Oil prices moved downward through the second half of the week after initially increasing at the beginning of the week. (Source: Shutterstock)

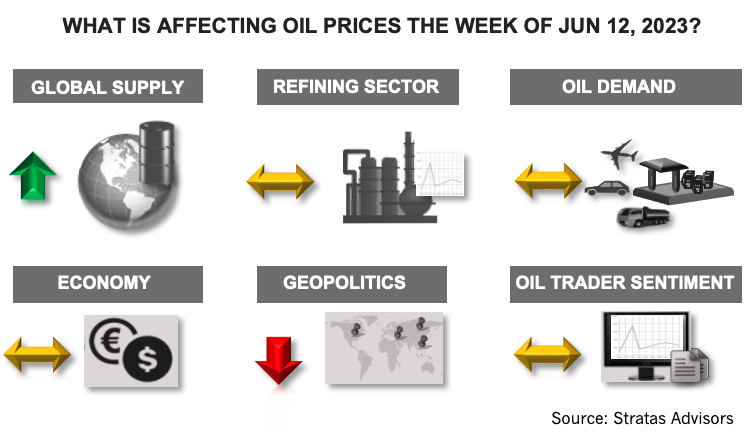

The price of Brent crude ended the week at $74.79 after closing the previous week at $76.40. The price of WTI ended the week at $70.17 after closing the previous week at $71.87. Oil prices moved downward through the second half of the week after initially increasing at the beginning of the week, with OPEC+ announcing an extension of the current production cuts through the end of the year and an additional supply cut of 1.0 MMbbl/d in July by Saudi Arabia.

One reason for the reversal in oil prices was the rumor of a potential deal between Iran and the U.S., which would allow Iran to export up to 1.0 MMbbl/d of oil. Both the U.S. and Iran stated that report of a deal was false. Since the early days of the Biden Administration, we have been skeptical of any such deal. We do not believe that Iran will give up its nuclear ambitions, and this point was recently reiterated by Iran’s supreme leader, who stated that the infrastructure of Iran’s nuclear industry should not be touched. At the same time, the U.S. State Department stated that the Biden Administration is committed to never allowing Iran to acquire a nuclear weapon. Additionally, we do not think Iran is that interested in a deal because of its growing ties to China and Russia, which provides an alternative to making concessions with the West. Concurrently, the Biden Administration is constrained by the need to appear being tough with Iran for domestic audiences, as well as for key allies.

There also has been some talk about tensions growing between Russia and Saudi Arabia because Saudi Arabia has continued to reduce production, while Russia has not made any additional cuts. We do not put too much credence in such reports. It is our view that Russia and Saudi Arabia understand the importance of maintaining the relationship with respect to the stability of the oil market. Additionally, both parties are interested in pushing oil prices higher to support other goals.

The big financial news in the U.S. pertains to the Federal Reserve and the decision about interest rates that will come out of the meetings to be held on June 13 and June 14. We expect that the Federal Reserve will pause with rate hikes, in part, because the Federal Reserve has strongly hinted that will be the decision. The pause will happen even though inflation remains well above the 2% target and the May jobs report, which indicated that the U.S. added 339,000 jobs according to its payroll survey.

In contrast to the U.S. (and the EU), China is not facing inflationary pressures, in part, because China’s economy continues to struggle, especially the manufacturing sector. During May, the producer price index (PPI) decreased by 4.6%, which is the fastest rate in seven years–and the eighth consecutive month of decreases. There were concerns that with the removal of the COVID-related restrictions would result in China adding to the inflationary pressures in the West; however, it seems that China is exporting deflation because demand is lagging the rebounding production.

During this week, we are expecting that the price of Brent crude will continue to fluctuate between $72 and $76.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

E&P Highlights: Nov. 18, 2024

2024-11-18 - Here’s a roundup of the latest E&P headlines, including new discoveries in the North Sea and governmental appointments.

McKinsey: Big GHG Mitigation Opportunities for Upstream Sector

2024-11-22 - Consulting firm McKinsey & Co. says a cooperative effort of upstream oil and gas companies could reduce the world’s emissions by 4% by 2030.

Nabors Takes to Global Expansion in 3Q as Rig Count Shrinks in Lower 48

2024-10-25 - Nabors Industries saw broad growth across key international geographies in third-quarter 2024, with more rig deployments expected.

What Chevron’s Anchor Breakthrough Means for the GoM’s Future

2024-12-04 - WoodMac weighs in on the Gulf of Mexico Anchor project’s 20k production outlook made possible by Chevron’s ‘breakthrough’ technology.

Chevron Gets Approval for Farm-in Offshore Uruguay

2024-09-26 - Chevron Corp. received approval for farm-in at the AREA OFF-1 block offshore Uruguay and along with partner CEG Uruguay SA eyes the acquisition of 3D seismic over the remainder of 2024.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.