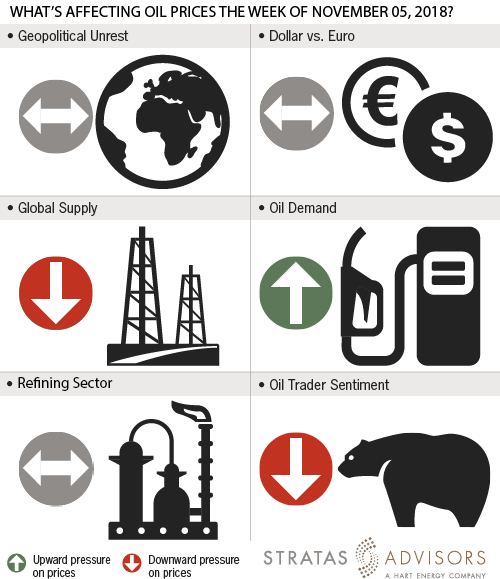

In the week since our last edition of What’s Affecting Oil Prices, Brent fell $2.50/bbl last week to average $74.89, right in line with our expectations. WTI fell $2.40/bbl to average $65.07.

While current price levels are much more reasonable, we think a hard floor should exist at $70/bbl. While supply concerns have been somewhat alleviated, there is still risk in the markets and fears of a demand slowdown may be overblown. Recent news indicates that there might be some progress on the trade war front with rumors that both sides have been negotiating a resolution. However, nothing official has been announced and this is likely just optimistic messaging in advance of Tuesday’s midterm elections.

We expect Brent to average $73/bbl this week. The implementation of Iran sanctions is unlikely to add significant value to prices, especially with waivers approved for eight countries/territories that have significantly reduced imports. White House administration officials have refused to name the eight jurisdictions being granted an exemption but China, Japan, India and South Korea are expected to be among them.

Recommended Reading

Q&A: Crescent Midstream Charts CCS Course with $1B Project

2025-02-05 - CEO Jerry Ashcroft discusses the carbon capture and storage landscape and how the company is evolving.

Kinder Morgan to Build $1.7B Texas Pipeline to Serve LNG Sector

2025-01-22 - Kinder Morgan said the 216-mile project will originate in Katy, Texas, and move gas volumes to the Gulf Coast’s LNG and industrial corridor beginning in 2027.

Mobile Pipeline Maker Hexagon Agility Receives $11.2MM Order

2024-12-31 - Hexagon Agility says an oilfield service company is planning on converting its well-completion equipment fleet from diesel to natural gas.

Burgum: Feds ‘Will Step In’ to Build Marcellus-to-New England Pipeline

2025-03-12 - Trump administration officials want to greenlight a pipeline to carry Marcellus Shale gas from Pennsylvania into New England states, says U.S. Interior Secretary Doug Burgum.

The Wall: Uinta, Green River Gas Fills West Coast Supply Gaps

2025-03-05 - Gas demand is rising in the western U.S., and Uinta and Green River producers have ample supply and takeaway capacity.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.