Editor's note: To interact with charts, visit StratasAdvisors.com.

In the week since our last edition of What’s Affecting Oil Prices, Brent averaged $58.78/bbl. For the upcoming week we expect prices to average $59/bbl as fundamental support remains. We also expect the Brent-WTI differential to average $6.50/bbl.

The supporting rationale for the forecast is provided below.

Geopolitical: Neutral

Geopolitics as it relates to oil could continue to drive volatility but is unlikely to have an additional immediate fundamental impact. However, the few active hotspots that bear watching are more likely to hamper oil supply, further helping prices.

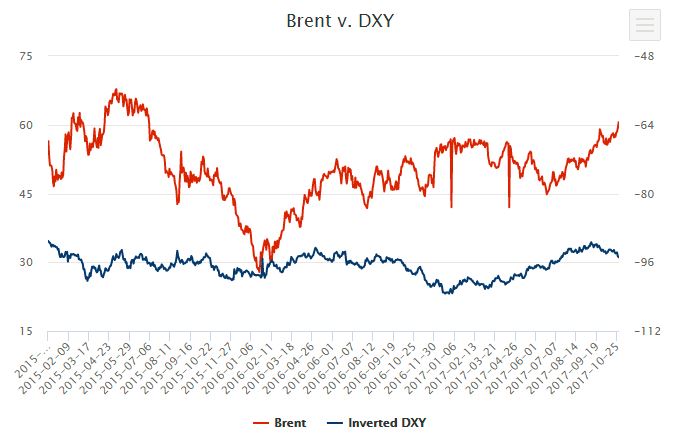

Dollar: Neutral

Crude oil and the dollar diverged with both strengthening over the course of the week. Overall, crude remains more influenced by fundamentals and sentiment, but strength in the dollar could potentially weigh on crude if markets continue tightening. The search for a new Federal Reserve chairman could drive short-term volatility in the dollar as three very different candidates are supposedly being considered. President Trump has said he will announce his decision this week with current consensus pointing toward him choosing Jerome Powell.

Trader Sentiment: Positive

Hedge fund managers remain active with net managed money positions in ICE Brent and ICE WTI well above prior years, and NYMEX WTI net positions increasing as well. Funds increased their bullish positions on ICE Brent and WTI last week. Trader sentiment remains general positive, and will continue to be a supportive factor in the week ahead after prices broke through the psychologically important $60/bbl barrier.

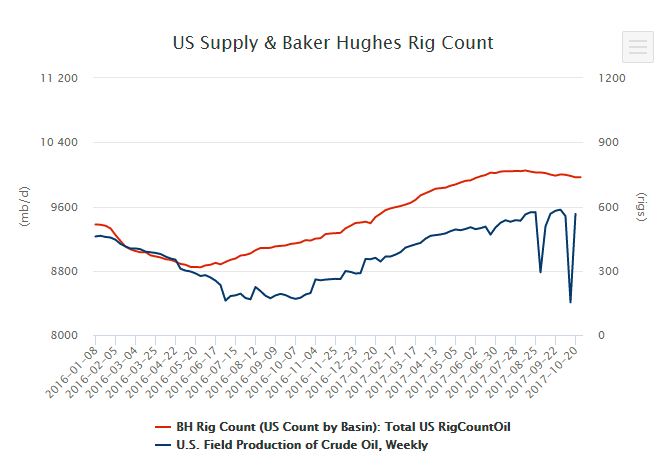

Supply: Positive

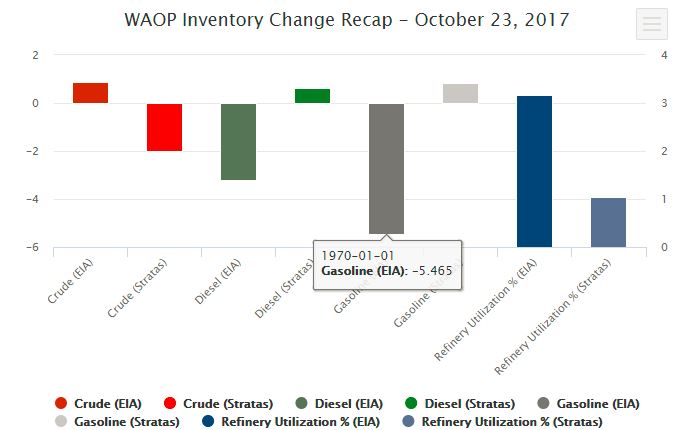

U.S. inventories continue to fall counter-seasonally, drawn by strong exports and crude runs. Supply increased sharply last week, correcting from Hurricane Nate disruptions and is now returned to previous levels. While crude runs could drop on seasonal maintenance, the wide Brent-WTI differential will continue to support strong exports, leading to further stock draws.

