The price of Brent crude ended the week at $85.03 after closing the previous week at $86.54. The price of WTI ended the week at $82.21 after closing the previous week at $83.16. The price of DME Oman crude ended the week at $84.65 after closing the previous week at $86.38.

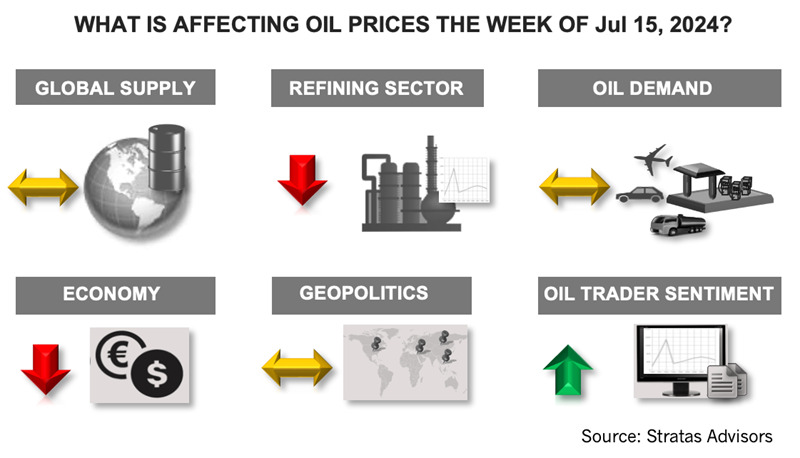

We are expecting that economic news will put some downward pressure on oil prices during the upcoming week. Data just released by China shows that economic growth slowed in the second quarter from 5.3% in the first quarter to 4.7%, which is the weakest growth since the third quarter of 2023. China’s economy continues to be hampered by weak domestic demand. China’s economic growth is also being hampered by its debt-ridden real estate market and the elevated level of provincial debt.

The recent economic news from the U.S. continues to be mixed. The consumer price index (CPI) decreased by 0.1% in June, which is the first decrease since May 2020; however, the core CPI, which excludes food and energy, increased by 0.1% from the previous month and 3.3% year-on-year. Additionally, wholesale prices increased by 0.2% from May and 2.6% from the previous year, which is the largest increase since March 2023. With the exclusion of food and energy, core wholesale prices increased 0.4% from May and 3.0% from the previous year. There are also signs that the U.S. labor market is cooling down. While nonfarm jobs increased by 206,000, 70,000 of the jobs were government jobs. Additionally, there were significant downward revisions in the previous months with the number of jobs added in May being revised to 218,000 from 272,000 and the number of jobs in April being revised to 108,000 from 165,000. Furthermore, the unemployment rate has increased to 4.1%, which is the highest level since October 2021. The U6 unemployment rate, which includes discouraged workers and those holding part-time jobs for economic reasons, remained at 7.4%. While the labor force participation rate increased to 62.6%, which is the highest since 2002, the household survey shows that full-time jobs decreased by 28,000 and part-time jobs increased by 50,000.

While many observers of the Federal Reserve have been predicting multiple rate cuts this year and are now forecasting a rate cut in September, we have been forecasting that the Federal Reserve will not make any rate cuts before the presidential election. We are holding to our forecast because the inflation rate remains well above the 2% target of the Federal Reserve, and the labor market, while cooling, is still adding jobs and the unemployment rate remains relatively low. Additionally, we think that the Federal Reserve is hesitant to have a rate cut before the presidential election because of the appearance of attempting to influence the election results.

Oil traders have been adding to their net long positions in recent weeks. Last week, traders of WTI increased their net long positions by 6.84% by increasing their long positions while decreasing their short positions. Traders of Brent crude also increased their net long positions by increasing their long positions more than their short positions. We think, however, that this trend will change this week.

We are also seeing some weakness in the refining sector with margins decreasing last week in the U.S., as well as in Asia, even though crude oil prices decreased.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

NatGas A&D Warms Up as BKV Sells Marcellus Assets for $132MM

2024-07-12 - Natural gas M&A may be heating up as Barnett Shale-focused E&P BKV Corp. sold interests in gassy northeast Pennsylvania properties for nearly $132 million, according to regulatory filings.

Are 3-mile Laterals Worth the Extra Mile?

2024-07-12 - Every additional foot increases production, but it also increases costs.

Enverus Inventory Rankings: Pinpointing Shale’s Best Remaining Runway

2024-07-12 - The Montney Shale steals the spotlight in Enverus’ play rankings, while the Eagle Ford draws plaudits for its resilience.

BPX Expands Its US Shale Game

2024-07-10 - BPX CEO Kyle Koontz delves into development plans in the Permian, Eagle Ford and Haynesville.