The price of Brent crude ended the week at $85.00 after closing the previous week at $84.33. (Source: Shutterstock)

The price of Brent crude ended the week at $85.00 after closing the previous week at $84.33. The price of WTI ended the week at $81.54 after closing the previous week at $80.59. The price of DME Oman crude ended the week at $85.02 after closing the previous week at $84.63.

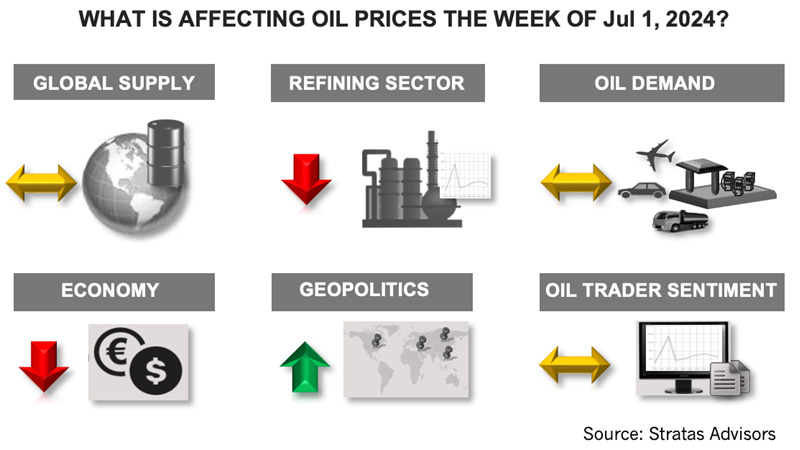

At the beginning of last week, we expected that after the significant gains of the previous two weeks price movement would be dampened because of economic and political uncertainty. We expect similar market action this week.

We do not see any signs that global demand growth will surprise to the upside. With respect to the U.S., the latest Energy Information Administration (EIA) report shows that gasoline demand in the U.S. decreased to 8.97 MMbbl/d from the previous week’s 9.39 MMbbl/d. In comparison with 2019, gasoline demand is running 6.13% less during the last four weeks, and 1.47% less in comparison with 2023. Diesel demand in the U.S. decreased to 3.54 MMbbl/d from the previous week of 3.98 MMbbl/d. In comparison with 2019, diesel demand is running 7.96% less during the last four weeks, and 3.22% less in comparison with 2023. Jet fuel demand decreased to 1.68 MMbbl/d from the previous week of 1.71 MMbbl/d. In comparison with 2019, jet fuel demand is running 5.07% less during the last four weeks, but 2.53% more than in 2023.

The International Energy Agency (IEA) recently revised its forecast for oil demand growth downward one more from 1.10 MMbbl/d to 0.96 MMbbl/d, in part because of weak demand from China in April. We are currently forecasting that China’s oil demand growth will be only 0.25 MMbbl/d in the second half of the year in comparison with the second half of 2023.

Economic data continues to be disappointing. The latest data from China’s National Bureau of Statistics (NBS) purchasing managers' index (PMI) for manufacturing came in at 49.5 in June and is the second consecutive month of reading below 50, which indicates contraction. New orders, raw material stocks, employment and new export orders were all in contraction. The non-manufacturing PMI (including services and construction) showed a slowdown in growth, with the PMI decreasing to 50.5 from 51.1 in May, which is the lowest since last December.

There is also political uncertainty in the West, which was highlighted by recent events. The projected results of the France election from the first round of voting indicate that the National Rally party is leading with a projected 34% of the vote. The New Popular Front, a left-wing coalition of parties, is in second place with 28%, Macron’s Ensemble Coalition group of centrists in third place with around 20% of the vote and the Les Republicans in fourth place with 10%. The second round of voting takes place on July 7. The recent debate between President Biden and Donald Trump raised concerns about Biden’s ability to serve for another term and increased the possibility of Trump returning to office.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Matador May Tap Its Haynesville ‘Gas Bank’ if Prices Stabilize

2024-10-24 - The operator holds 8,900 net Haynesville Shale acres and 14,800 net Cotton Valley acres in northwestern Louisiana, all HBP, that it would drill if gas prices stabilize—or divest for the right price.

Nigeria Halts Shell Asset Sale, Approves Exxon-Seplat Deal

2024-10-21 - Nigeria blocked Shell's sale of its entire onshore and shallow-water oil operations.

Chevron Pushing Longer Laterals in Argentina’s Vaca Muerta Shale

2024-09-13 - Chevron Corp., already drilling nearly 2.8-mile laterals at its Loma Campana Field in Argentina, wants to drill even longer horizontals, an executive told Hart Energy.

Chevron Gets Approval for Farm-in Offshore Uruguay

2024-09-26 - Chevron Corp. received approval for farm-in at the AREA OFF-1 block offshore Uruguay and along with partner CEG Uruguay SA eyes the acquisition of 3D seismic over the remainder of 2024.

With Montney Production Set to Grow, US E&Ps Seize Opportunities

2024-10-02 - Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.