The price of Brent crude ended the week at $70.45 after closing the previous week at $73.11. The price of WTI ended the week at $67.05 after closing the previous week at $70.04. The price of DME Oman crude ended the week at $71.17.

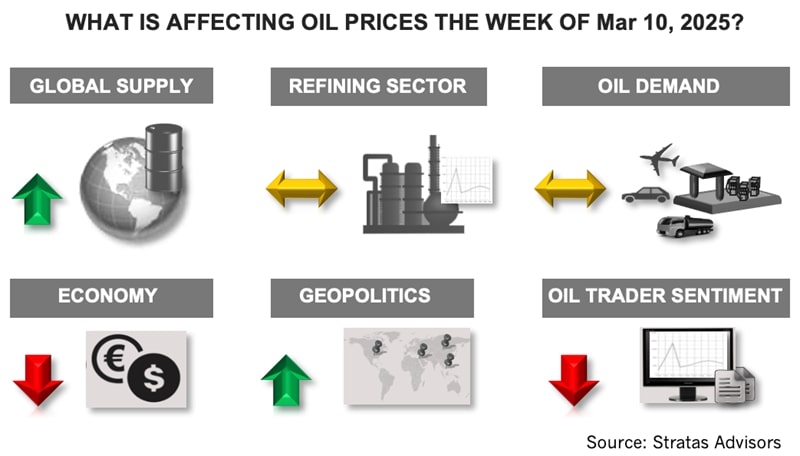

At the beginning of last week, we expressed the view that the price of Brent crude would continue to bounce around but would trend upward. Well, prices bounced around – but they did not trend upwards until the end of the week. Prices were weighed down by concerns about economic growth, in part, because of more tariffs being imposed by the Trump administration, and OPEC+ reiterating that its production cuts would start unwinding in April. The uptick at the end of the week was supported by Russia’s deputy prime minister stating that OPEC+ could reverse the decision if the market appears to be oversupplied. This aligns with our long-held view that members of OPEC+ will be pragmatic in aligning supply with demand in an attempt to put support under oil prices.

Looking forward to this week, there remain plenty of uncertainties that support more price volatility.

- The Trump Administration continues to make noise about sanctions on several oil exporters. As part of the plan to put maximum pressure on Iran, sanctions are to be placed on Iran’s oil sector with the objective of reducing Iran’s oil exports from around 1.60 MMbbl/d to essentially zero. While that may prove to be ambitious – the administration has earlier expressed the view that a reduction of 500,000 bbl/d to 750,000 bbl/d was doable. The Trump Administration is also hinting at more sanctions on Russian oil exports that go beyond the sanctions that the Biden Administration imposed on Jan. 10 of this year. Additionally, President Trump revoked the license given to Chevron by the prior administration to operate in Venezuela stating that President Maduro had not made sufficient progress on electoral reforms and migrant returns.

- Geopolitical risks are increasing with the ongoing Russia-Ukraine conflict. Even if the parties come to the negotiating table, a deal will be difficult. Ukraine wants explicit security guarantees, and we think it is very unlikely that the U.S. will make any agreement that locks the U.S. into a future military commitment – regardless of what commitment Europe might make. Dealing with Russia is no easier since it seems unlikely at this point that additional sanctions will change Russia’s position. Additionally, Russia has indicated an unwillingness to give up any gained territory or to accept European troops in Ukraine to provide security for Ukraine. Meanwhile, the tensions between Iran and Israel continue to rise. Both conflicts still present the risk of escalation.

- The imposition of tariffs and the threat of additional tariffs is not helping reduce concerns about the global economy. While the latest jobs report showed that the U.S. added 151,000 jobs, the labor force participation decreased to 62.4%, which is the lowest since January 2023 and the U6 unemployment rate (including discouraged workers and those holding part-time positions for economic reasons) increased by 0.5% to 8.0%, which is the highest since October 2021. Additionally, the household survey shows that 588,000 jobs were lost in February and the number of people holding part-time jobs for economic reasons increased by 460,000 to reach 4.9 million people. The U.S. is also facing the threat of a government shutdown if Congress cannot pass a continuing resolution before Friday at midnight. Last week, the European Central Bank reduced its 2025 outlook for EU GDP growth to 0.9% from its previous forecast of 1.1%, highlighting concerns about decreasing exports and investments. China’s economy continues to struggle with deflation. In February, the producer price index decreased by 2.1% after decreasing by 2.3% in January – and continues the trend of decreasing producer prices that started in September 2022.

For the upcoming week, we think that the supply situation will give some support for oil prices with the Trump Administration intending to place more sanctions on Russia, Iran and Venezuela. We also expect some additional support from the geopolitical risks. But will these factors be enough to overcome the economic concerns and the bearish sentiment of the oil traders, who have reduced their net long positions sharply during the last six weeks? We are leaning that way, but the upside is limited, and we do not expect the price of Brent crude to break through $72.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Segrist: American LNG Unaffected by Cut-Off of Russian Gas Supply

2025-02-24 - The last gas pipeline connecting Russia to Western Europe has shut down, but don’t expect a follow-on effect for U.S. LNG demand.

Grappling with the Majors: Boardwalk Bets on Southeast’s Infrastructure Growth

2025-04-08 - Boardwalk Pipelines CEO Scott Hallam discusses his company’s niche in the Haynesville and on the west side of Appalachians.

FERC Approves Enstor’s Salt-Dome Storage Expansion in Mississippi

2025-04-15 - The Mississippi Hub’s total natural gas capacity will reach approximately 56.3 Bcf, Enstor Gas said.

US NatGas Dominance Collides with Permitting, Tariffs, Layoffs

2025-03-16 - Executives at BP, Sempra Infrastructure and the American Petroleum Institute weighed in on U.S. natural gas prowess and the obstacles that could stand in the way: snagged permitting, prohibitive steel tariffs and layoffs of federal workers needed to approve projects.

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.