In the week since our last edition of What’s Affecting Oil Prices Brent averaged $57.76/bbl, in line with Stratas Advisors’ belief that prices would strengthen.

For the upcoming week Stratas Advisors expect prices to hold most of these gains, averaging $57.50/bbl. Stratas Advisors also expect the Brent-West Texas Intermediate (WTI) differential to average $5.50/bbl.

The supporting rationale for the forecast is provided below.

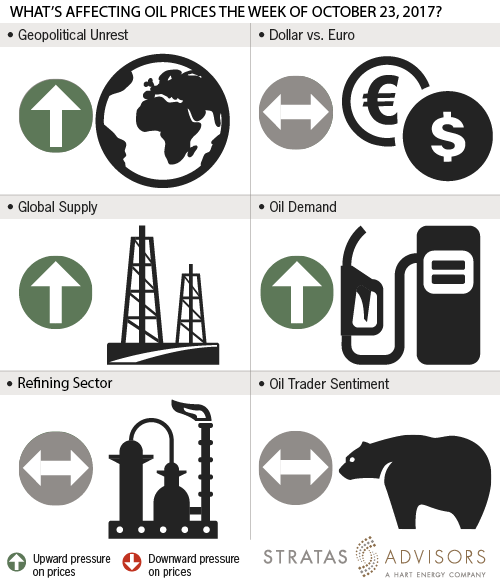

Geopolitical: Positive

Tensions remain high in northern Iraq, with Kurdish shipments of oil through the Ceyhan pipeline sharply reduced. Leaders of the two major Kurdistan political parties have announced they are willing to enter negotiations with Iraq, a move that is likely to forestall any more military maneuvers on the part of Baghdad. Iraq has swiftly reclaimed and occupied all territory outside of the Kurdish mandated borders, but it is unclear when oil production will resume at normal levels.

Dollar: Neutral

The latest Commodity Futures Trading Commission numbers show the outlook for the dollar improving slightly as speculators reduced short positioning; however, net positioning remains short. If tax reform remains on track, there could be an uptick in long positioning. Overall, crude remains more influenced by fundamentals and sentiment, but strength in the dollar could still lend some support to crude.

Trader Sentiment: Neutral

Hedge fund managers have a mixed outlook on prices. Funds increased their bearish positions on WTI last week while taking a more bullish stance on Brent, removing shorts and increasing long positions. However, overall open interest has generally trended up, indicating that traders are generally more willing to place bets on the market.

