In the week since our last edition of What’s Affecting Oil Prices, Brent averaged $56.55/bbl with prices strengthening throughout the week as OPEC and IEA released bullish reports.

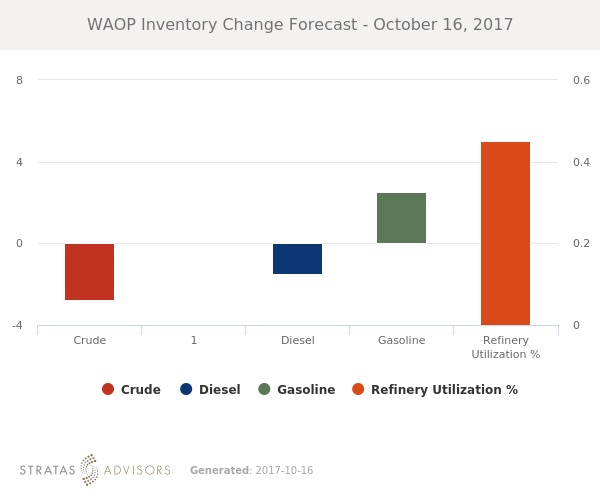

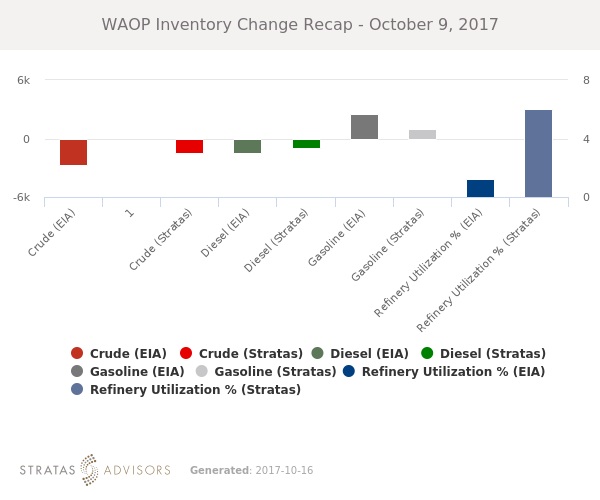

For the upcoming week, Stratas Advisors expect prices to average around $58/bbl with U.S. crude stocks falling 2.8 MMbbl. Stratas Advisors also expect the WTI-Brent differential to average closer to $6.00/bbl as WTI sees less support than Brent from geopolitical events.

The supporting rationale for the forecast is provided below.

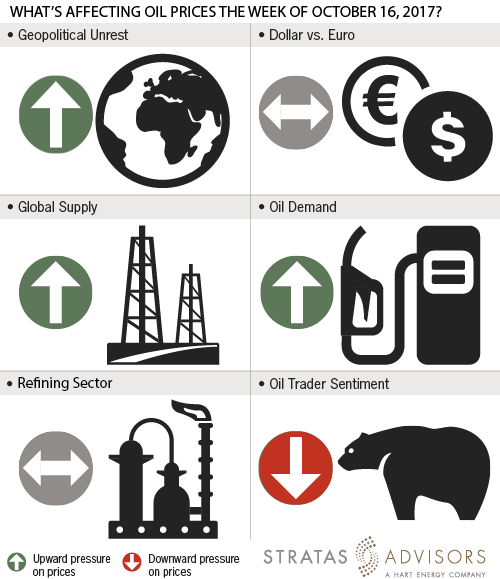

Geopolitical: Positive

Iraq’s northern oil fields are slipping into chaos as Baghdad is attempting to take back control of parts of the Kirkuk region. Reportedly, 350 MMbbl/d of output has been shut due to security concerns. Stratas Advisors expects this story to continue dominating headlines as fighting potentially escalates during the week.

President Trump has officially refused to recertify the nuclear deal with Iran. While refusing to certify the deal does not have any immediate short-term impacts, the evolution of the deal now bears watching. Next steps to either renegotiate the deal or renew the deal without the president’s certification are up to Congress, where members are divided on the best course of action. In the meantime, the European signatories to the deal have reaffirmed their commitment and belief that Iran is adhering to the deal. This does not bode well for snapping back sanctions as some of the most effective sanctions on shipping originated from Europe.

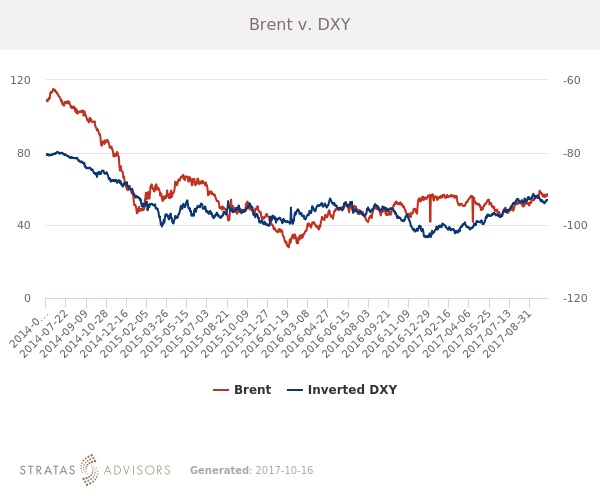

Dollar: Neutral

The dollar’s relationship with crude was not as strong last week as crude is more supported by fundamentals and sentiment. Federal Reserve Chair Janet Yellen and her international counterparts continue to signal that inflation will soon increase. Ongoing expectations of a rate hike from the Federal Reserve in December, combined with optimism about prospects of tax reform, are likely to continue supporting the dollar in coming weeks.

