The price of Brent crude ended the week at $78.79 after closing the previous week at $78.14. (Source: Shutterstock)

The price of Brent crude ended the week at $78.79 after closing the previous week at $78.14. The price of WTI ended the week at $75.49 after closing the previous week at $74.45. The price of DME Oman crude ended the week at $78.58 after closing the previous week at $77.33.

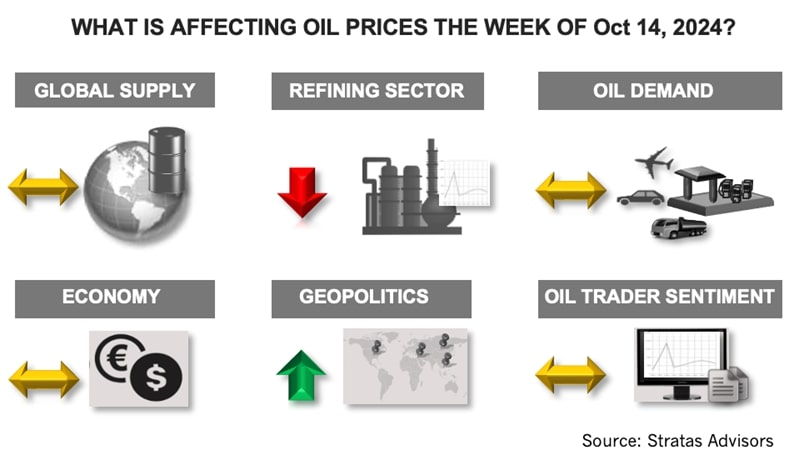

While there were no major military attacks exchanged between Israel and Iran last week, the ongoing conflict still represents a risk to the oil supply because of the potential of an Israel attack on Iran’s oil facilities. On Oct. 13, the U.S. announced that it would send a Terminal High Altitude Area Defense (THAAD) battery and associated troops to Israel. While the move is being viewed as escalatory by some, in part, because of Iran’s warning against such a move by the U.S., we believe that the announcement aligns with our previously stated view that while the U.S. will support Israel against attacks, the current U.S. administration is unlikely to support Israel in a major offensive action against Iran, including attacks on Iranian nuclear facilities as well as any major attack on Iran’s oil facilities. Additionally, the further involvement of the U.S. provides more cause for Iran to continue to show restraint in responding to an Israeli attack.

That said, we think that there is a limited chance for the dynamics of the Israel-Iran conflict, as well as the Russia-Ukraine conflict, to change until after the U.S. presidential election. At that time, the risks associated with both conflicts could increase because of a shift away from the status quo – especially if the U.S. decides to support more aggressive military action. The success of this type of approach, from the perspective of the U.S. and allies, would be dependent on the other side not responding with their own escalatory initiatives, but instead backing off. While the latter may have the highest probability, the alternative of wider and more intensive conflicts cannot be assumed to have a probability of 0%. Additionally, a more aggressive approach is likely to have broader geopolitical ramifications – especially with respect to those countries more sympathetic toward Russia and Iran.

Offsetting the geopolitical risk are the concerns associated with Saudi Arabia’s warning of plans to take back market share. There are reports that Saudi Arabia will be bringing on substantial additional supply with the intention of collapsing the oil price. We do not think this is the strategy that Saudi Arabia will ultimately follow because of the risks associated with fracturing OPEC+, especially when the sentiment of the oil traders remains relatively negative. Saudi Arabia did employ an aggressive strategy to regain market share in 2014, which resulted in oil prices dropping below $40, and while Saudi Arabia was successful in slowing down investments in U.S. shale, the strategy did not result in oil prices moving back to $100. Saudi Arabia took a similar aggressive approach in 2020, which resulted in oil prices dropping even lower – and only stabilized when an agreement was reached between Saudi Arabia and Russia. While Saudia Arabia is frustrated by members of OPEC+ overproducing — including Russia, Iraq and Kazakhstan — the supply/demand fundamentals are not nearly as dire as during 2014 and 2020. Furthermore, the pending growth in non-OPEC supply is more moderate – especially in comparison to 2014.

Similar to last week, for the upcoming week, we are expecting that oil prices will be relatively flat with a downward bias unless there is another military strike of note. If an attack does occur oil prices will spike higher.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Diamondback Energy Appoints Industry Veteran Holderness to Board

2025-02-04 - Diamondback Energy has named Darin G. Holderness, who founded and served as CFO at P&A Exchange LLC and CFO at ProPetro Holding Corp. as a board of directors at the Permian Basin E&P.

Pearl Energy Investments Closes Fund IV with $999.9MM

2025-02-04 - Pearl Energy Investments’ Fund IV met its hard cap within four months of launching and closed on Jan. 31.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Confirmed: Liberty Energy’s Chris Wright is 17th US Energy Secretary

2025-02-03 - Liberty Energy Founder Chris Wright, who was confirmed with bipartisan support on Feb. 3, aims to accelerate all forms of energy sources out of regulatory gridlock.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.