The price of Brent crude ended the week at $72.94 after closing the previous week at $75.46. The price of WTI ended the week at $69.33 after closing the previous week at $71.69. The price of DME Oman crude ended the week at $71.79 after closing the previous week at $75.76.

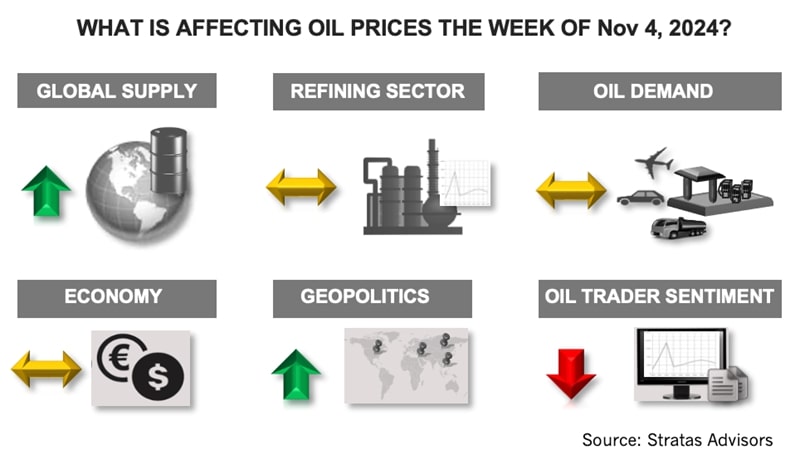

We expected oil prices to be under pressure last week with the ongoing stream of disappointing economic news about China, the reduction in the geopolitical concerns about the Middle East (at least for the short-term), and that the price of Brent crude could test $70. Prices rebounded in the second half of the week with signs that Iran will respond to the latest Israeli attack. There are additional reports over the weekend that Iran is preparing for an attack on Israel that will make use of more powerful warheads and other weapons than used in previous Iranian attacks on Israel. Also, it has been reported that Iran’s military will take part in the attack, while the previous attacks only involved the Islamic Revolutionary Guard. Another worrisome development is that the conflict is spreading. Israel has been carrying out attacks on Hezbollah positions in Lebanon, and on Sunday, Israel announced that it also has been carrying out military operations in Syria in recent months. It is being reported that in its next attack on Israel, Iran may launch missiles from Iraq.

Another development that will provide upward support for oil prices is OPEC+ announcing on Sunday that it is delaying the supply increase planned for December by one month, thus maintaining the voluntary supply cut of 2.2 MMbbl/d in addition to the previous supply cut of 3.66 MMbbl/d. This latest delay follows the initial delay announced in early September when OPEC+ shifted the beginning of the phase-out of the supply cuts from October to December. The current plan now calls for the supply cut of 2.2 MMbbl/d to start being phased out in January and continue until November 2025.

The delay is consistent with our previously stated view that Saudi Arabia has been trying to encourage discipline across OPEC+ by signaling that it is not willing to take on the burden of reducing production to support oil prices by itself – and not as some thought – an intention of bringing on additional supply to collapse oil prices. We do not think this is the strategy that Saudi Arabia intends to follow because of the risk associated with the potential fracturing of OPEC+. Saudi Arabia employed this approach in 2014, which resulted in oil prices dropping below $40, and again in 2020, which resulted in oil prices dropping even lower. While Saudi Arabia has been frustrated by some members of OPEC+ overproducing, the supply/demand fundamentals are not nearly as dire as during 2014 and 2020. The growth in non-OPEC supply is also more moderate – especially in comparison to 2014. Additionally, the delay aligns with members of OPEC+ decreasing their production in August and September, including those members that have been producing about their quotas. During September, OPEC+’s production decreased by 557,000 bbl/d, falling from 40.68 MMbbl/d to 40.12 MMbbl/d. Russia and Iraq each reduced their production during September to just slightly above their quotas. Russia reduced its production by 28,000 bbl/d to around 9 MMbbl/d, while its quota is 8.98 MMbbl/d, while Iraq reduced its production by 155,000 bbl/d to around 4.1 MMbbl/d, while its quota is 4.00 MMbbl/d.

Based on our demand forecast (which is higher than IEA, but significantly lower than the forecast from the research arm of OPEC) there is room for OPEC+, including Saudi Arabia, to increase supply gradually and not collapse oil prices — if there is no dramatic increase in non-OPEC supply (which we do not expect). However, given the current level of oil prices, we think there is incentive for OPEC+ to delay the phase-out of the supply cuts of 2.2 MMbbl/d until 2Q of 2025 when oil demand will be poised to move upwards because of the forthcoming driving season.

For the upcoming week, with the increased geopolitical risk and OPEC+’s delay in phasing out its production cut, we are expecting that the price of Brent crude could test $77.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

What's Affecting Oil Prices This Week? (Dec. 9, 2024)

2024-12-09 - For the upcoming week, Stratas Advisors believes the announced delay by OPEC+ will keep the price of Brent crude above $70, but not reach $73.

What's Affecting Oil Prices This Week? (Jan. 6, 2025)

2025-01-06 - Recent geopolitical news also provided some support for oil prices with the rhetoric heating up between Iran and Israel.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

Oil Set for Weekly Loss on Surplus Fears After OPEC+ Cut Extensions

2024-12-06 - The Organization of the Petroleum Exporting Countries and its allies on Dec. 5 pushed back the start of oil output rises by three months until April.

What's Affecting Oil Prices This Week? (Dec. 16, 2024)

2024-12-16 - For the upcoming week, Stratas Advisors expect oil prices will move sideways with more downside risk than upside potential.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.