The price of Brent crude ended the week at $86.54 after closing the previous week at $85. The price of WTI ended the week at $83.16 after closing the previous week at $81.54. The price of DME Oman crude ended the week at $86.38 after closing the previous week at $85.02.

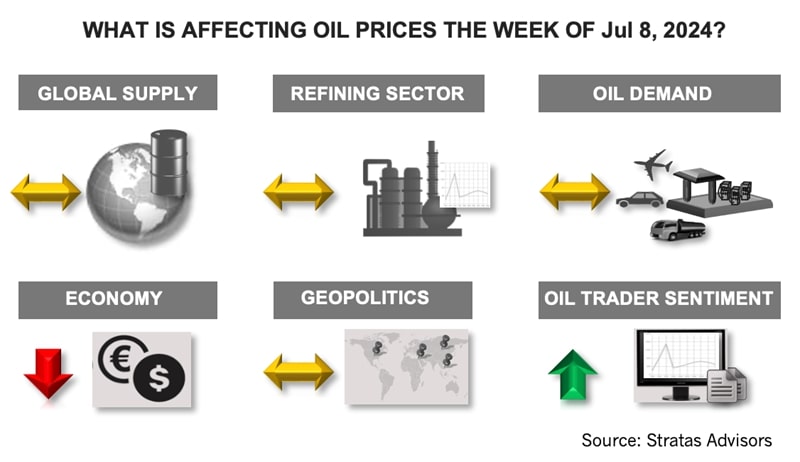

Oil prices moved up last week, in part, because of the following reasons:

- The large drawdown in U.S. crude inventories. The latest weekly report from the EIA indicated that crude inventories in the U.S. decreased by 12.16 MMbbl/d. Crude inventories currently are less than in 2019 (448 million vs. 469 million), but comparable to the inventory level of last year (448 million vs. 454 million).

- The expected boost in demand from the holiday weekend in the U.S. While we expect that gasoline demand in the U.S. will get a boost because of the holiday weekend, product demand in the U.S. has been tepid throughout the first half of the year. With respect to the last four weeks, gasoline demand is running 5.01% below the demand of 2019 and 1.74% below the demand of last year. Diesel demand is running 8.31% below the demand of 2019, but 1.36% more than last year. Jet fuel demand is running 4.26% below the demand of 2019 and 1.31% below the demand of last year.

- The movement in oil prices was also supported by the traders of WTI and traders of Brent crude increasing their net long positions. Last week, traders of WTI increased their net long positions by 24% and traders of Brent crude increased their net long positions by a similar percentage.

Looking forward to the rest of the year we are forecasting the following with respect to oil prices and the factors driving the oil prices:

- During Q3, we are forecasting that the price of Brent crude will average $87.90 and the price of WTI will average $82.37. During Q4, we are forecasting that the price of Brent crude will average $86 and the price of WTI will average $80.76.

- We are forecasting that oil demand will increase by a net 1.20 MMbbl/d in the second half of the year in comparison to the second half of 2023. Asia’s oil demand is forecasted to increase by 1.11 MMbbl/d.

- With respect to oil supply, we are forecasting that non-OPEC supply will average 1.17 MMbbl/d more in the second half of 2024 than in the second half of 2023. Additionally, we are forecasting that supply will be outstripped by demand in Q3 by around 350,000 bbl/d. During Q4 we are forecasting that supply and demand will be essentially balanced.

- For the remainder of the year, it is our base case that geopolitics and the ongoing wars will have a limited material impact on the volumes of oil available to the market. Geopolitical developments, however, do present a potential risk to the future flow of oil, as well as the outlook of oil demand. More importantly, the developments have the potential to disrupt the stability of the geopolitical structure that has been in place for the last 30-plus years.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Energy Transition in Motion (Week of Oct. 4, 2024)

2024-10-04 - Here is a look at some of this week’s renewable energy news, including the startup of a solar module manufacturing facility with an annual 2-gigawatt capacity.

Energy Transition in Motion (Week of Sept. 6, 2024)

2024-09-06 - Here is a look at some of this week’s renewable energy news, including $7.3 billion in clean energy funding for rural Americans.

Energy Transition in Motion (Week of Sept. 27, 2024)

2024-09-27 - Here is a look at some of this week’s renewable energy news, including a commitment of more than $116 billion annually in renewables and grids.

Energy Transition in Motion (Week of Sept. 13, 2024)

2024-09-13 - Here is a look at some of this week’s renewable energy news, including an agreement between Exxon Mobil and Mitsubishi Corp. concerning ammonia from a planned hydrogen facility in Texas.

Energy Transition in Motion (Week of Nov. 1, 2024)

2024-11-01 - Here is a look at some of this week’s renewable energy news, including progress on the largest U.S. offshore wind project being developed.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.