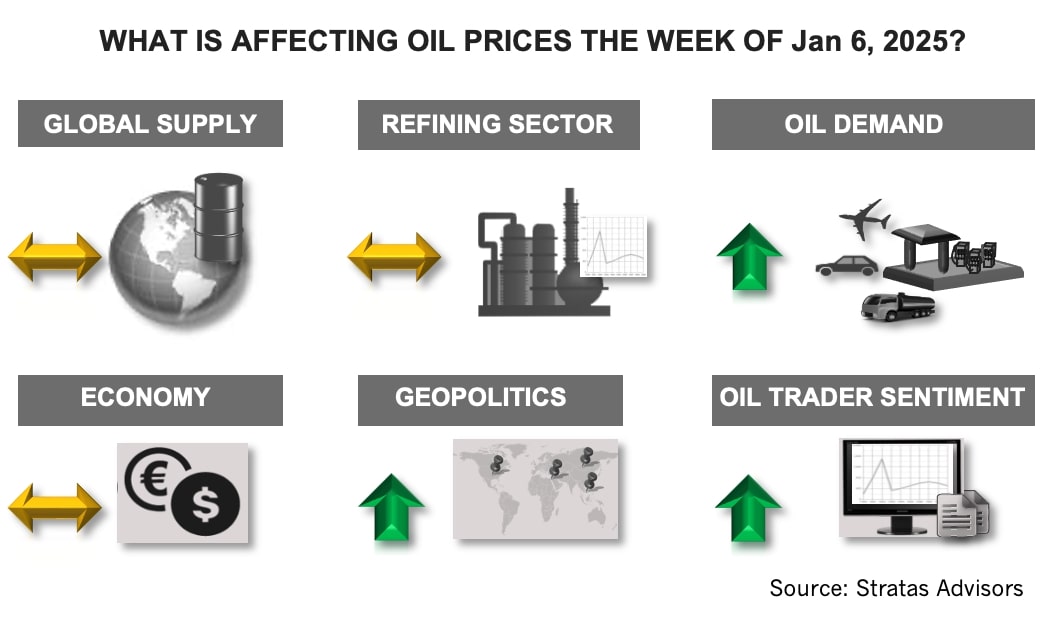

We have been expecting that oil prices would increase because of several factors, including the optimism associated with China’s announced intent to move forward with future interest rate cuts and additional fiscal stimulus to boost economic growth. Recent geopolitical news also provided some support for oil prices with the rhetoric heating up between Iran and Israel. During a Dec. 28, 2024 interview with China’s state-run media, Iran’s foreign minister stated that Iran is ready for any future Israeli attacks.

He also stated that 2025 will be an important year for Iran’s nuclear program. The foreign minister did moderate his remarks by saying that Iran prefers a diplomatic approach with respect to Israel – and that Iran would consult with allies, including China. In local newspapers, Israelis are discussing the need to attack Iran as a response to Houthi attacks, which have continued despite Israel’s aerial attacks on Yemen. Additionally, the Houthis have been able to gain control over much of Yemen despite years of attacks from Saudi Arabia. The view being put forward is the only way to stop the Houthis from attacking Israel with drones and ballistic missiles is for Israel to attack Iran.

The fundamentals have also provided some support for crude prices with crude inventories in the U.S. being drawn down in rent weeks. Currently, crude inventories are less than the level of the previous year (416 MMbbl vs. 437 MMbbl) and less than the inventory levels in 2019 (416 MMbbl vs. 430 MMbbl). The inventory level at Cushing has decreased to 22.54 MMbbl, which compares to 33.97 MMbbl of the previous year.

Last week, the SPR inventories increased to 393.57 MMbbl from 393.31 MMbbl. The SPR reached its lowest level (347.16 MMbbl) during the week of June 30, 2023. During the week of Aug. 20, 2020, the SPR was at 648.17 MMbbl. Despite recent builds in product inventories, inventories of gasoline are at the typical level for this time of year when compared to the previous five years (excluding 2020 when inventories were unusually high because of COVID-19). Diesel inventories are below the typical level for this time of year. Inventories of jet fuel are above the typical level for this time of year.

For the upcoming week, we think that the oil prices will get a boost from the continuation of support from the factors of last week, as well as from the forecasted cold weather, which will increase demand for heating oil and have the potential to affect upstream production. Some downward pressure will come from the strengthening U.S. dollar. The U.S. Dollar Index increased last week, finishing the week at 108.92 from the previous week of 108.13 and is at the highest level since October of 2022 and up from 100.42 on September 22, 2024. The U.S. 10-Year Treasury ended the week at 4.602%, up from 4.151% on Dec. 6, 2024, and from 3.621% on Sept. 16, 2024. The increasing 10-year rate will make it more difficult for the Federal Reserve to cut interest rates.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Energy Transfer Announces $3B Senior Notes Offering

2025-02-19 - Midstream company Energy Transfer plans to use the proceeds from its $3 billion offering of senior notes to refinance existing debts and for general partnership purposes.

Energy Careers Platform Offering Free Access to Job Seekers

2025-02-19 - Ally Energy and Parallel say their new energy industry hiring platform has advantages for both job seekers and hiring companies.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Infrastructure Firm HASI Makes Executive Leadership Changes

2025-02-18 - HA Sustainable Infrastructure Capital Inc. announced four executive leadership appointments, effective March 1.

Expand Appoints Dan Turco to EVP of Marketing, Commercial

2025-02-13 - Expand Energy Corp. has appointed industry veteran Dan Turco as executive vice president of marketing and commercial.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.