The price of Brent crude ended the week at $78.14 after closing the previous week at $71.98. The price of WTI ended the week at $74.45 after closing the previous week at $68.94. The price of DME Oman crude ended the week at $77.33 after closing the previous week at $71.

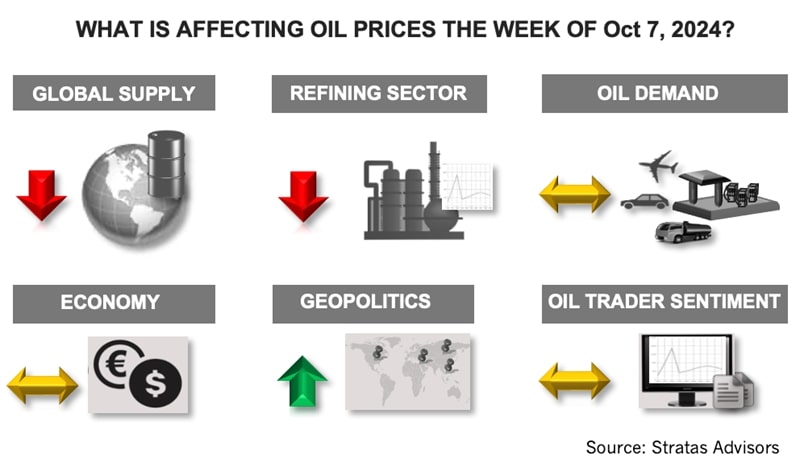

Oil prices moved up with the conflict between Israel and Iran intensifying, which overshadowed the pending return of Libya’s oil production and exports – and concerns about Saudi Arabia’s warning of plans to take back market share.

For most of the year, the impact of the military conflicts on the oil market and prices has been muted because the flow of oil has continued for the most part unabated – resulting in the oil market dismissing the potential risks. Given last week’s price increase, it is our estimation that the oil market is placing about a 10% probability that the conflict between Israel and Iran will result in a disruption to the flow of oil. It is our view that this is a market overreaction, in part, because we think Iran will continue to show restraint in responding to Israel since Iran is not interested in a major conflict with the Israeli military that will be supported by the U.S. and allies. Additionally, while the U.S. will support Israel against attacks, the current U.S. administration is unlikely to support Israel in a major offensive action against Iran, including attacks on Iranian nuclear facilities and attacks on Iran’s oil and gas infrastructure – especially with the presidential election on the horizon. Furthermore, such an aggressive move cannot be taken without considering the response from China, which is a supporter of Iran and the most significant buyer of Iranian crude oil. Without U.S. support, Israel will find it difficult to carry out these types of attacks with access to only fighter jets, which do not have the necessary range to reach the required targets. Therefore, we think the probability of major conflict between Israel and Iran is much lower than reflected by the price increase of last week – and as such, it is highly unlikely that there will be any material interruption to the flow of oil.

Oil prices are getting support from positive news about the U.S. economy with the surprisingly strong jobs report for September, which showed that the US economy added 254,000 jobs. Additionally, the August jobs report was revised upwards by 17,000 to 144,000 jobs and the July jobs report was revised upwards by 55,000 to 159,000 jobs. With the increase in jobs during September, the unemployment rate fell to 4.1% from the previous 4.2%. Average hourly wages increased by 0.4% on a month-to-month basis and by 4.0% on an annual basis. The U6 unemployment rate (includes discouraged workers and those holding part-time jobs for economic reasons) is 7.7% and the labor force participation rate is 62.7%. Additional good news is associated with the suspension of the port strike that was affecting ports along the eastern seaboard and the Gulf Coast with the extension of the current contract until January 15, 2025. A tentative agreement was reached on wages with the issue pertaining to automation still to be resolved. The three-day work stoppage at the ports, however, is expected to take around three weeks to clear the backlog of ships waiting to offload their cargoes. In contrast to the U.S., recent data pertaining to China’s economy continue to be disappointing. Last week, the official PMI for China’s manufacturing sector provided by the National Bureau of Statistics remained below 50 with the September reading coming in at 49.8 (a reading below 50 indicates contraction) and is the fifth consecutive month of a reading below 50. The index for total new orders was 49.9, while the index for employment was 48.2 – the thirteenth consecutive month of a reading below 50. As we pointed out last week, while China recently announced a stimulus plan that includes lower interest rates, the plan does little in the way of providing support for the consumers and domestic demand – instead, it is focused on supporting the sectors that China is already over-dependent on for growth – namely, the manufacturing sector and real estate sector.

For the upcoming week, we are expecting that oil prices will drift downwards unless there is another military strike of note; however, we think that is unlikely during the upcoming week.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Riverstone’s Leuschen Plans to IPO Methane-Mitigation-Focused SPAC

2025-01-21 - The SPAC will be Riverstone Holdings co-founder David Leuschen’s eighth, following the Permian Basin’s Centennial Resources, the Anadarko’s Alta Mesa Holdings and the Montney’s Hammerhead Resources.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.