The price of Brent crude ended the week at $74.60 after closing the previous week at $71.05. The price of WTI ended the week at $71.22 after closing the previous week at $66.95. The price of DME Oman crude ended the week at $73.50 after closing the previous week at $70.24.

As we pointed out last week there are some developments that will provide upward support for oil prices, and developments of last week further boosted this support.

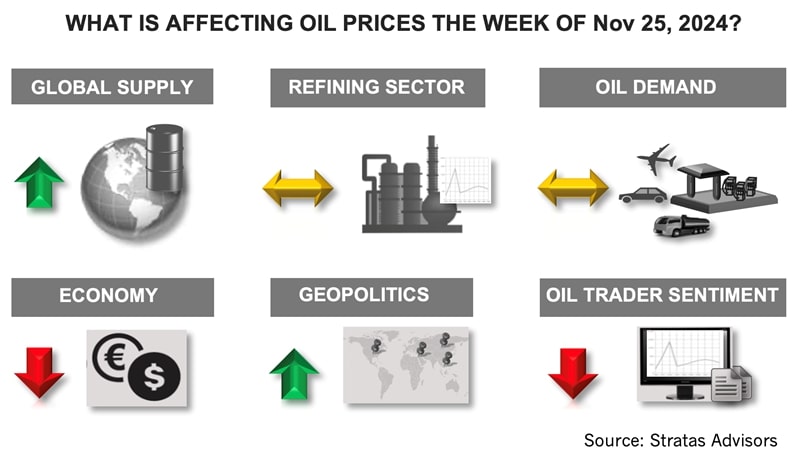

Geopolitics

The conflict involving Russia and Ukraine and the conflict involving Israel and Iran (and proxies) are showing signs of further escalation. In response to President Biden authorizing Ukraine to use U.S.-made long-range ATACMS missiles to attack Russia, Russia changed its doctrine pertaining to the use of nuclear weapons. The change allows Russia to utilize nuclear weapons in response to conventional attacks by any nation that is supported by a nuclear power. Additionally, Russia launched a ballistic missile into central Ukraine that carried six warheads.

The missile has a range of 3,000 miles (5,000 km), can carry nuclear warheads, and represents a challenge to Ukraine’s air defense. With Donald Trump returning to presidency, it is likely that the U.S. will put more pressure on Iran, including enforcement of sanctions on Iran’s oil exports, and Israel is likely to have the opportunity to take a more aggressive stance with respect to Iran. The risk is that this approach will lead to China and Russia aligning with Iran.

Oil supply

We are expecting that OPEC+ will continue to delay the unwinding supply cuts at its next meeting, which is scheduled for Dec. 1. Given the current level of oil prices and the supply/demand dynamics, there is an incentive and rationale for OPEC+ to delay any change to its supply until the beginning of 2Q of 2025. The delay will also provide time for OPEC+ to learn more about the intentions of the reelected President Trump, who has discussed policies that are positive and negative for oil prices. From a positive perspective, Trump has indicated that he will place sanctions on the Iranian oil sector and Venezuelan oil sector – and reduce support for alternatives. From a negative perspective, he is supporting an increase in domestic oil production.

The most significant risk to oil prices remains the extent of oil demand growth. While the U.S. economy continues to show signs of strength, the economies of the eurozone and China continue to struggle. Earlier this month, the European Commission reduced its forecast slightly for EU economic growth in 2025 from 1.4% to 1.3% and projected that the EU will grow by only 0.8% in 2024. Last week, the congressionally chartered U.S.-China Economic and Security Review Commission recommended that the U.S. remove the “most favored nation” status for China. The removal of the status would result in all of China’s exports to the U.S. ($427 billion in 2023) being exposed to tariffs ranging from 35% to 100%. Trump has indicated that he will impose tariffs of 60% on Chinese imports. Additionally, and even so in the U.S., the manufacturing sector is struggling and contracting in all the major economies.

For the upcoming week, a key resistance level for the price of Brent crude is $76. If the price of Brent crude can break above this level, we could see Brent crude moving towards $80. Otherwise, the price of Brent crude is likely to drift downwards to $72.

For a complete forecast of crude oil and refined products and other energy-related fundamentals and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

PE Firm Voyager to Merge Haynesville OFS Firm with Permian’s Tejas

2025-03-17 - Private equity firm Voyager Interests’ Haynesville Shale portfolio company VooDoo Energy Services will merge with Tejas Completion Services as part of a transaction backing Tejas, Voyager said.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.