The price of Brent crude ended the week at $74.72 after closing the previous week at $72.18. The price of WTI ended the week at $71.77 after closing the previous week at $69.24. The price of DME Oman crude ended the week at $74.32 after closing the previous week at $72.03.

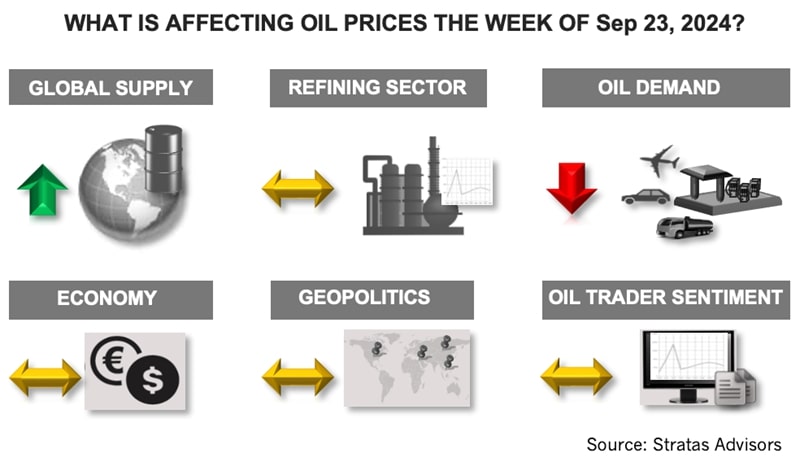

Oil prices got a boost from the U.S. Federal Reserve reducing interest rates for the first time since 2020 to a range of 5.25% to 5.5% to 4.75% to 5% with a cut of 50 basis points. Chairman of the Federal Reserve Jerome Powell stated that the 50-basis point cut, instead of the more typical 25 basis point cut, should be taken as a sign of the Federal Reserve’s commitment to not get behind a potential economic downturn – and not as a sign that the Federal Reserve is concerned about the U.S. economy.

Regardless, the Federal Reserve made this aggressive move while core inflation (minus food and energy) was still well above its 2% inflation target at 3.2%. The core personal consumption expenditures (PCE) rate, which is the Federal Reserve’s preferred measurement of inflation, was 2.6% in July and the August data is to be released Sept. 27. With the rate cut, the U.S. dollar index finished last week at 100.82 and has dropped significantly from 106.05 on July 26 of this year.

Additionally, traders of WTI increased their net long positions. Prior to last week, traders had reduced their net long positions in six of the last eight weeks. Despite last week’s increase, net long positions are still nearly 50% below the level seen on July 16 of this year. Traders of Brent crude increased their net long positions slightly, but still are negative with more short positions than long positions.

For the upcoming week, oil prices could get a boost from another storm forming in the Gulf of Mexico that could be a hurricane by the evening of Sept. 25 and possibly affect much of the eastern Gulf Coast. The previous storm that occurred two weeks ago affected 30% of the oil production in the U.S. Gulf of Mexico. The situation in Libya could also provide a boost. Libya’s oil exports decreased by 80% two weeks ago (from around 1.2 MMbbl/d) and while exports increased last week to around 550,000 bbl/d the underlying dispute has not been resolved.

As has been the case for most of this year, oil prices continue to be dampened not only by concerns about the global economy and the stability of oil demand but also by the market’s dismissal of geopolitical concerns, even as the two major conflicts continue to move towards major escalation. So far, the impact on the oil market and prices has been muted because the flow of oil has continued, for the most part, unabated.

We expect this will remain the case unless there is some unexpected interruption to the flow of oil since oil sanctions have had a limited impact. The ability of Russia to get around the sanctions is illustrated by reports from government sources that Indian refiners are negotiating to purchase Russian oil for next year for crude priced about the $60 price cap by using suppliers that make use of Russian insurance providers. Russia has become the leading supplier of oil for India and Russia’s leading destination for seaborne oil.

For the upcoming week, we are expecting that oil prices will move upwards and the price of Brent crude oil will test the $77 level.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Oklahoma E&P Canvas Energy Explores Midcon Sale, Sources Say

2025-04-04 - Canvas Energy, formerly Chaparral Energy, holds 223,000 net acres in the Anadarko Basin, where M&A has been gathering momentum.

Chord Drills First 4-Mile Bakken Well, Eyes Non-Op Marcellus Sale

2025-02-28 - Chord Energy drilled and completed its first 4-mile Bakken well and plans to drill more this year. Chord is also considering a sale of non-op Marcellus interests in northeast Pennsylvania.

Early Innings: Uinta’s Oily Stacked Pay Exploration Only Just Starting

2025-03-04 - Operators are testing horizontal wells in less developed Uinta Basin zones, including the Douglas Creek, Castle Peak, Wasatch and deeper benches.

‘Golden Age’ of NatGas Comes into Focus as Energy Market Landscape Shifts

2025-03-31 - As prices rise, M&A interest shifts to the Haynesville Shale and other gassy basins.

Streaming On-Demand: Expand Shifts to Just-in-Time NatGas TILs

2025-03-07 - Expand Energy’s just-in-time TIL model—turning new wells inline into sales—could shorten receipt of returns by up to two years.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.