The price of Brent crude ended the week at $89.17 after closing the previous week at $92.16. (Source: Shutterstock)

The price of Brent crude ended the week at $89.17 after closing the previous week at $92.16. The price of WTI ended the week at $85.46 after closing the previous week at $88.08. The price of DME Oman ended the week at $90.88 after closing the previous week at $92.33.

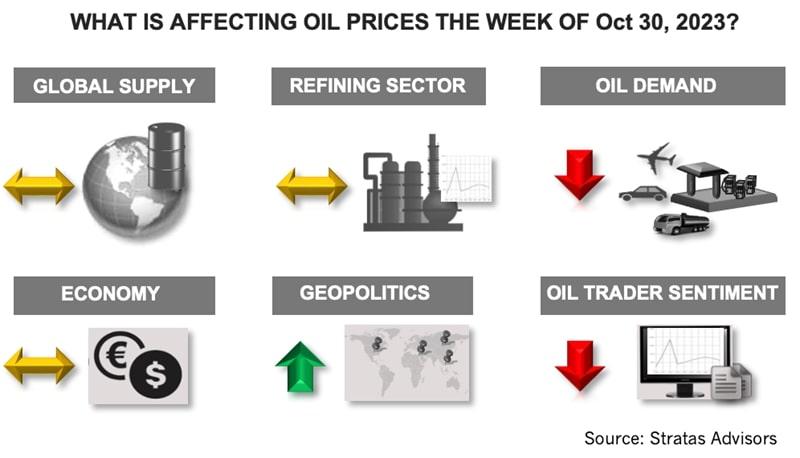

During the past week, oil traders dismissed the geopolitical situation and the potential impact on the oil markets. As we have been highlighting, if the threat to the flow of oil is viewed to be a low probability, the risk premium would start eroding and the previous price dynamics would govern price movements. While we also think that it is unlikely that the flow of oil will be interrupted, the Israeli - Hamas conflict has reached a volatile period with Israel initiating the ground attack on Gaza. The conflict has the potential to expand further in Lebanon and Syria. The conflict also has the potential to involve several other countries, including Turkey with Erdogan expressing support for Hamas, while speaking harshly of Israel and stating that western powers are the main culprit behind the massacre of Palestinians in Gaza.

There also remains the possibility of Iran becoming directly involved, given Iran’s support for Hamas and Hezbollah. The involvement of Iran represents the most likely trigger event that could lead to disruption of oil flows – either through Iran’s actions to interfere with oil traffic associated with the Strait of Hormuz, or through the U.S. tightening sanctions on Iran’s oil-related exports. Much less probable is the possibility of Iran, in conjunction with other producers, imposing an oil embargo on oil moving to western countries. At this time, we think the probability of Iran becoming directly involved is low, but it is not zero, given that the conflict is still progressing, coupled with Iran’s geopolitical goals and Iran’s expanding relationships with non-western powers.

Besides the geopolitical risks, the fundamentals remain favorable for higher oil prices. During Q4, we are forecasting that crude supply will increase in comparison with 3Q with non-OPEC supply forecasted to increase by 1.10 MMbbl/d, while OPEC supply remains essentially unchanged. However, we are also forecasting that oil demand will outpace supply by 0.87 MMbbl/d even with the forecasted oil demand in Q4 being about around 400,000 bbl/d less in comparison to demand in 3Q 2023.

For the upcoming week, we are expecting that oil prices will move sideways with a downward bias. We think, however, that oil prices still have the potential to spike higher depending on geopolitical developments.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Diamondback’s Stice to Step Down as CEO, Van’t Hof to Succeed

2025-02-20 - Diamondback CEO Travis Stice, who led the company through an IPO in 2012 and a $26 billion acquisition last year, will step down as CEO later this year.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Viper Makes Leadership Changes Alongside Diamondback CEO Shakeup

2025-02-21 - Viper Energy is making leadership changes alongside a similar shake-up underway at its parent company Diamondback Energy.

Lion Equity Partners Buys Global Compression from Warren Equipment

2025-01-09 - Private equity firm Lion Equity Partners has acquired Warren Equipment Co.’s Global Compression Services business.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.