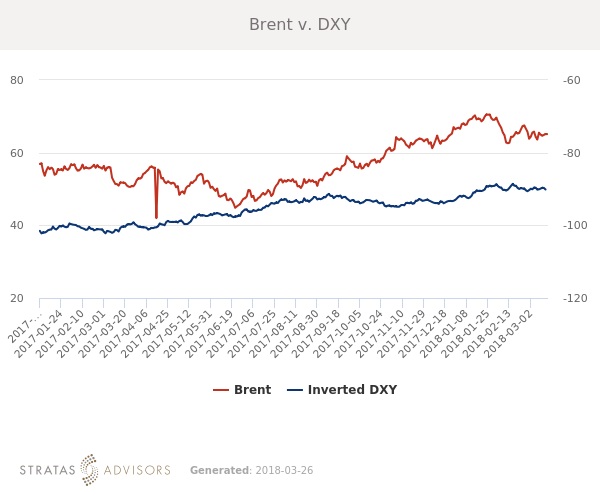

In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged $68.46/bbl last week, up $3.30/bbl from the week before.

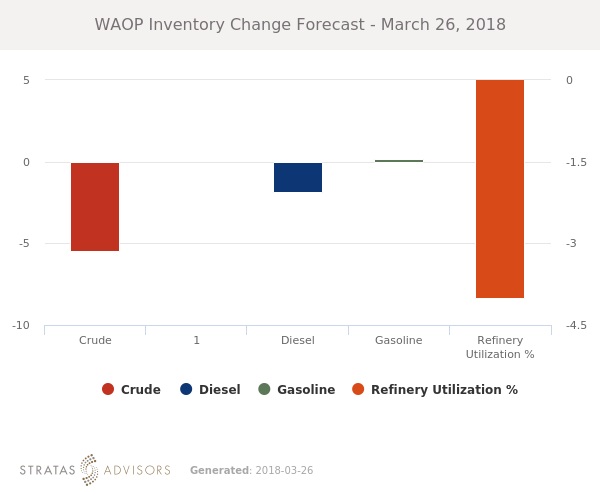

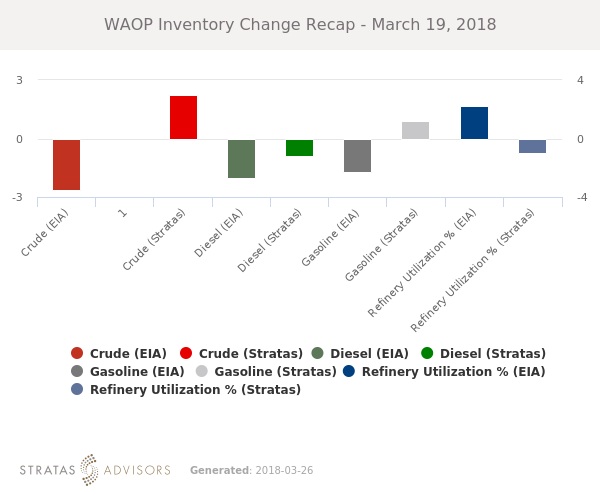

Prices were supported by an unexpected crude draw along with comments from OPEC members that the current production deal may be extended into 2019. This week prices will likely lose some momentum, averaging $66.50/bbl.

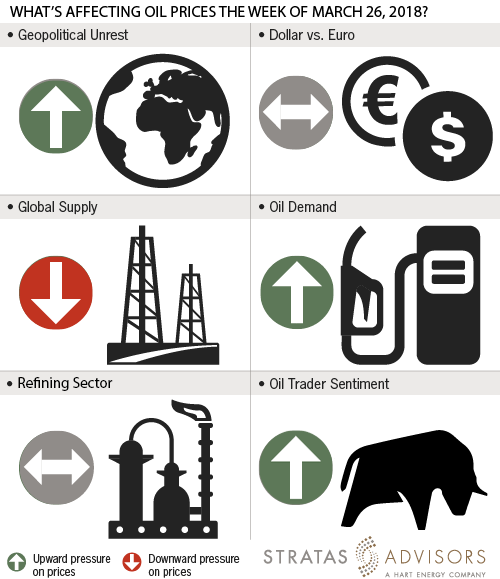

Geopolitical: Positive

While perennial issues such as the decline in Venezuela and unrest in Libya remain, analysts do not expect them to become more impactful in the short term. The appointment of John Bolton, a notorious foreign policy hawk, as national security advisor will be closely watched by markets for indications of the future direction of White House foreign policy. Despite no concrete actions, this could cause some volatility in markets moving forward.

Dollar: Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar and crude oil moved in opposite directions last week. The dollar is seeing some fluctuation over concerns about recent tariffs enacted by the White House.

Trader Sentiment: Positive

Nymex WTI and ICE Brent managed money net long positioning increased slightly last week. Overall market sentiment remains supportive, but positioning has been moderating on a lack of new bullish indicators. Sentiment is seeing some support from statements by OPEC members that the production deal may be extended into 2019.

