In the week since our last edition of What’s Affecting Oil Prices, Brent prices were nearly flat, up only 37 cents to average $77.56/bbl. WTI prices saw more support, rising nearly $2 to average $73.71/bbl.

The week ahead will see both prices continue to climb on higher demand and myriad supply outages. We expect that Brent prices will likely average at least $78/bbl in the week ahead, while WTI could potentially reach $75. We reiterate that the strength in WTI is likely temporary, driven primarily by a production outage in Canada.

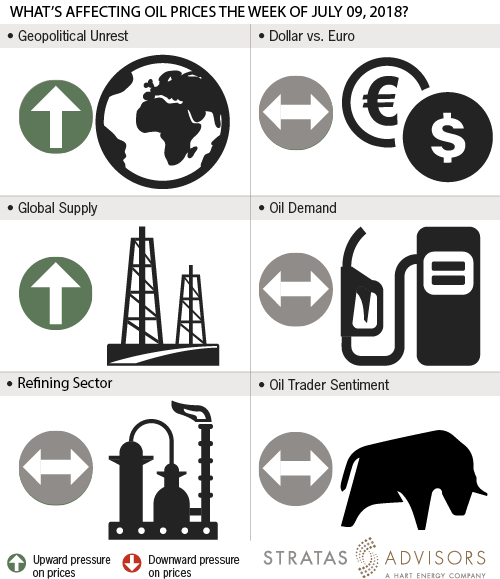

Geopolitical: Positive

Geopolitics will be a positive factor in the week ahead as fighting in Libya and sanctions against Iran are supporting prices.

Dollar: Neutral

The dollar will be a neutral factor in the week ahead as fundamental and sentiment-related drivers continue to have more impact on crude oil prices.

Trader Sentiment: Neutral

Trader sentiment will be a neutral factor in the week ahead, with fundamentals providing more direction to crude prices.

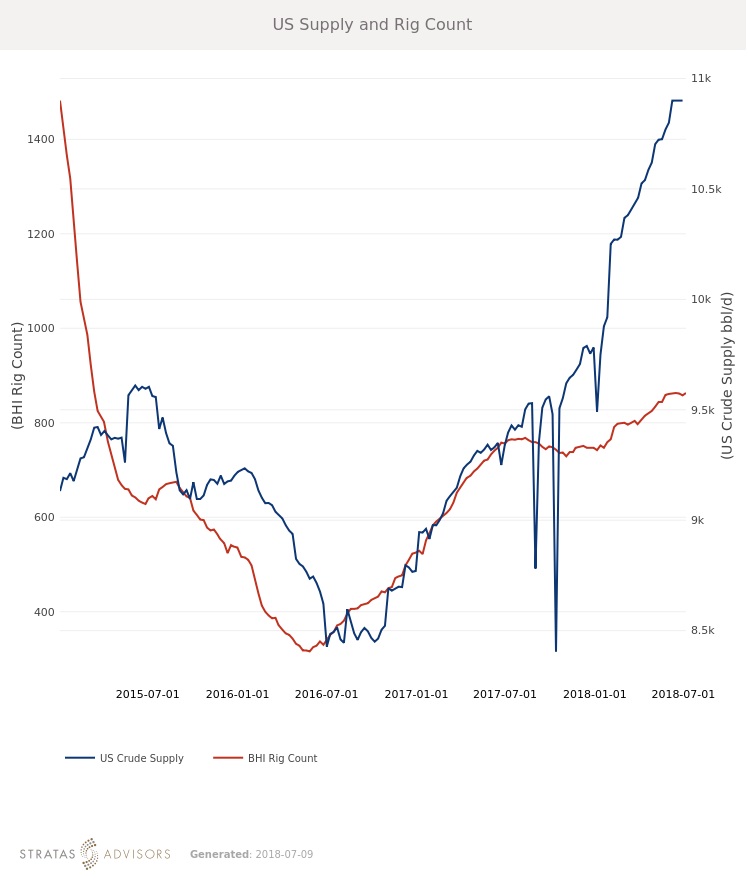

Supply: Positive

Supply will likely be a marginally positive factor in the week ahead with Venezuelan, Iranian, Libyan and Syncrude volumes all constrained.

Demand: Neutral

Demand will be a neutral factor in the week ahead as rising prices fail to stymie demand but also do not create opportunities for strong growth.

Refining: Neutral

Refining will be a neutral factor in the week ahead with margins, especially in Asia, continuing to fall on higher crude prices and more regional product supply.

How We Did

Recommended Reading

McKinsey: Big GHG Mitigation Opportunities for Upstream Sector

2024-11-22 - Consulting firm McKinsey & Co. says a cooperative effort of upstream oil and gas companies could reduce the world’s emissions by 4% by 2030.

US Drillers Cut Oil, Gas Rigs for Second Week in a Row

2024-11-22 - The oil and gas rig count fell by one to 583 in the week to Nov. 22, the lowest since early September. Baker Hughes said that puts the total rig count down 39, or 6% below this time last year.

Water Management Called ‘Massive Headwind’ for Permian Operators

2024-11-21 - Amanda Brock, CEO of Aris Water Solutions, says multiple answers will be needed to solve the growing amounts of produced water generated by fracking.

Coterra Takes Harkey Sand ‘Row’ Show on the Road

2024-11-20 - With success to date in Harkey sandstone overlying the Wolfcamp, the company aims to make mega-DSUs in New Mexico with the 49,000-net-acre bolt-on of adjacent sections.

Suriname's Staatsolie Says Exxon has Withdrawn from Offshore Block

2024-11-20 - Suriname's state-run oil company Staatsolie said on Nov. 20 that U.S. oil giant Exxon Mobil has withdrawn from its offshore block 52, and block operator Petronas Suriname E&P will take over its 50% stake.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.