The price of Brent crude ended the week at $81.13 after closing the previous week at $82.63. The price of WTI ended the week at $77.16 after closing the previous week at $78.64. The price of DME Oman crude ended the week at $80.57 after closing the previous week at $81.88.

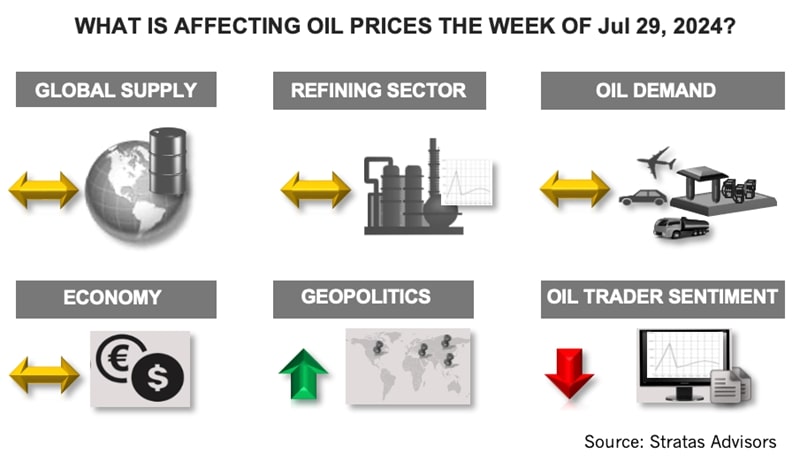

Last week’s price movement aligned with our expectations that the downward trend associated with oil prices would continue. While there was some better news last week about the U.S. economy with the U.S. Commerce Department releasing data that showed that the U.S. economy grew at an annualized rate of 2.8% during Q2 of this year, not all is positive with the U.S. economy. The Conference Board’s Leading Economic Index (LEI) decreased by 0.2% in June, which follows a 0.4% decrease in May – and for the first half of 2024 by 1.9% after decreasing by 2.9% in the second half of last year. The main reasons for the decreases include lower consumer expectations, the decreasing level of new orders, and increasing unemployment claims. The June data is consistent with U.S. GDP growth of only around 1% in Q3 on an annualized basis. Consistent with the more pessimistic view is the U of M consumer sentiment index, which decreased to 66.4 in July which is the lowest level since last November. There is also a softening in consumer demand, as indicated by recent financial results and anecdotal evidence being provided by major consumer-facing companies. There are other signs of consumers facing difficulties. The personal savings rate decreased to 3.4% in June and has been falling since March 2023 when the savings rate was 5.2%. For the decade before COVID-19, the savings rate averaged 6.1%. The current savings rate is approaching the lows experienced in the aftermarket of the 2008 financial crisis.

Despite mix economic news, in recent weeks, the U.S. demand for oil products has been running above last year, according to Energy Information Administration data.

- Gasoline demand in the U.S. increased to 9.46 MMbbl/d from the previous week of 8.78 MMbbl/d. In comparison with 2019, gasoline demand is running 2.81% less during the last four weeks, but 2.52% more in comparison with 2023.

- Diesel demand in the U.S. increased to 3.86 MMbbl/d from the previous week of 3.59 MMbbl/d. In comparison with 2019, diesel demand is running 3.81% less during the last four weeks but 3.25% more in comparison with 2023.

- Jet fuel demand increased to 1.76 MMbbl/d from the previous week of 1.43 MMbbl/d. In comparison with 2019, jet fuel demand is running 6.99% less during the last four weeks, but 3.81% more than in 2023.

The demand situation in the U.S., however, has not been enough to offset the concerns about Asia, and especially about China. Consequently, the sentiment of oil traders has deteriorated, as indicated by traders of WTI reducing their net long positions by 9.22% last week by decreasing their long positions while increasing their short positions. Traders of Brent crude also decreased their net long positions by decreasing their long positions while increasing their short positions.

One factor that is giving upward support to oil prices is the situation in the Middle East. The risk of a broader conflict in the Middle East has increased with the recent rocket attack on Israel, apparently by Hezbollah. In response, Israel’s security council has authorized Netanyahu’s government to launch a retaliatory attack, which could lead to a major fighting between Hezbollah and Israel – and possibly even draw in Iran. The Biden administration continues to push for a ceasefire in Gaza – but that seems unlikely with Netanyahu still focused on destroying Hamas. Additionally, the Biden Administration has lost some ability to influence Israel with President Biden becoming a lame-duck president.

For the upcoming week, we are expecting that oil prices will finish higher with the heightened concerns about the Middle East, coupled with the headline GDP number for the U.S. and the increasing expectation for a rate cut by the U.S. Federal Reserve. We are expecting that Brent will test $82 during the week.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Inside Prairie’s 11-Well Program in the D-J

2025-04-08 - Prairie Operating Co.’s 11-well program in the Denver-Julesburg Basin is drilling horizontal 2-milers with a Precision Drilling rig.

Momentum AI’s Neural Networks Find the Signal in All That Drilling Noise

2025-02-11 - Oklahoma-based Momentum AI says its model helps drillers avoid fracture-driven interactions.

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-16 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.