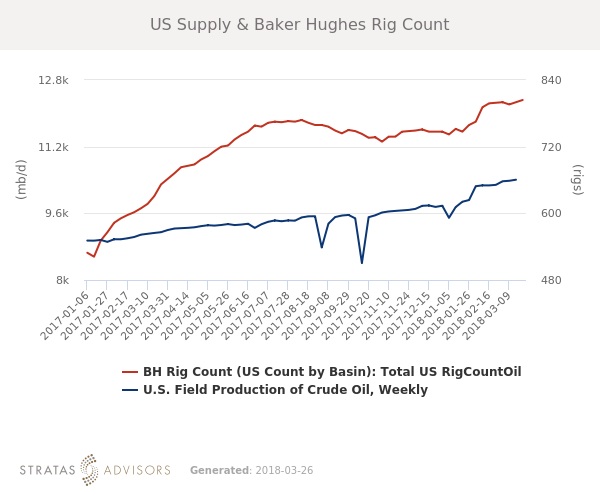

Supply: Negative

According to Baker Hughes, the number of U.S. oil rigs again rose by four last week. U.S. oil rigs now stand at 804, compared to 652 a year ago. Evidence of renewed global oversupply continues to pose the greatest threat to prices.

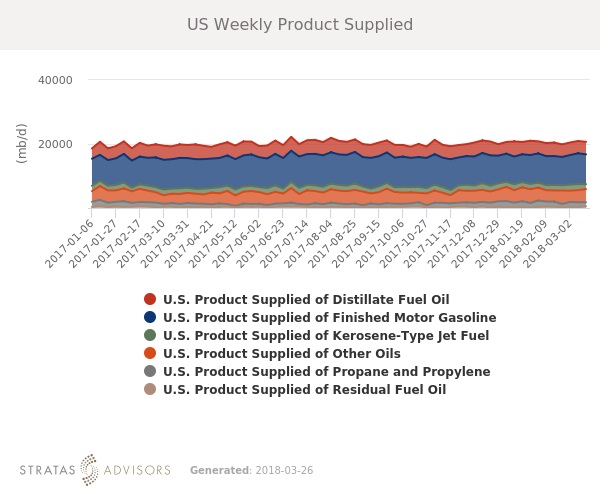

Demand: Positive

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products including fuel oil. Economic indicators so far presage strong consumer spending through the summer demand season and refined product demand is likely to remain a supportive factor in the short-term.

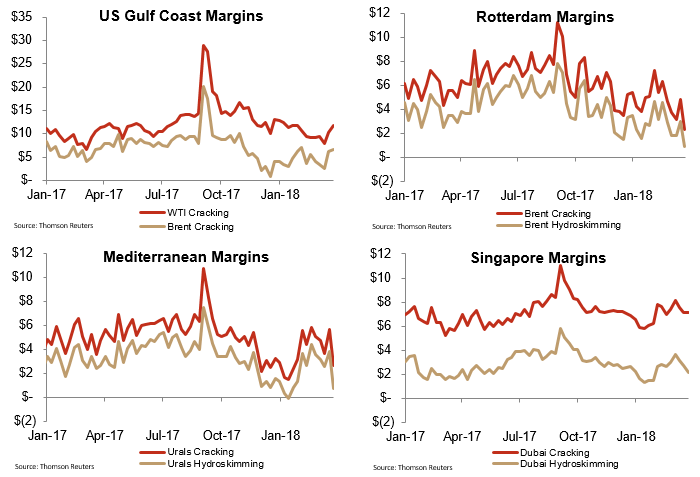

Refining: Neutral

Margins fell everywhere except the U.S. Gulf Coast last week and saw their largest decline in Europe. Brent cracking in Rotterdam fell $2.53/bbl while Urals cracking in the Mediterranean fell $2.95/bbl. This comes as Brent rose $3.30/bbl last week. Despite the drop, margins generally remain around the five-year seasonal average.

How We Did

Recommended Reading

Lyten Unveils Plans for $1B Battery Gigafactory in Nevada

2024-10-15 - Lyten will invest more than $1 billion to build what it called the world’s first lithium-sulfur battery gigafactory.

Mantel Receives Funding to Commercially Deploy Carbon Capture System

2024-09-06 - Mantel Capture Inc. raised $30 million for the demonstration of its high-temperature carbon capture system at an industrial site, paving the way for eventual commercial deployment.

Fervo Energy Achieves ‘Record Breaking’ Geothermal Well Flow Rates

2024-09-10 - Fervo Energy’s Cape Station project will generate 90 megawatts of renewable energy capacity during its first phase.

Enlight Begins Operations at New Mexico Solar Project

2024-09-12 - Enlight Renewable Energy has started initial operations at its $827 million Atrisco Solar and Energy Storage project, which will reach full commercial operations over the coming weeks.

Energy Transition in Motion (Week of Oct. 11, 2024)

2024-10-11 - Here is a look at some of this week’s renewable energy news, including nearly $7.9 million in bids for geothermal leases in Nevada.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.