Stratas Advisors are expecting that the price of Brent crude will test $70 this week. (Source: Shutterstock)

The price of Brent crude ended the week at $75.46 after closing the previous week at $73.17. The price of WTI ended the week at $71.69 after closing the previous week at $69.35. The price of DME Oman crude ended the week at $75.76 after closing the previous week at $72.64.

At the beginning of last week, we expected the price of Brent crude would struggle to break through $75 without a geopolitical shock. We also expected that when the Israeli response to Iran’s attack occurred, it would be measured. And in fact, the response by Israel that occurred over the weekend was limited in nature with the attack focused on Iranian military targets, including anti-aircraft systems and missile production facilities. In the aftermath of the attack, Iran’s Foreign Minister sent a letter to the U.N. Secretary-General stating that Iran had the inherent right to respond at the appropriate time. Iran’s supreme leader, Ali Khamenei, however, in his address about the attack, did not mention any future retaliation by Iran.

The limited attack and the restraint shown by Iran were as we have been expecting. It has been our view that while the U.S. would support Israel against attacks, the current U.S. administration would not support Israel in a major offensive action against Iran, including attacks on Iranian nuclear facilities as well as any attack on Iran’s oil and gas infrastructure. Additionally, it has been our view that Iran will continue to show restraint in responding to Israel, in part, because Iran is not interested in a major conflict with the Israeli military that will be supported by the U.S. and allies. The recent attack by Israel may provide Iran with further reason for restraint, since Israel showed the ability to carry out the attack, even though Iran had weeks to prepare. Additionally, given that Israel supposedly inflicted substantial damage on Iran’s anti-aircraft systems during the recent attack, Iran is now likely to have fewer capabilities to prevent another attack. Therefore, in the near term, we think the probability of major conflict between Israel and Iran is low – and as such, it is highly unlikely that there will be any material interruption to the flow of oil.

A significant development pertaining to the Russia-Ukraine conflict is North Korea sending around 12,000 troops to Russia. The U.S. is concerned about the possibility that Russia is providing North Korea with military technology, while North Korea is providing Russia with munitions – and now troops. There are reports that China may not be happy with the expanding Russia-North Korea relationship, and while we are not sure if that is necessarily true – it seems that China would prefer de-escalation of the Russia-Ukraine conflict, given that China is focusing on reinvigorating its economy, which is struggling, in part, because of weak export markets, including European markets.

The U.S. presidential election could be an inflection point for both conflicts, especially with respect to the Middle East. If Donald Trump returns to the presidency, it is likely that the U.S. will put more pressure on Iran, including enforcement of sanctions on Iran’s oil exports, and Israel may have the opportunity to carry out more extensive attacks on Iran. The Ukraine-Russia conflict will also be affected by the results of the U.S. presidential election. With the election of Donald Trump, there is a greater likelihood that a negotiated settlement will occur. While Trump will face some resistance from his own party and others, it is our view that he is inclined to push for a negotiated settlement at the beginning of his administration when he will have significant political power.

As we previously stated, the risks associated with both conflicts could increase because of a shift away from the status quo – especially if the U.S. decides to support more aggressive military action. The success of this type of approach, from the perspective of the U.S. and its allies, would be dependent on the other side not responding by their escalatory initiatives, but instead backing off. While this result may have the highest probability, the alternative of wider and more intensive conflicts cannot be assumed to have a probability of 0%. Additionally, a more aggressive approach is likely to have broader geopolitical ramifications – especially with respect to those countries more sympathetic toward Russia and Iran.

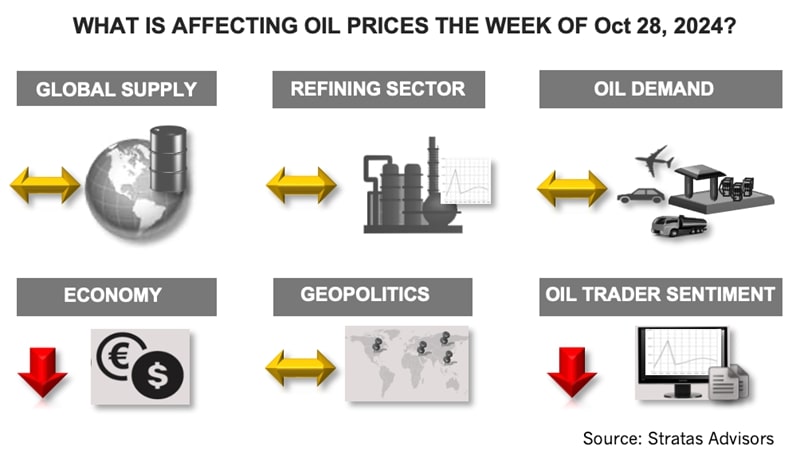

For the upcoming week, with the ongoing stream of disappointing economic news about China, and the reduction in the geopolitical concerns about the Middle East (at least for the short term), we expect that there will be downward pressure on oil prices. We are expecting that the price of Brent crude will test $70 this week.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

US Oil and Gas Rig Count Rises to Highest Since June, Says Baker Hughes

2025-02-21 - Despite this week's rig increase, Baker Hughes said the total count was still down 34, or 5% below this time last year.

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

Baker Hughes: US Drillers Add Oil, Gas Rigs for Third Week in a Row

2025-02-14 - U.S. energy firms added oil and natural gas rigs for a third week in a row for the first time since December 2023.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.