The price of Brent crude ended the week at $82.82 after closing the previous week at $88.06. In our weekly memo for the week of April 22 we highlighted that the price of Brent could test $83 with the price of Brent falling out of the upward channel that had been in place since January of this year – and during last week this price dynamics played out. The price of WTI ended the week at $77.98 after closing the previous week at $83.68. With the downward movement, the price of Brent and the price of WTI both have broken below 200-day moving average for the first time since early March. The price of DME Oman crude ended the week at $83.19 after closing the previous week at $89.99.

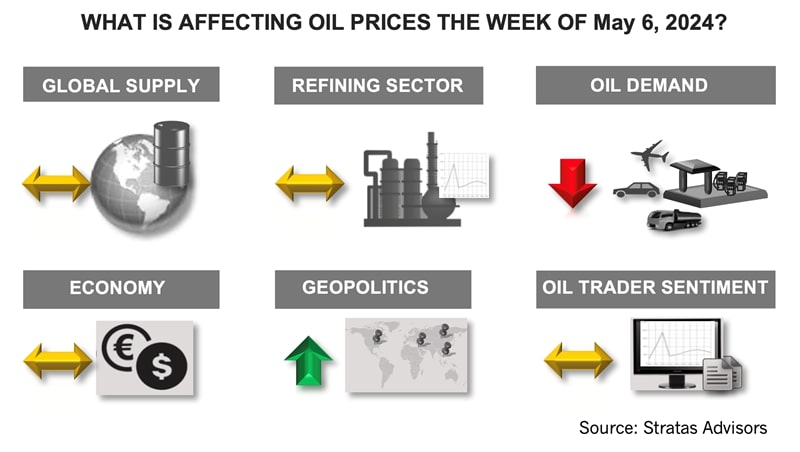

The diminishment of geopolitical tensions has removed the support for higher oil prices – and while there are still geopolitical uncertainties, we are maintaining our view that the oil supply will not be disrupted. The economic news also continues to indicate that the growth in oil demand will be moderate in 2024. We are forecasting that oil demand for 2024 will increase by 1.41 MMbbl/d in comparison to 2023 and that oil demand will increase by 810,000 bbl/d in comparison to 2Q23. The demand data associated with the U.S. highlights the lackluster demand growth. The latest weekly report from EIA shows the following change in U.S. demand for transport fuels:

- Gasoline demand in the U.S. increased to 8.62 MMbbl/d from the previous week of 8.42 MMbbl/d. In comparison with 2019, gasoline demand is running 9.37% less during the last four weeks, and 3.56% less in comparison with 2023.

- Diesel demand in the U.S. decreased to 3.68 MMbbl/d from the previous week of 3.55 MMbbl/d. In comparison with 2019, diesel demand is running 8.35% less during the last four weeks, and 8.25% less in comparison with 2023.

- Jet fuel demand decreased slightly to 1.71 MMbbl/d from the previous week of 1.76 MMbbl/d. In comparison with 2019, jet fuel demand is running 5.25% less during the last four weeks, but 4.31% more than in 2023.

The weakness in U.S. oil demand is consistent with the recent disappointing economic data. While the headline unemployment rate increased to only 3.9%, a more accurate indication of the U.S. labor market is the U6 unemployment rate (includes discouraged workers and part-time workers who desire to have full-time jobs) increased to 7.4%, which is the highest level since November 2021.

In contrast to geopolitics and oil demand, we are expecting that oil supply will help stabilize oil prices. We think the likelihood of OPEC+ maintaining its production cuts through the rest of the year is increasing given the recent downturn in oil prices. Other factors supporting the maintenance of the production cuts include that the breakeven fiscal oil price for Saudi Arabia, as calculated by the IMF, has increased to more than $96, which is an increase of nearly $20 above the breakeven fiscal oil price in 2020. Additionally, production from Iran, Venezuela and Libya are exempt from OPEC+ quotas – and each of these producers are attempting to increased supply. Moreover, it is imperative that OPEC+ maintains discipline and projects the willingness to manage supply proactively to boost the sentiment of the oil market. Further support for our view is provided by the latest survey from Reuters, which estimates that OPEC oil supply decreased in April by 100,000 bbl/d in comparison to March with OPEC production decreasing to 26.49 MMbbl/d.

We are also forecasting that growth in non-OPEC supply will increase by only 1.19 MMbbl/d in 2024, which is significantly lower than in 2023. There are downside risks to this forecast, in part, because of current trends associated with U.S. production. The latest EIA report indicates that U.S. oil production remains stagnant at 13.1 MMbbl/d, which is unchanged from the previous seven weeks. Additionally, the number of operating oil rigs in the U.S. decreased by seven last week and now stands at 499, which compares to the pre-COVID level of 683 that occurred during the week of March 13, 2020. One year ago, the U.S. oil rig count was 588. U.S. producers will need to increase capex to push production upwards – and at higher levels than currently planned.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Electron Gold Rush: ‘White Hot’ Power Market Shifts into High Gear

2025-03-06 - Tech companies are scrambling for electrons as AI infrastructure comes online and gas and midstream companies need to be ready, Energy Exemplar CEO says.

Paradoxes and Power: Why DeepSeek AI May Be Good News for Energy

2025-03-05 - The lower cost and power demand of DeepSeek could be a positive for AI adoption and result in increased proliferation and demand, an analyst said.

SLB Launches Electric Well Control Tech to Replace Hydraulics

2025-03-04 - SLB says the new systems reduce costs and provide real-time data for operators.

No Drivers Necessary: Atlas RoboTrucks Haul Proppant, Sans Humans

2025-03-04 - Atlas Energy Solutions and Kodiak Robotics have teamed up to put two autonomous trucks to work in the Permian Basin. Many more are on the way.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.