As Stratas Advisors predicted in last week’s edition of What’s Affecting Oil Prices, Brent crude prices pulled back last week as traders began to grow weary of the recent price rally, averaging $55.68/bbl.

This week, Stratas Advisors expect more price declines as the market remains weary. Stratas Advisors expect prices to average $54.50 this week with U.S. crude stocks remaining generally flat—an increase of 90,000 barrels (bbl). Stratas Advisors also expects a large decline in diesel—3.4 million barrels (MMbbl)—but only a small draw from gasoline inventories—120,000 bbl.

Geopolitical: Positive

Iran returns to the limelight with the potential for President Trump to decertify the nuclear deal. While decertification is not likely to have any immediate impacts on the long-term prospects of the deal in and of itself, it could begin laying the foundation for an eventual reversal of the deal and, in the meantime, will drive up geopolitical uncertainty. Stratas Advisors does not expect the market to react aggressively in the short term, but investors will be watching this closely. This is happening in parallel with continued offline talks between the Russians and key OPEC members in regard to an extension of the existing OPEC/non-OPEC agreement. At this stage, however, few commitments have been made and it remains an outstanding variable, despite Stratas’ view that a cut extension is all but certain.

Dollar: Negative

The dollar’s relationship with crude remains strong, and its strengthening last week has kicked out some support for crude. Despite disappointing job numbers on Oct. 6, the market widely regarded the first fall in U.S. employment in seven years as a blip due to weather (i.e. hurricanes) and did not see it as structural. As the market continues to anticipate a rate hike from the Federal Reserve in December, this, combined with more optimism around the prospects of tax reform, is likely to support the dollar in the coming weeks.

Trader Sentiment: Negative

In general, hedge fund managers have begun to slowly pull back their long positions as the market has begun to believe the commodity is overbought. Due to the fall in prices last week, Stratas Advisors expects the momentum to continue this week as fund managers look to take profits from recent price performance. While a net long drop of one MMbbl—on a net basis on both CFTC and ICE—is not substantial, net longs have increased by 109 million contracts over the past three weeks, showing a trend reversal that is likely to continue.

Supply: Positive

Last week, the Baker Hughes (NYSE: BHGE) oil-directed rig count fell by two to 748, when compared to the week before. This reinforces the narrative that U.S. shale producers are facing both capital and operational challenges, and their pain supports overall market rebalancing. In the U.S., Tropical Storm/Hurricane Nate has disrupted more than 90% of Gulf of Mexico’s oil production, which is also likely to support tightening global supply, temporarily. Globally, OPEC continues to send signals to the market that further intervention is the most likely path.

Demand: Negative

According to the latest EIA data, the U.S. has seen some weakening in demand, both when comparing to the previous week and the same week in 2016. While overall demand sentiment remains positive, a lack of data releases last week is likely to create some weight on prices.

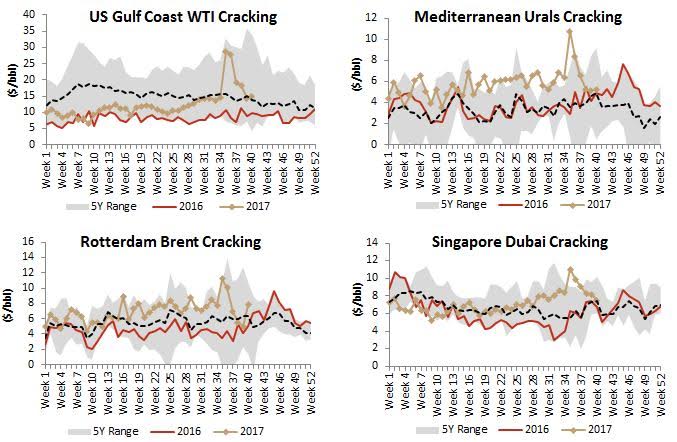

Refining: Neutral

Refining: Neutral

Refining margins were a mixed bag last week, with declines in Singapore, increases in Europe and general flatness in the U.S. While some uptick in utilization after Hurricane Nate is possible this week, Stratas Advisors does not expect it to have a material impact on crude prices or refining margins.

How We Did

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

Shale Outlook: E&Ps Making More U-Turn Laterals, Problem-Free

2025-01-09 - Of the more than 70 horseshoe wells drilled to date, half came in the first nine months of 2024 as operators found 2-mile, single-section laterals more economic than a pair of 1-mile straight holes.

Darbonne: The Power Grid Stuck in Gridlock

2025-01-05 - Greater power demand is coming but, while there isn’t enough power generation to answer the call, the transmission isn’t there either, industry members and analysts report.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.