Crude oil and the dollar continue to diverge as crude remains more influenced by fundamentals and sentiment.

In the week since our last edition of What’s Affecting Oil Prices, Brent averaged $61.10/bbl. For the upcoming week, Stratas Advisors expect prices to average $62.50/bbl as fundamental support remains.

Stratas Advisors also expects the Brent-West Texas Intermediate (WTI) differential to average $6.50/bbl.

The supporting rationale for the forecast is provided below.

Geopolitical: Positive

The implications of this weekend’s “anti-corruption” crackdown in Saudi Arabia are still playing out. While Mohammed bin Salman’s actions are being viewed a consolidation of power within The Kingdom, the arrest of many elites and members of the royal family reinforces attempts to draw foreign investment by indicating that no one is “above the law.” This issue will be watched closely this week and is likely to push prices higher and drive an increase in volatility. In Nigeria, The Niger Delta Avengers have called an end to their cease-fire and promised to resume their campaign of destruction against oil operators in the Niger Delta. It is unclear how quickly attacks might resume or at what scope, but the group’s previous campaign in 2016 hobbled the Nigeria oil industry and dragged the country into a recession. If the group again begins attacking oil facilities, prices will likely see some additional support.

Dollar: Neutral

Crude oil and the dollar continue to diverge as crude remains more influenced by fundamentals and sentiment, and the dollar saw support from optimism around the recently broadcasted Republican tax plan and a new Federal Reserve chair. President Trump said his choice of Jerome Powell as the next Federal Reserve chair. Based on Powell’s experience and statements, he will likely follow a policy path very similar to the one enacted under Janet Yellen.

Trader Sentiment: Positive

Hedge fund managers have unsurprisingly increased bullish bets on U.S. crude oil, with WTI managed money long positioning extending once again as short positions fell. NYMEX and ICE managed money net WTI positions are now both above the five-year range. This bullishness likely reflects a sentiment Stratas Advisors have been echoing, that the Brent-WTI differential is too wide and will have to close as U.S. crude runs increase. ICE Brent is also benefitting from positive sentiment, with speculators again increasing long positions while decreasing shorts in the latest data release.

Supply: Positive

U.S. inventories continue to fall counter-seasonally, drawn by strong exports and crude runs. Supply again rose last week as U.S. producers continue to ramp up activity. Runs are returning in the Gulf Coast, but with seasonal maintenance reducing intake in other PADDs, the wide Brent-WTI differential is likely to remain in the week ahead. This will encourage exports and help to draw down crude stocks.

Demand: Positive

Demand remains healthy in the U.S., with strong product exports indicating a robust appetite elsewhere. U.S. gasoline domestic demand and exports are both at the top of their five-year range, drawing down stocks even as production increases. Distillate stocks have also been falling despite higher production, but unlike gasoline these draws are primarily supported by higher exports, likely to Latin America. In Europe, total product stocks continue to fall driven by persistent declines in gasoline and diesel.

Refining: Positive

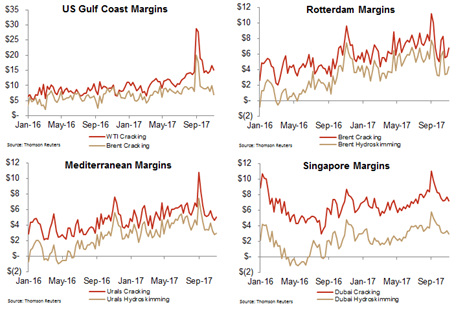

Margins were a mixed bag last week, rising in Europe, but falling slightly in Asia and the U.S. Overall margins are generally trending in line with seasonal averages and at-or-above 2016 levels and will continue to encourage crude runs. WTI and Brent cracking at the Gulf Coast fell $1.48/bbl and $2.98/bbl respectively. However, margins in the region remain high enough to encourage growth in crude runs, slowly narrowing the Brent-WTI differential (Brent-WTI Set to Narrow on Higher Crude Runs, Depressing Crude Exports).

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-01-31 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Crescent Energy Closes $905MM Acquisition in Central Eagle Ford

2025-01-31 - Crescent Energy’s cash-and-stock acquisition of Carnelian Energy Capital Management-backed Ridgemar Energy includes potential contingency payments of up to $170 million through 2027.

On The Market This Week (Jan. 27, 2025)

2025-01-31 - is a roundup of marketed oil and gas leaseholds in Appalachia and the Central Basin from select E&Ps.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.