In the week since our last edition of What’s Affecting Oil Prices, Brent averaged $67.53/bbl last week, continuing to ride bullish sentiment through the New Year.

For the upcoming week Stratas Advisors expect Brent prices to average $67.50/bbl as trading activity picks up and little evidence is present to justify continued gains. Given high price levels and extraordinary long positioning, the chance for a sharp pullback on unexpected news is very still very real. Stratas Advisors expects the Brent-West Texas Intermediate (WTI) differential to average $6.20/bbl.

The supporting rationale for the forecast is provided below.

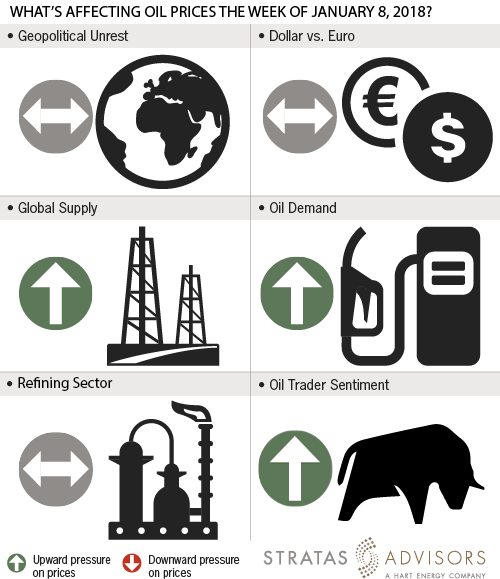

Geopolitical: Neutral

Geopolitics as it relates to oil could continue to drive volatility, but is unlikely to have an additional immediate fundamental impact. However, the few active hotspots that bear watching are more likely to hamper oil supply, further helping prices.

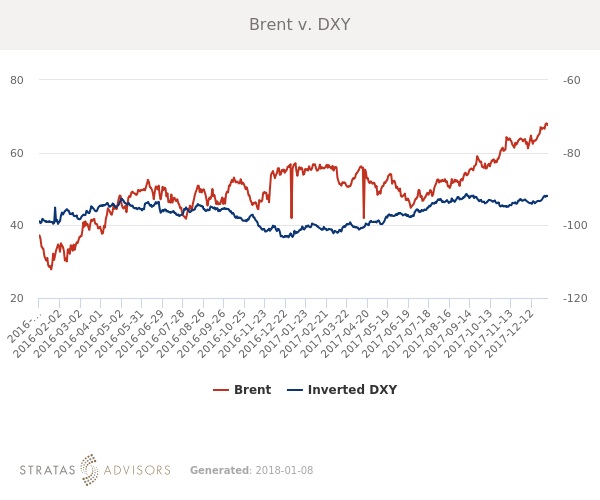

Dollar: Neutral

Crude oil and the dollar traded independently last week as crude remains more influenced by fundamental factors and sentiment.

Trader Sentiment: Positive

The first CFTC release of 2018 showed that Brent and WTI managed money net longs remain near record levels. Sentiment remains generally positive although WTI’s prospects continue to lag behind Brent’s based on production growth expectations. RSI hovers near overbought territory as it has since end-December, raising the possibility of a price correction, likely triggered by a negative weekly U.S. inventory report.

