In the U.S., oil production has stayed essentially flat since the middle of last year, and the rate of the increase in oil rigs has recently slowed. (Source: Hart Energy; Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

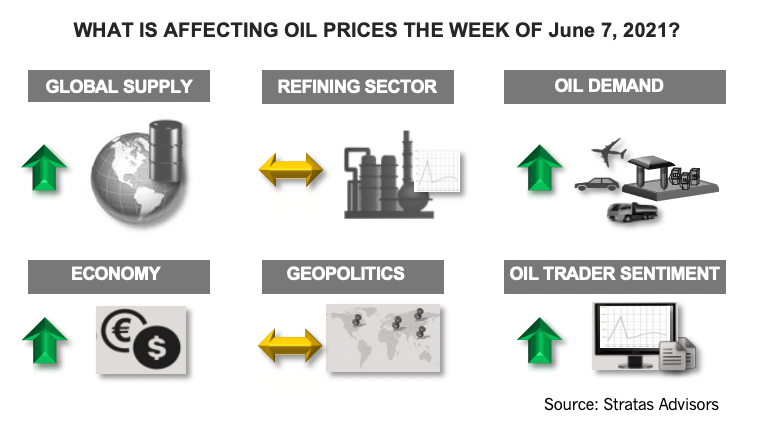

The price of Brent crude oil ended the week at $71.89 after closing the previous week at $69.02. The price of WTI ended the week at $69.62 after closing the previous week at $66.63. The price movement aligned with our expectations that oil prices would move upward with support from the strengthening economy and rebounding demand.

The same themes that have been driving oil prices continue to provide support for oil prices. The U.S. economy continues to rebound with the latest US jobs report showing that 559,000 jobs were added in May. However, the rate of job increases is still below expectations, which continues to provide support for the Federal Reserve to maintain its accommodating monetary policies. Additionally, the yield of the 10-year treasury ended the week at only 1.554%—well below the recent high of 1.722% that occurred at the end of March. The U.S. Dollar Index also strengthened slightly—and remains about the critical support level preventing a significant drop in the U.S. dollar.

Meanwhile, while oil demand increases and oil prices go higher, the supply response remains muted. OPEC+ decided to maintain the previously agreed production increases of 350,000 bbl/d in June and 441,000 bbl/d in July. Additionally, Saudi Arabia will reduce its one-million b/d of unilateral cuts by 350,000 bbl/d in June and 400,000 bbl/d in July. In the U.S., oil production has stayed essentially flat since the middle of last year, and the rate of the increase in oil rigs has recently slowed. As such, with the oil demand poised to continue to increase during the summer months, crude inventories are expected to continue to decline.

The risks also remain the same—with the main risk still being a potential rebound in COVID-19 because of variants and the slow rollout of vaccinations in Asia and other countries outside of the U.S. and Europe. With respect to the supply side, the risk has been associated with the breakdown in the OPEC+ framework. At this time, this risk is diminished by the U.S. shale sector shifting to a focus on delivering financial returns and dividends—and the outlook for a quick return of Iranian barrels fading for now.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Exclusive: LNG Takes Control in Meeting Data Center Reliability, Capacity Needs

2025-04-02 - William Seller, solutions architect at DartPoints, shares insight on the impact that data center power demand will have on the natural gas industry, in this Hart Energy Exclusive interview.

Prairie Operating Plans 11-Well Development at Rusch Pad in Colorado

2025-04-02 - Prairie Operating Co. has begun an 11-well development program in Weld County, Colorado, following the closing of its $603 million deal for Bayswater Exploration and Production assets.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

BlackRock’s Fink Calls for Reliable US Power Grid—Now

2025-03-31 - “That starts with fixing the slow, broken permitting processes in the U.S. and Europe,” Larry Fink, the co-founder, chairman and CEO of $12 trillion investment-management firm BlackRock Inc., told shareholders March 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.