Supply: Positive

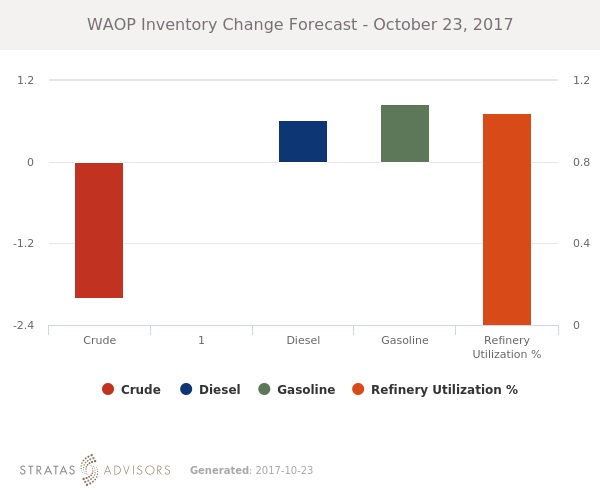

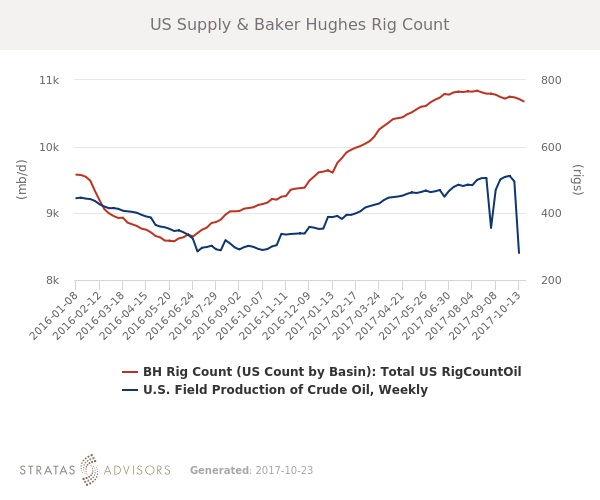

The Energy Information Adminstration’s weekly production estimates saw a strong drop last week, which was likely almost entirely caused by the temporary shut-ins from Hurricane Nate. As such, the number normalizing this week should not spook markets. Baker Hughes (NYSE: BHGE) reported a third decrease in U.S. oil rigs, with operating oil rigs falling by seven last week. Globally, OPEC continues to publically discuss the likelihood of extending its ongoing supply deal, and Iraqi volumes remain offline due to regional fighting in Kurdistan.

Demand: Positive

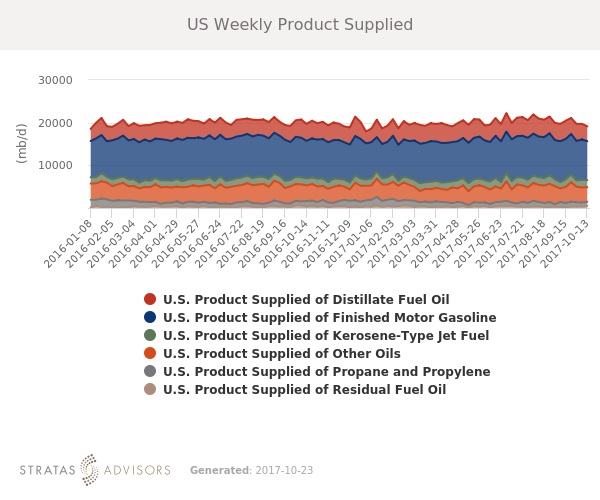

Demand remains healthy in the U.S., with strong product exports indicating a decent appetite elsewhere as well. The dip in reported diesel demand last week was likely a one-off weather-related occurrence and will reverse in this week’s numbers. Preliminary reports indicate that the shipping industry expects a strong finish to the year spurred by holiday shopping, a positive for demand. In Europe, gasoil and gasoline stocks continue their steady decline, although other fuels’ performance has been more mixed.

Refining: Neutral

Margins were a mixed bag last week, but they remain at or above seasonal averages in all major enclaves. Margins in Europe fell the most, with Brent cracking in Rotterdam down $2.81/bbl and Urals cracking in the Mediterranean down $0.83/bbl. Margins in Asia increased slightly, while margins on the Gulf Coast were mixed.

How We Did

Recommended Reading

Chevron Sells Canadian Oil Sands, Duvernay Shale Assets for $6.5B

2024-10-07 - Chevron said the divestitures are part of its plans to sell $10 billion to $15 billion worth of assets by 2028 following the company’s acquisition of Hess Corp. for $53 billion.

ADNOC Drilling, SLB and Patterson-UTI Form JV Turnwell Industries in UAE

2024-10-01 - Their joint venture Turnwell Industries LLC has been contracted to drill an initial 144 wells in the United Arab Emirates, scheduled for completion by the end of 2025.

Asia, EU Buyers Warming Up to US Shale M&A Again—Jefferies

2024-10-29 - Foreign asset buyers are considering U.S. upstream M&A to lower their LNG supply costs and avoid windfall taxes on European operations, Jefferies Managing Director Bill Marko says.

Phillips 66 Sells Interest in Swiss-based Petrol Station Operator

2024-10-16 - Phillips 66 Ltd. is selling its 49% non-operated equity interest in Switzerland’s Coop Mineraloel, an operator of retail sites and petrol stations.

Matador Slashes Debt with $113MM Piñon Midstream Payout

2024-10-29 - Enterprise Products Partners closed its purchase of Piñon Midstream for $950 million on Oct. 28, earning Matador Resources $113 million for its roughly 19% ownership interest.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.