The price of Brent crude ended the week at $84.00 after closing the previous week at $82.79. The price of WTI ended the week at $80.00 after closing the previous week at $78.26. The price of Brent and the price of WTI are both approaching their 200-day moving average. The price of DME Oman crude ended the week at $84.96 after closing the previous week at $83.53.

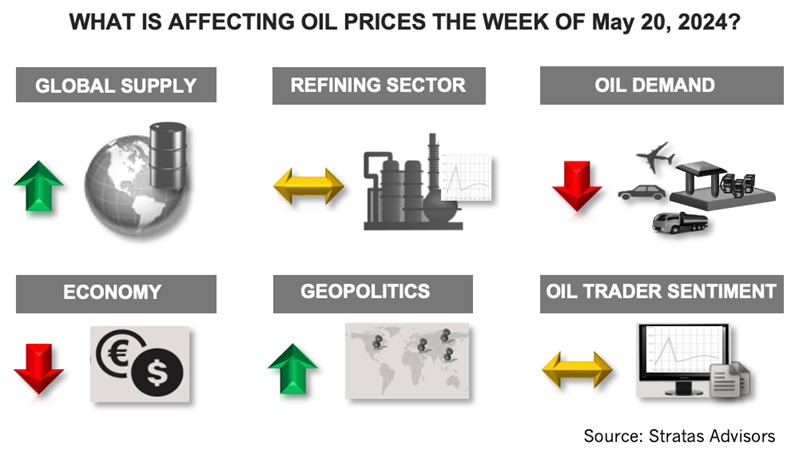

Oil prices received some support from the latest EIA report which indicated that U.S. production remained at 13.1 MMbbl/d, unchanged from the previous nine weeks. The report also indicated that U.S. crude inventories decreased by 2.51 MMbbl. Crude inventories are now less than the level of the previous year (457 MMbbl vs. 468 MMbbl) and less than the inventory levels in 2019 (457 MMbbl vs. 472 MMbbl).

Oil prices also got a boost from recent U.S. economic data. Last week, the Bureau of Labor Statistics released the latest data for the Consumer Price Index (CPI), with the reading coming in for April at 3.4%, which is slightly down from 3.5% in March and the first month since December 2023 with a reading lower than the previous month. The core CPI (excluding food and energy) reading for April came in at 3.6%, in comparison to 3.8% in March, and the smallest year-on-year increase since April 2021. The U.S. dollar index finished last week at 104.44, which is down from 106.26 on April 16, with the market expecting that the Federal Reserve is getting closer to rate cuts. The U.S. 10-Year Treasury ended the week at 4.374%, which is down from the previous week of 4.46%.

All the economic news, however, coming out of the U.S. is not positive. The reduction in inflation seems to be coming with a pending slowdown in economic activity. The index of leading economic indicators provided by the Conference Board decreased by 0.6% in April, in part, because of a downturn in business orders along with fewer permits for building new homes. The disappointing results from the Conference Board’s leading economic indicators follow from the previous week the disappointing results from the University of Michigan Consumer Sentiment with the initial reading for May coming in at 67.4, which is a significant decrease from 77.2 in April, and is the lowest reading in six months. Additionally, the decrease in sentiment was consistent across age, income and education groups and was the result of concerns about inflation, unemployment and interest rates.

While there remains plenty of geopolitical uncertainty stemming from developments in the Middle East and the Russia-Ukraine conflict, the associated risk premium has diminished as the oil continues to flow. On May 19, it was reported that a helicopter carrying the Iranian President Ebrahim Raisi crashed. At the time of this writing, the status of the Iranian president was still not known, as the rescue teams still had not been able to reach the helicopter. Regardless of the outcome, our initial thoughts are that Iranian policies will not change in any material way.

[Editor’s note: Reuters reported on May 20 that Iran’s president was killed in the helicopter crash, according to officials and state media.]

The market, however, is likely to see this development, at least initially, as positive for oil prices.

What could be a more important development is the announcement by the Biden administration on the increase of import duties of Chinese EVs from 27.5% to 100%, along with other tariffs that will be imposed on EV batteries and critical inputs to batteries originating from China. Additional explanations of the tariffs and their implications can be found here.

While these tariffs will not have a direct impact on oil prices, the increasing tension, and less cooperation between the two largest economies in the world are likely to have a negative effect on future economic growth and energy demand.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Eight Weeks

2025-01-31 - For January, total oil and gas rigs fell by seven, the most in a month since June, with both oil and gas rigs down by four in January.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-01-10 - The oil and gas rig count fell by five to 584 in the week to Jan. 10, the lowest since November.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

US Oil, Gas Rigs Unchanged for Fourth Straight Week

2025-01-03 - The oil and gas rig count stayed at 589 in the week to Jan. 3. Baker Hughes said that puts the total rig count down 32 rigs, or 5% below this time last year.

Baker Hughes: US Drillers Keep Oil and NatGas Rigs Unchanged for Third Week

2024-12-27 - U.S. energy firms this week operated the same number of oil and natural gas rigs for third week in a row.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.