The price of Brent crude ended the week at $81.37 after closing the previous week at $82.12. The price of WTI ended the week at $77.16 after closing the previous week at $77.72. The price of Brent and the price of WTI have dropped below their 200-day moving average. The price of DME Oman crude ended the week at $82.08 after closing the previous week at $82.68.

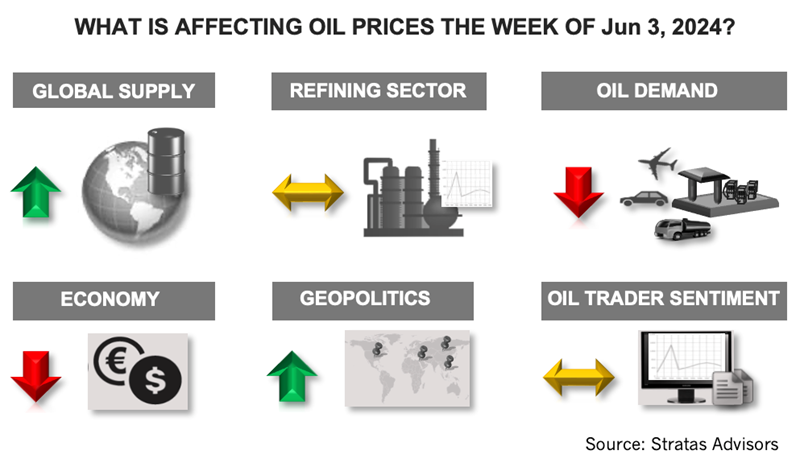

As expected, OPEC+ at its June meeting agreed to extend its production cuts through the rest of the year. Additionally, eight producers have agreed to maintain their voluntary cuts of 2.2 MMbbl/d at least through March of next year, at which point, the intent is to trim the cuts through September. We have been stating for several months that the rationale for maintaining the cuts was too compelling for OPEC+ not to extend them – relatively low oil prices, elevated breakeven fiscal oil price for oil producers, including Saudi Arabia, and the disappointing (from OPEC’s perspective) oil demand growth so far this year.

Moreover, we have been pointing out that it is imperative that members of OPEC+ maintain the appearance of discipline and, as importantly, project the willingness to manage supply proactively to boost the sentiment of the oil market. Consistent with this view is OPEC moving away from publishing an estimate of demand for OPEC crude in its monthly reports to publishing an estimate of demand for OPEC+ crude. The publishing of the broader estimate for OPEC+ highlights the level of cooperation between the 12 OPEC members plus the additional 10 oil producers, including Russia.

Besides, the extension of the OPEC+ cuts, the growth in U.S. production continues to be non-existent so far this year. The latest Energy Information Administration report indicated that U.S. oil production was 13.1 MMbbl/d, which is unchanged from the previous 11 weeks. Last week, the number of operating oil rigs in the U.S. decreased by one and now stands at 496, which compares to the pre-COVID-19 level of 683 that occurred during the week of March 13, 2020.

One year ago, the U.S. oil rig count was 555. We are currently forecasting that U.S. oil production will average 13.5 MMbbl/d in 2024. This forecast, however, has substantial downside risk unless U.S. production picks up significantly during the rest of the year, as it did in 2023. At the beginning of 2023, U.S. production was 12.2 MMbbl/d and production remained flat through most of May. By the end of 2023, U.S. production had reached 13.2 MMbbl/d. For 2024, increasing supply will be more challenging unless U.S. producers start ramping up their capital expenditures and drilling programs beyond their current plans.

The near-term outlook for oil prices is becoming more dependent on the extent of the growth in oil demand. The recent release of economic data from the major economies, however, indicates that oil demand will remain tepid.

- The economic data pertaining to the U.S. that was released last week points to a slowing economy with inflation remaining stubbornly above the 2% target set by the Federal Reserve. The updated view released by the Bureau of Economic Analysis reduced Q1 GDP growth to 1.3% on an annualized basis (In comparison, economic growth in Q4, 2023 was 3.4%). The reduction in Q1 growth stemmed, in part, from a downward revision in consumer spending from 2.5% to 2%. Additionally, there are signs that the consumers are increasingly strapped. On an inflation-adjusted basis, personal spending in April decreased by 0.1% down from an increase of 0.4% in March. The personal savings rate in April decreased to 3.6% and has been decreasing since the savings rate was 5.3% in May 2023. The delinquency rate on consumer loans (auto, mortgage, credit card and personal loans) fell to 0.86% in April from 1.04% in February; however, the rate is still higher than one year ago when the rate was 0.74%. In addition to the weakness in consumer spending, the manufacturing sector continues to struggle. The May reading from the Chicago Purchasing Managers Index pertaining to manufacturing activity decreased to 35.4 from 37.9 in April which is the sixth consecutive month of decreases. It is also the lowest reading since May 2020 and is approaching recession levels seen in 2009 and 2001, and the low seen during the peak of COVID-19. While the economy seems to be cooling, the inflation rate remains higher than 2.0%. The latest data from the Bureau of Economic Analysis shows that the personal consumption expenditures price index increased 0.3% in April, which was the same reading in March. Since last April, the PCE index has increased by 2.7%. The so-called “super core” inflation rate (excludes energy, food, and housing) increased by 0.3% in April.

- The two largest economies in the EU – Germany and France – continue to struggle. Last week, the S&P downgraded France’s credit rating from AA to AA- because of concerns about France’s budget deficit, which was 5.5% of France’s GDP in 2023. Additionally, France’s government debt is on pace to reach 112% of GDP by 2027 with France’s annual budget deficit forecasted to remain above 3.0% of GDP through 2027. Germany’s industrial production remains below the level of February 2020. Additionally, the gap between the EU’s economic performance and Germany’s economic performance has been increasing during 2023 and 2024. One positive is that given that the latest inflation rate in the countries using the euro stands at 2.4% supports the view that the European Central Bank will move forward with an initial rate cut at its meeting scheduled for June 6.

- As has been the case, the latest economic data associated with China has been disappointing. The Manufacturing Purchasing Managers Index released last week shows that the manufacturing sector contracted from 50.4 to 49.5 because of a decrease in output coupled with a decrease in new domestic and export orders. There was also disappointing data pertaining to Chinese consumers with retail sales of consumer goods increasing by only 2.3% in April, which is the smallest increase since December 2022. The growth in retail sales of consumer goods has been on a downward path since November 2023 when the growth rate (year-on-year) was around 10% having rebounded back to the level typical of the pre-COVID period.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Give Us a Signal: Tech Firm Ups E&P Coverage in Remote Plays

2024-07-02 - As E&Ps struggle to transmit information over public networks in out-of-the-way oil and gas basins, tech firm Digi is working to improve its reception.

Drowning in Produced Water: E&Ps Seek Economic Ways to Handle Water Surge

2024-07-01 - Strained disposal limits push beneficial reuse to the forefront for produced water management.

Cracking the Fracking Code: Efficient Approaches to Optimize Wellbores

2024-06-30 - Technology and process innovations improve operational efficiencies even as companies scramble for greener fracking solutions.

At Last, AI Brings Good News for Gas Producers

2024-06-21 - Is artificial intelligence humanity’s power-hungry new friend?

Oceaneering Nabs GoM Umbilical Contract Worth $50MM

2024-06-20 - Offshore services firm Oceaneering secured a large contract with a domestic independent energy customer in the Gulf of Mexico.