The price of Brent crude ended the week at $72.18 after closing the previous week at $71.47. The price of WTI ended the week at $69.24 after closing the previous week at $68.16. The price of DME Oman crude ended the week at $72.03 after closing the previous week at $71.55.

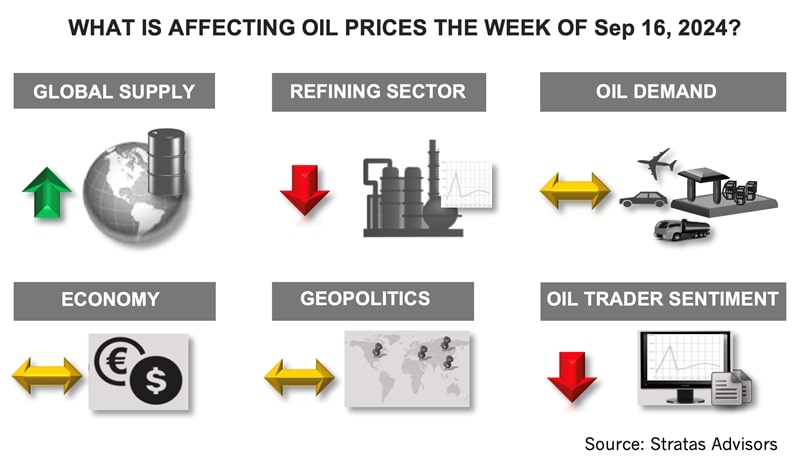

Oil prices got a boost from the disruption to oil supply associated with the hurricane in the Gulf of Mexico which affected about 30% of production in the Gulf of Mexico. According to the Bureau of Safety and Environmental Enforcement around 520,000 bbl/d of production remained offline as of Sep.t 14.

Additionally, Libya’s oil production and exports continue to be disrupted despite the two competing sides in Libya – Government of National Unity, which is recognized by the United Nations and the government based in Tobruk, established by the former dissident parliament and its military wing, Libyan National Army, which is commanded by Field Marshal Khalifa Haftar – reaching an agreement on the process for appointing the Central Bank Governor and board of directors. Last week, Libya’s oil exports decreased by around 33%, falling to around 315,000 bbl/d.

The impact of any temporary loss of supply, however, is partially offset by the extent of spare capacity associated with OPEC+’s shut-in capacity.

The sentiment of oil traders continues to be extremely negative because of concerns about oil demand and is putting significant downward pressure on oil prices. Last week, traders of WTI decreased their net long positions by reducing their long positions and increasing their short positions. Net long positions have decreased in six of the last eight weeks. During this period, net long positions have decreased by 61%. Traders of Brent crude also decreased their net long positions to the point that traders are holding more short positions than long positions.

We think the sentiment of oil traders, however, will shift to being more positive, as we are forecasting that supply/demand fundamentals will improve over the course of the next few months with demand outpacing supply. With expectations for more favorable supply/demand fundamentals and improvement in the sentiment of oil traders, we are forecasting higher oil prices with the price of Brent crude moving back above $80.

For the upcoming week, we are expecting that oil prices will drift sideways.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Energy Spectrum, UGI JV Buys Three Appalachia Gathering Systems

2025-01-28 - Pine Run Gathering LLC, a joint venture between Energy Spectrum Partners and UGI Corp., purchased three gathering systems in Pennsylvania from Superior Midstream Appalachian LLC.

Chord Drills First 4-Mile Bakken Well, Eyes Non-Op Marcellus Sale

2025-02-28 - Chord Energy drilled and completed its first 4-mile Bakken well and plans to drill more this year. Chord is also considering a sale of non-op Marcellus interests in northeast Pennsylvania.

Antero Stock Up 90% YoY as NatGas, NGL Markets Improve

2025-02-14 - As the outlook for U.S. natural gas improves, investors are hot on gas-weighted stocks—in particular, Appalachia’s Antero Resources.

Matador Touts Cotton Valley ‘Gas Bank’ Reserves as Prices Increase

2025-02-21 - Matador Resources focuses most of its efforts on the Permian’s Delaware Basin today. But the company still has vast untapped natural gas resources in Louisiana’s prolific Cotton Valley play, where it could look to drill as commodity prices increase.

Acquisitive Public Minerals, Royalty Firms Shift to Organic Growth

2025-04-04 - Building diverse streams of revenue is a key part of growth strategy, executives tell Oil and Gas Investor.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.