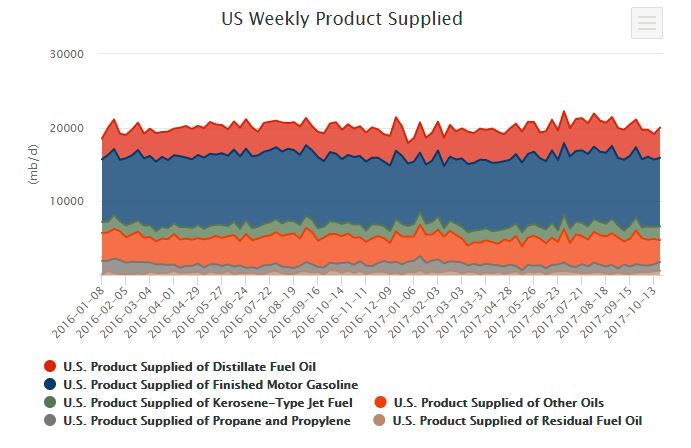

Demand: Positive

Demand remains healthy in the US with strong product exports, indicating a decent appetite elsewhere as well. While gasoline exports have backed off of their highs earlier in the year, recent weeks have seen some increases. US distillate demand recovered slightly and should continue to seasonally increase while exports have also steadily improved. In Europe, total product stocks continue to fall driven by persistent declines in gasoline and diesel.

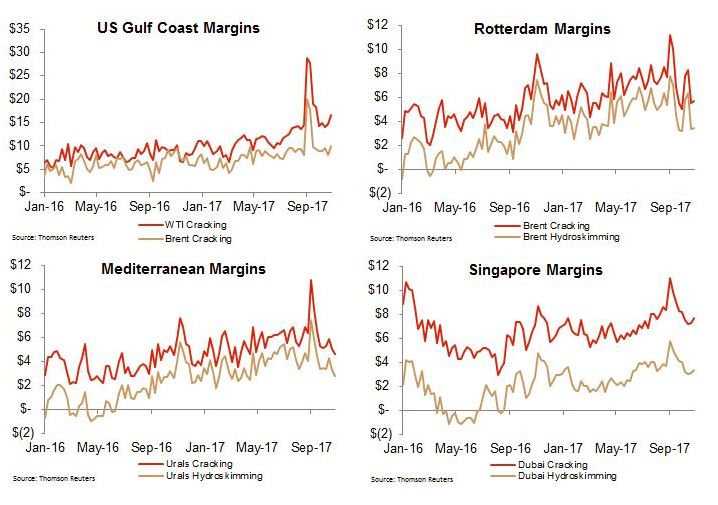

Refining: Positive

Margins were generally up last week, with only some weakness in the Mediterranean. Margins are generally trending along the seasonal five-year average and will remain supportive of ongoing runs.WTI cracking on the Gulf Coast increased $1.91/bbl while Brent cracking on the Gulf Coast increased $1.86/bbl. In the Mediterranean, Urals cracking and hydroskimming declined $0.38/bbl and $0.48/bbl, respectively, likely on strength in Urals pricing.

How We Did

Recommended Reading

Midstream M&A Adjusts After E&Ps’ Rampant Permian Consolidation

2024-10-18 - Scott Brown, CEO of the Midland Basin’s Canes Midstream, said he believes the Permian Basin still has plenty of runway for growth and development.

Post Oak-backed Quantent Closes Haynesville Deal in North Louisiana

2024-09-09 - Quantent Energy Partners’ initial Haynesville Shale acquisition comes as Post Oak Energy Capital closes an equity commitment for the E&P.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.

Dividends Declared Sept.16 through Sept. 26

2024-09-27 - Here is a compilation of dividends declared from select upstream, midstream and service and supply companies.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.