The price of Brent crude ended the week at $82.67 after closing the previous week at $79.56. The price of WTI ended the week at $78.49 after closing the previous week at $75.38. The price of DME Oman crude ended the week at $82.38 after closing the previous week at $80.09.

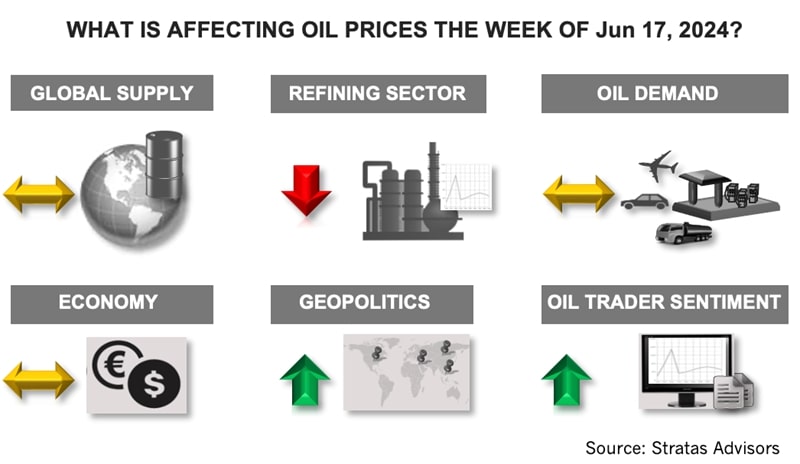

As we expected, oil prices bounced back from what we viewed as a market overreaction to the news that OPEC+ is intending to trim its supply cuts through September of next year coupled with concerns about demand, which had been exacerbated by a recent spate of disappointing economic news.

While OPEC+ is facing inherent challenges with maintaining discipline between its members, we think that OPEC+ will continue, for the most part, to be successful in managing supply to align with demand. That said, we are concerned by the demand growth forecast from the research arm of OPEC, which has recently reiterated its forecast of 2.25 MMbbl/d of oil demand growth during 2024. Additionally, OPEC is forecasting that demand will increase by 2.3 MMbbl/d during the second half of this year. In contrast, IEA is forecasting an oil demand growth of only 1.1 MMbbl/d in 2024.

In our latest update to our Short-term Outlook, we are forecasting that oil demand for 2024 will increase by 1.3 MMbbl/d in comparison to 2023, which is a downward revision of our previous forecast of 1.4 MMbbl/d. During 3Q24, total oil demand is forecasted to increase by 1 MMbbl/d China product demand is forecasted to increase by 0.14 MMbbl/d during 3Q24 in comparison with 3Q23

- India product demand is forecast to increase by 0.50 MMbbl/d during 3Q24 in comparison with 3Q23;

- U.S. product demand is forecasted to increase by 0.51 MMbbl/d during 3Q24 in comparison with 3Q23; and

- Europe demand is forecasted to decrease by 0.29 MMbbl/d during 3Q24 in comparison with 3Q23.

While oil prices increased last week, oil prices remained below their 200-day moving average. For the upcoming week, we are expecting that the price of Brent crude will test $84 and the price of WTI will test $80. We are expecting that the positive sentiment of the oil traders will continue to provide a boost to oil prices. Last week, the net long positions of WTI traders increased with traders increasing their long positions while decreasing their short positions. The net long position of Brent traders also increased with traders decreasing their short positions, which offset the decrease in long positions.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.