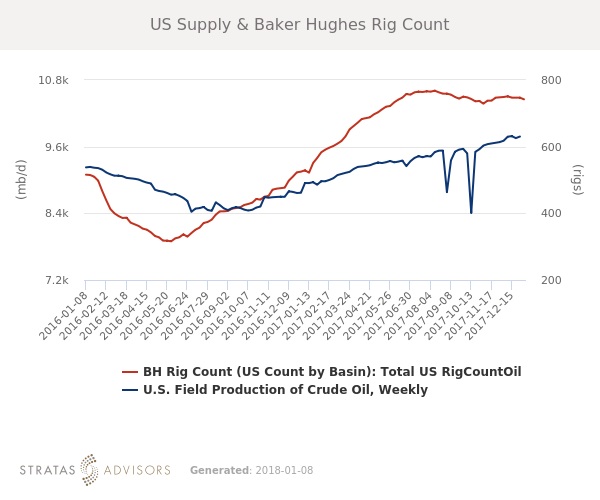

Supply: Positive

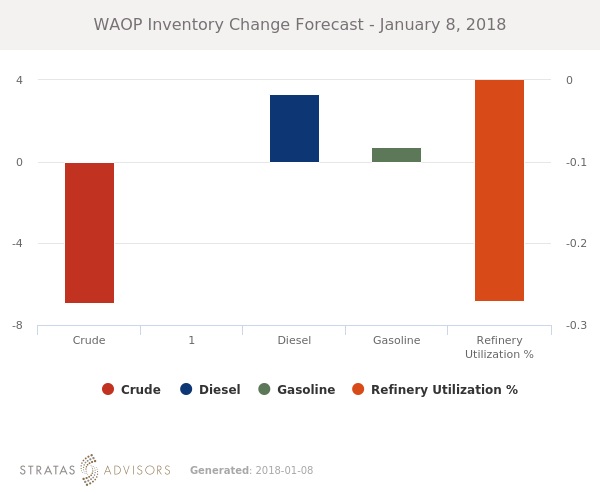

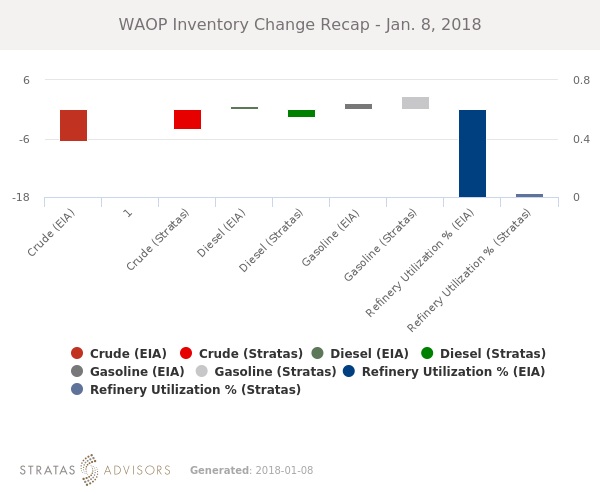

Last week the number of operating oil rigs in the U.S. fell by five. U.S. oil rigs now stand at 742 compared to 529 a year ago. U.S. crude production again increased, a potentially bearish sign for oil markets, but one that was largely ignored. Additionally, a survey of OPEC production indicated compliance remained high supported by continued declines in Venezuela. A tanker fire offshore China could disrupt unloading, but is unlikely to cause any longer-term outages.

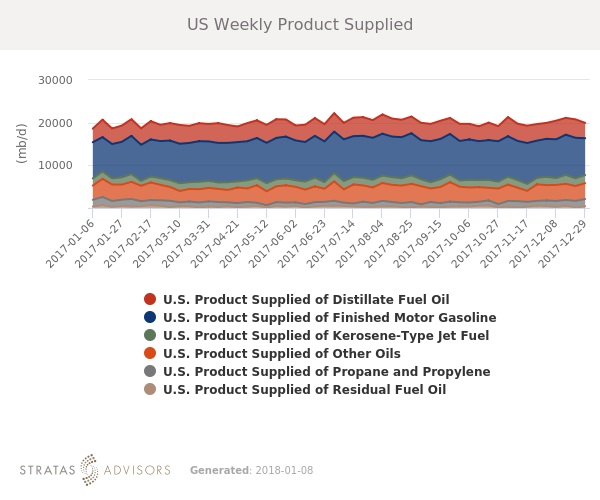

Demand: Positive

Refinery crude intake has been exceptionally strong the last few weeks, partly due to end-of-year tax maneuvering, but also due to strong product demand. Last week’s large product stock builds were primarily driven by higher production, which should ease back in the weeks ahead. Product demand and exports especially remain very healthy, helping to control stocks in the U.S.

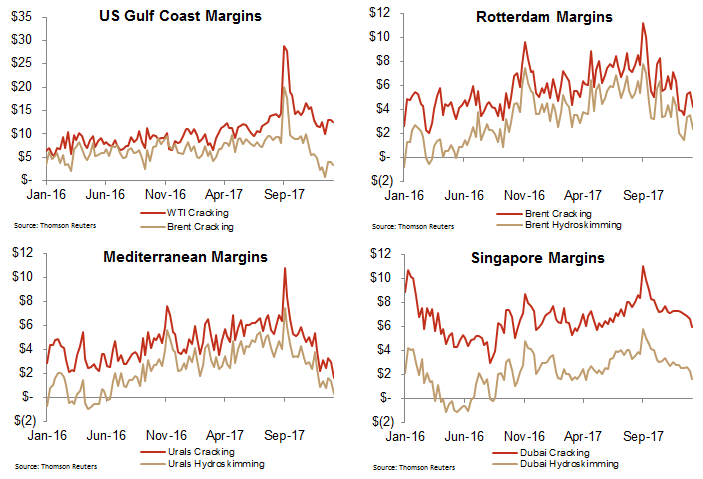

Refining: Neutral

Margins began 2018 at generally more seasonably appropriate levels. While margins within the average range won’t necessarily hurt crude runs, they do not incentivize significant increases from those facilities that are not going down for spring maintenance.

How We Did

Recommended Reading

VTX Energy Quickly Ramps to 42,000 bbl/d in Southern Delaware Basin

2024-09-24 - VTX Energy’s founder was previously among the leadership that built and sold an adjacent southern Delaware operator, Brigham Resources, for $2.6 billion.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row

2024-10-04 - The oil and gas rig count fell by two to 585 in the week to Oct. 4.

EY: How AI Can Transform Subsurface Operations

2024-10-10 - The inherent complexity of subsurface data and the need to make swift decisions demands a tailored approach.

Bowman Consulting to Manage, Monitor Delaware Basin Wells

2024-10-14 - Bowman Consulting Group’s scope of work includes conducting detailed field surveys of above-ground infrastructure assets across well sites of up to to 8 acres.

E&P Highlights: Oct. 7, 2024

2024-10-07 - Here’s a roundup of the latest E&P headlines, including a major announcement from BP and large contracts in the Middle East.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.