While the shutdown last week of the Colonial Pipeline—the largest fuel pipeline network in the U.S.—caused panic buying resulting in some retail outlets running out of gasoline, Stratas Advisors said the impact on oil and products prices from the outage was relatively minor. (Source: Hart Energy; Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

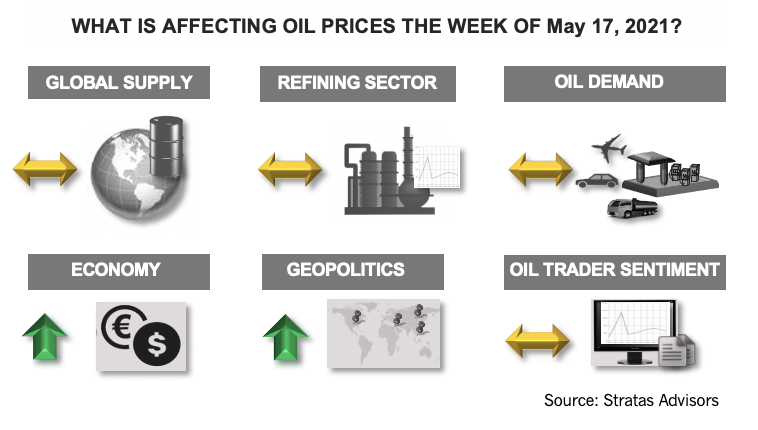

The price of Brent crude oil ended the week at $68.83 after closing the previous week at $68.27. The price of WTI ended the week at $65.51 after closing the previous week at $64.71. The price movements aligned with our expectation that crude prices would drift sideways with an upward bias.

One of the big developments at the beginning of the week was resolved with the Colonial Pipeline returning to service on May 12. While the outage caused panic buying, which resulted in some retail outlets running out of gasoline, the impact on oil and products prices was relatively minor.

The other big development was the disappointing jobs report for the U.S. economy and the concerns about the U.S. economy continued last week with the Consumer Price Index (CPI) report, which showed that on a month-on-month basis, inflation increased by 0.8%, in comparison to the expected 0.2%. On an annual basis, the CPI increased by 4.2%, which is the highest rate since 2008. The reported increase is higher, in part, from base effects in that the prices declined last year because of COVID-19. Considering the base effects, the increase would have been around 3.0%. Even with the increase in the CPI for April, we still hold that the inflation will not be a lasting issue. The increase in wage growth will moderate for several reasons: progress with the vaccine is reducing concerns about COVID-19; schools will be moving back to normal operations, thus mitigating the issue of lack of childcare; the extra $300 unemployment benefit will go away by September—and for many states—is already going away. Furthermore, the market is not putting pressure on the Federal Reserve to raise rates with the 10-year treasury only moving to 1.626% after last week’s CPI report (in comparison to 1.577% of the previous week) and below the recent high of 1.745% that occurred at the end of March.

One factor to watch, however, is the U.S. Dollar Index. At the end of last week, the U.S. Dollar Index was at 90.30. Pre-COVID-19, the U.S. Dollar Index was hovering round 99, and had been doing so since the beginning of 2015. However, before this period, the U.S. Dollar Index had been in a lower range for an extended period. From October of 2003 through April of 2014, the U.S. Dollar Index stayed in the range of between 72 and 85. During the era of the low U.S. Dollar Index, the price of WTI moved from $30.00 to nearly $145 in August 2008, then fell sharply to below $40.00 at the end of the year, before rebounding to above $100 by March 2011 and staying above $100 until April 2014. Once breaking below $100, oil prices continued falling to below $30.00 in February 2016. The first of the major price corrections that occurred during this period was the result of a demand shock from the financial meltdown, while the second one was the result of a supply shock from the ramp-up in U.S. shale production. Otherwise, during the period of low U.S. Dollar Index, crude prices were elevated. In October 2014, the U.S. Dollar Index was 79.78 and then increased to 102.21 by October 2016. Since this time, the U.S. Dollar Index has approached 90 three times—at the beginning of 2018 and in October 2020—and at this time. If the U.S. Dollar Index breaks through the support level of 90, the next support level is at 80. If this magnitude of decline occurs in the U.S. Dollar Index, we are expecting that commodities, including oil prices will see significant upward pressure—and oil prices could be pushed toward $100.

In next week’s note we will explore further the likelihood of the U.S. Dollar Index declining to the levels seen during the period of October of 2003 through April 2014.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US NatGas Prices Hit 23-Month High on Increased LNG Feedgas, Heating Demand

2024-12-24 - U.S. natural gas futures hit a 23-month high on Dec. 24 in thin pre-holiday trading.

TotalEnergies' Mozambique LNG Project Faces Delay Beyond 2029

2025-01-22 - TotalEnergies' $20 billion Mozambique LNG project will not be operational by 2029 as hoped, the French oil major said on Jan. 22, citing the need to end force majeure and ensure security at the project site.

Oil Prices Ease as US Tariffs On Mexico Paused for a Month

2025-02-03 - WTI crude futures were down $0.04, or 0.01%, at $72.49 after climbing as much as 3.7% earlier in the session to reach their highest since Jan. 24 at $75.18.

Gas-Fired Power Plant to be Built Close to Austin, Texas

2025-02-06 - The project, to be built by Argan subsidiary Gemma Power Systems, is expected to hook up to the ERCOT grid in 2028.

Guyana Exported a Total of 225 Crude Cargoes in 2024

2025-01-14 - Guyana, Latin America's newest oil producer, is now the region's fifth largest crude exporter after Brazil, Mexico, Venezuela and Colombia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.