Trader Sentiment: Negative

Hedge fund managers continue to pull back their long positions despite prices shifting away from overbought territory. Stratas Advisors expects this momentum to continue this week as fund managers look to take profits. WTI NYMEX net longs fell by 10,766 while ICE WTI net longs increased by 3,583.

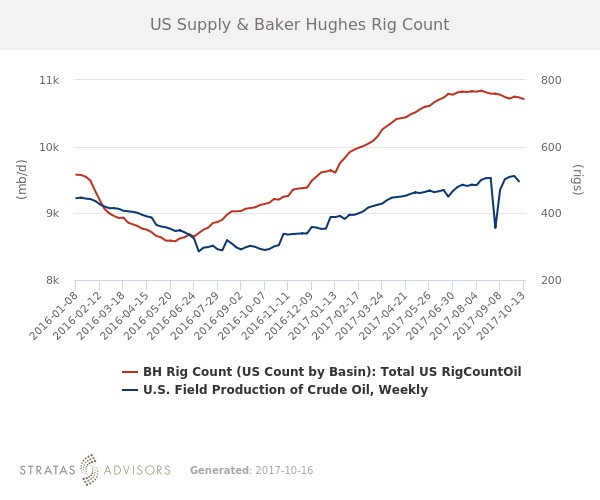

Supply: Positive

Last week the number of operating oil rigs in the U.S. fell by five, according to the weekly report from Baker Hughes (NYSE: BHGE). U.S. oil rigs now stand at 743 compared to 432 at the same time in 2016. Hurricane Nate’s disruption will likely be reflected in this week’s production numbers. Globally, OPEC continues to send signals to the market that further intervention is the most likely path. The current fighting in Iraq has removed about 350 MMbbl/d of production; while this could easily fluctuate since it is caused by security concerns and not damage, reports of volumes offline are typically supportive.

Demand: Positive

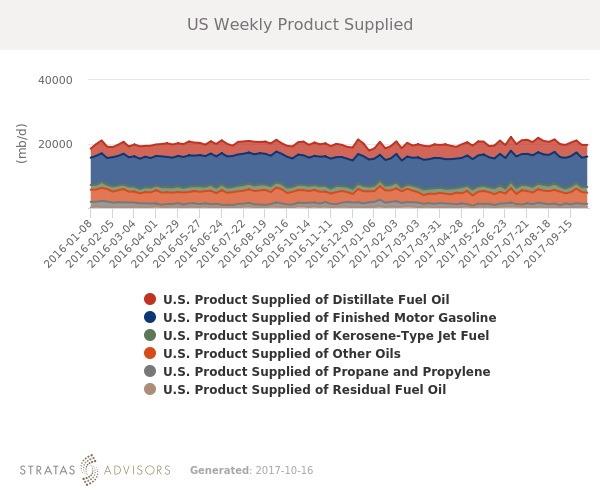

According to the EIA, U.S. gasoline and distillate demand on a four-week-average basis remain healthy. However, total product demand has fallen below year-ago levels, potentially pressuring domestic prices; however, the bulk of the decline appears to be outside of gasoline and diesel. Globally, bullish IEA and OPEC monthly reports with strong demand estimates will continue to lend some support.

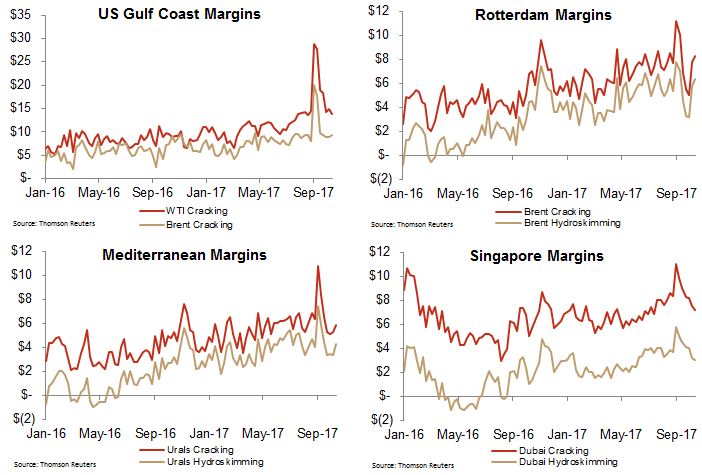

Refining: Neutral

Refining margins were a mixed bag again last week. Margins in Europe all increased while falling in Singapore. In the U.S., WTI cracking at the Gulf Coast fell $1.09/bbl while Brent cracking at the Gulf Coast increased by $0.49/bbl.

How We Did

Recommended Reading

LongPath Adds Vital Energy Assets to Methane Sensing Network

2024-09-26 - LongPath Technologies is expanding its methane sensing network in the Permian Basin with a significant portion of Vital Energy’s assets.

TXO Partners Closes Williston Basin Acquisition for $296MM

2024-09-04 - MLP TXO Partners reported in regulatory filings that it had closed a 159,000 net acre acquisition in North Dakota and Montana for cash and units.

Analyst: Public E&Ps Race to Stay Relevant in a Consolidating Energy Market

2024-10-25 - A shrinking pool of opportunities is leading to scarcity and driving the rising valuations for crude E&Ps in the current A&D market, said TD Cowen analyst David Deckelbaum at Hart Energy’s A&D Strategies and Opportunities Conference.

Beyond Energy: EnergyNet Expands Marketplace For Land, Real Assets

2024-09-03 - A pioneer in facilitating online oil and gas A&D transactions, EnergyNet is expanding its reach into surface land, renewables and other asset classes.

Macquarie Buys Up to $1.73B Stake in D.E. Shaw Renewable Investments

2024-09-24 - Macquarie Asset Management is acquiring a minority stake in D.E. Shaw Renewable Investments in an equity investment of up to $1.73 billion.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.