Brent prices averaged $64.95/bbl last week, gaining strength at the end of the week. This week prices will likely remain range-bound, averaging $65/bbl with the Brent-WTI differential remaining about $3.50/bbl.

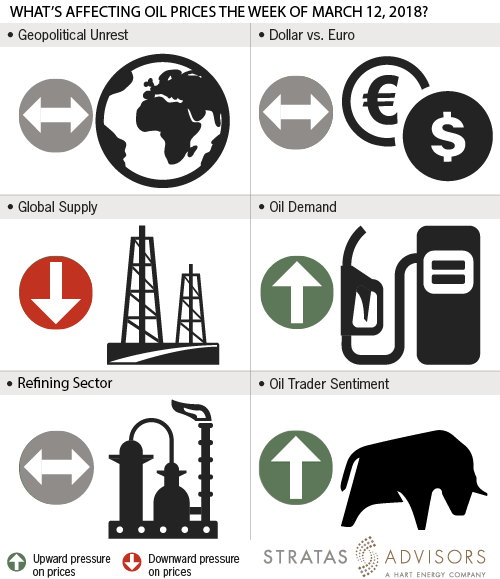

Geopolitical - Neutral

There is minimal news on the geopolitical front that is likely to influence prices this week. While perennial issues such as the decline in Venezuela and unrest in Libya remain, we do not expect them to become more impactful in the short term.

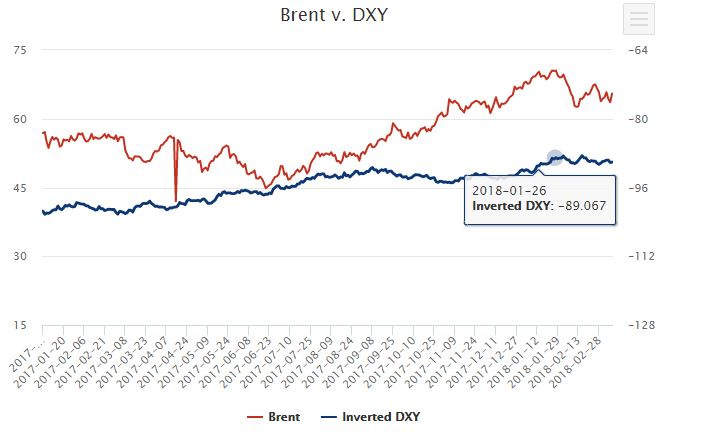

Dollar - Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar moved sideways last week as crude oil rose slightly. Crude oil will likely remain only marginally influenced by DXY in the week ahead.

Trader Sentiment - Positive

ICE Brent and Nymex WTI managed money net positioning both fell slightly last week. Short-selling also indicates that producer level hedging has ticked up in recent weeks as producers take full advantage of recently high prices before a possible correction. Trader sentiment remains generally positive despite recent increases in U.S. production.

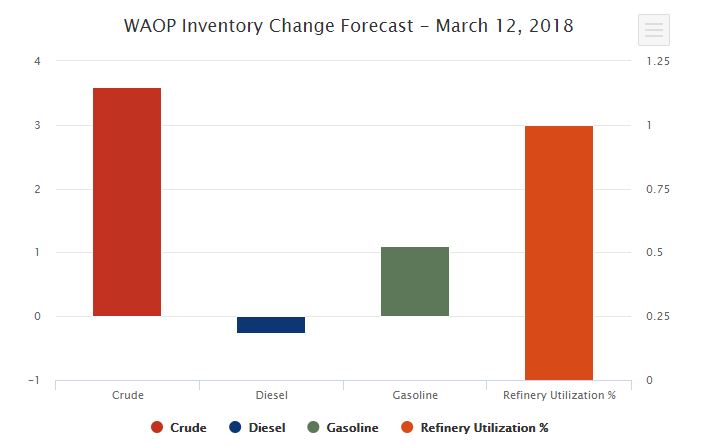

Supply – Negative

According to Baker Hughes, the U.S. rig count fell for the first time in six weeks last week. Such fluctuations in rig numbers are common and we do not believe this is the start of a trend. We continue to expect that the impact on production of these rising rigs will likely start to be seen in May. Libya has been having trouble keeping fields online in recent weeks due to protests, which has reduced production slightly. Evidence of renewed global oversupply continues to pose the greatest threat to prices.

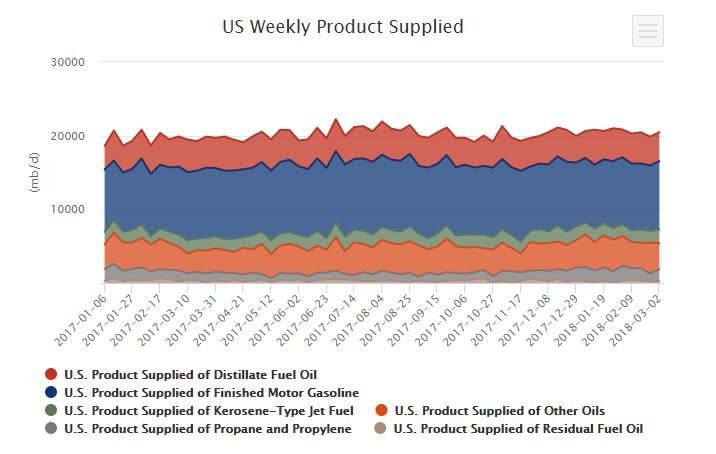

Demand – Positive

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products except fuel oil.

Refining – Neutral

Global refining margins fell across the board last week with the largest decline seen on the U.S. Gulf Coast. Declines in margins appear to be slowing, and we could even see some strengthening in margins in the weeks ahead as Asian refinery maintenance is underway. However, in the meantime, margins are not robust enough to incentivize additional runs of a level likely to support crude.

How We Did

Recommended Reading

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

2024-10-04 - Recently unconstrained by new rail capacity, operators are now putting laterals into the oily, western side of this long-producing basin that comes with little associated gas and little water, making it compete with the Permian Basin.

Coterra Takes Harkey Sand ‘Row’ Show on the Road

2024-11-20 - With success to date in Harkey sandstone overlying the Wolfcamp, the company aims to make mega-DSUs in New Mexico with the 49,000-net-acre bolt-on of adjacent sections.

Comstock: Monster Western Haynesville Wildcats Cost $30MM-plus

2024-10-31 - Comstock Resources is flowing back a 13th well currently in the play where the oldest has made 2.2 Bcf per 1,000 lateral feet to date in its first 29 months online.

E&P Highlights: Oct. 28, 2024

2024-10-28 - Here’s a roundup of the latest E&P headlines, including a new field coming onstream and an oilfield service provider unveiling new technology.

E&P Highlights: Sept. 9, 2024

2024-09-09 - Here’s a roundup of the latest E&P headlines, with Talos Energy announcing a new discovery and Trillion Energy achieving gas production from a revitalized field.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.