The price of Brent crude ended the week at $84.32 after closing the previous week at $82.67. The price of WTI ended the week at $80.59 after closing the previous week at $78.49. The price of DME Oman crude ended the week at $84.63 after closing the previous week at $82.38.

At the beginning of last week, we expected that the price of Brent crude would test $84 and the price of WTI would test $80. Both Brent and WTI broke through these levels and remained above the levels even though prices fell off on June 21. The price of Brent and WTI also stayed above their 200-day moving averages. Oil prices continued to get support from the sentiment of oil traders becoming more bullish. The net long position of Brent traders increased last week with traders decreasing their short positions while increasing their long positions.

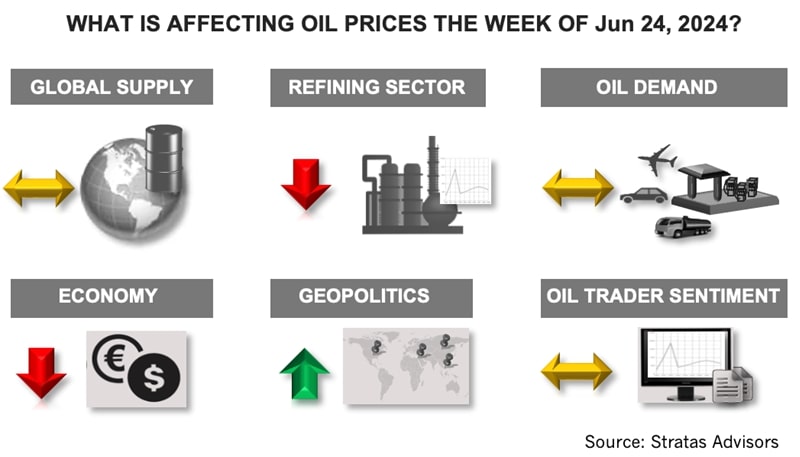

After the gains of the last two weeks, we are expecting that oil prices will be under pressure during the upcoming week, in part, because of economic uncertainty coupled with political uncertainty:

- The projected U.S. deficit for this fiscal year (October 1 through September 30) has increased to $1.9 trillion from $1.5 trillion that was projected in February. The projected tax revenue is 5.04 trillion and projected federal outlays of 6.9 trillion. Pre-COVID-19, federal outlays were $5.31 trillion. The increase in the deficit stems, in part, from the additional monies going to Ukraine and Israel along with the student loan forgiveness. Outlays are forecasted to be 24% of U.S. GDP, which compares to the average for the period of 1974 – 2023 of 21%. Tax revenues are around 18%, which compares to 17.3% for the period of 1974 – 2023. A growing concern about the deficit is that interest payments are exceeding defense spending – and the situation is not projected to get any better without significant policy course corrections. The Congressional Budget Office (CBO) is projecting that interest payments will increase from 2.4% of GDP in 2023 to 3.9% of GDP in 2034, while defense spending will decrease from 3% of GDP in 2023 to 2.5% in 2034. In comparison during the period of 1974 – 2023, defense spending represented 4.2% of GDP. CBO is projecting that budget deficits will continue to grow with federal debt held by the public reaching 116% of GDP in 2024 and 172% of GDP in 2054.

- There are also concerns about the debt situation in Europe, which, at the moment, is focused on France. The bond market is unsettled by the possibility of the National Rally party taking power in the upcoming election and the possibility of increased government spending. Currently, France is running a deficit that is around 5% of its GDP. In response, the bond market has increased France’s risk premium with respect to Germany to the highest level since 2012. The political concerns also seem to be affecting the business environment with new orders decreasing significantly in June. France’s Composite PMI has fallen to 48.2, which indicates economic contraction.

- China will be having its third plenum in July during which changes to China’s fiscal systems are expected to be discussed with the intent to address concerns about China’s debt including the $13 trillion debt being held by local government. The Peterson Institute for International Economics estimates that with all the budgets considered, China’s consolidated budget deficit for 2024 will be 7.2 % of the expected GDP, 1.4 percentage points higher than last year (In comparison, the U.S. is running a budget deficit of around 6.0% of GDP). One reason for the growing deficits is that China taxes at a very low rate with a tax-to-GDP rate of 14%, which compares to 23% for the G7 economies. China also has of very low capital gains tax rate of 20%.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Phillips 66 Buys EPIC’s Permian NGL Midstream Assets for $2.2B

2025-01-07 - Phillips 66 will buy EPIC’s NGL assets, including a 175,000 bbl/d pipeline that links production supplies in the Delaware and Midland basins and the Eagle Ford Shale to Gulf Coast fractionation complexes.

DNOW Closes Cash Acquisition of Water Service Company Trojan Rentals

2024-11-26 - DNOW Inc.’s acquisition of Trojan Rentals LLC is its third purchase aimed at providing a holistic water management solution to the market, the company said.

Martin Midstream Terminates Merger Agreement Following Pushback

2024-12-29 - Martin Midstream Partners will continue operating as a standalone publicly traded company following termination of its deal to merge with Martin Resource Management Corp.

Allete Gets OK From FERC for $6.2B Sale to Canada Pension Plan, GIP

2024-12-20 - Allete Inc. announced its acquisition by the Canada Pension Plan Investment Board and Global Infrastructure Partners in May.

Exxon Mobil Completes Purchase of FPSO Offshore Guyana

2024-12-19 - Exxon Mobil Corp. paid $535 million to SBM Offshore for the FPSO, which will operate the unit through 2033.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.