The return of Donald Trump to the U.S. presidency could have both positive and negative impacts on the oil market. (Source: Shutterstock)

The price of Brent crude ended the week at $73.90 after closing the previous week at $72.94. The price of WTI ended the week at $70.43 after closing the previous week at $69.33. The price of DME Oman crude ended the week at $72.78 after closing the previous week at $71.79. Earlier in the week, the price of Brent crude broke through $76.00 in intraday trading but could not sustain the upward movement.

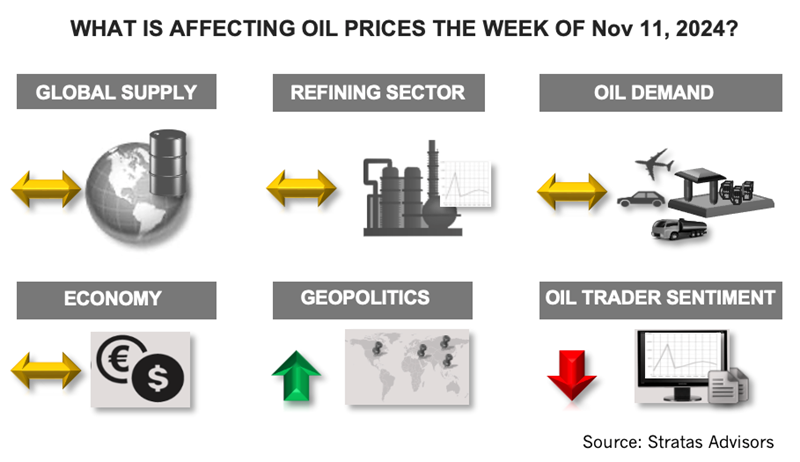

Looking forward, the return of Donald Trump to the U.S. presidency could have a major impact on the oil market—positive as well as negative.

With respect to U.S. supply, Trump’s energy policies will be more friendly to the oil and gas sector, including less intrusive regulations and efforts to encourage allies to import more oil and gas from the U.S. From a U.S. demand perspective, Trump will likely push to reduce support for electric vehicles and alternative fuels.

Trump’s policies will put further pressure on Europe’s economy with the threat of a 10% to 20% tariff on imports from Europe. Similarly, China is facing the threat of tariffs on its exports to the U.S.—and in China’s case—the tariffs could be 60% and higher. While the threat of tariffs could be a negotiating tactic, Trump will want something in exchange for not imposing the tariffs.

With Trump returning to the presidency, it is likely that the U.S. will put more pressure on Iran, including enforcement of sanctions on Iran’s oil exports, and Israel is likely to have the opportunity to carry out more extensive attacks on Iran. The Ukraine-Russia conflict will also be affected by the results of the U.S. presidential election. With the election of Donald Trump, there is a greater likelihood that a negotiated settlement will occur. While Trump will face some resistance from his party and others, it is our view that he is inclined to push for a negotiated settlement at the beginning of his administration when he will have significant political power. In the immediate aftermath of the election, we do not see any indications that we need to modify these expectations.

Israel–Iran

At the end of last week, with the breakdown of the ceasefire talks, Qatar directed the political leadership of Hamas to relocate from Doha—and it seems likely that the new location will be Iraq.

Prime Minister Netanyahu stated on Nov. 10 that he sees eye-to-eye with President Trump with respect to the Iranian threat.

Despite Israel’s Defense Minister stating that Israel has defeated Hezbollah, Israel is still launching aerial attacks on Hezbollah in Lebanon.

Russia–Ukraine

Trump talked to Putin on Nov. 7 and warned Putin not to escalate the conflict while reminding Putin of the U.S.’s sizable military presence in Europe.

It has been reported that Trump’s plan to end the conflict between Russia and Ukraine will include an 800-mile demilitarized zone along with freezing the current front line. Additionally, the U.S. will provide Ukraine with weapons to deter Russia, while Ukraine foregoes joining NATO for at least two decades.

For the upcoming week, we are expecting that the price of Brent crude will move sideways.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

NextDecade Plans 3 More Trains at Rio Grande LNG

2025-02-28 - Houston-based NextDecade continues to build the Rio Grande LNG Center in Brownsville, Texas, as its permits filed with the Federal Energy Regulatory Commission continue to go through the legal process.

Canadian Government to Fund Portion of Cedar LNG’s $5.96B Development Cost

2025-03-24 - The Government of Canada has pledged to contribute up to $200 million to help the Haisla Nation and Pembina Pipeline Corp. develop the $5.96 billion Cedar LNG Project

DOE Approves Venture Global’s CP2 LNG to Export to Non-FTA Countries

2025-03-20 - The U.S. Department of Energy approved Venture Global’s Calcasieu Pass 2 LNG project in Cameron Parish, Louisiana, to export LNG to non-FTA countries.

Tamboran, Santos Agree to Study Possible Darwin LNG Expansion

2025-01-23 - Tamboran Resources Corp. and Santos Ltd. entered a memorandum of understanding for technical studies, which could lead to a 6 mtpa expansion of Darwin LNG.

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.