The price of Brent crude ended the week at $71.98 after closing the previous week at $74.72. The price of WTI ended the week at $68.94 after closing the previous week at $71.77. The price of DME Oman crude ended the week at $71.00 after closing the previous week at $74.32.

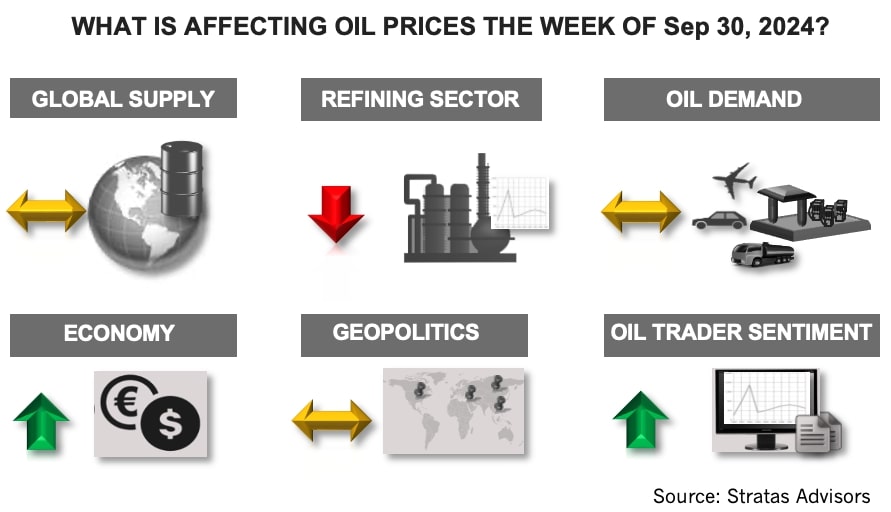

Prices fell in the second half of the week, in part, because Hurricane Helene did not have a major impact on oil production in the U.S. Gulf of Mexico.

While Hurricane Helene affected around 25% of crude oil production in the Gulf of Mexico early last week, according to the Bureau of Safety and Environmental Enforcement (BSEE), by Sept. 24, efforts were initiated to start bringing back the shut-in production.

An interesting piece of news from last week is the report by the Financial Times that Saudi Arabia is ready to abandon the $100 crude target in exchange for taking back market share. From our viewpoint, this is not as dramatic of a development as implied by the headline. First, $100 oil is not a reasonable expectation, given the current market dynamics, without a major disruption to the oil supply. Additionally, it is our view that the purpose of the leak is to issue a warning to the market that Saudi Arabia is not willing to take on the burden of reducing production to support oil prices by itself. This warning is meant mainly for other members of OPEC+ — especially those who have been overproducing and have promised to reduce future production to account for their earlier overproduction but have yet to do so — including Russia, Iraq and Kazakhstan.

It is imperative that OPEC+ exhibits cohesive and disciplined behavior to maintain credibility, especially when the sentiment of the oil traders is already very negative. The warning is also for non-OPEC producers — including U.S. shale producers. Saudi Arabia wants to make sure that these producers consider the risk of significantly lower oil prices when making capital investment decisions. Based on our demand forecast (which is somewhat higher than the IEA’s, but significantly lower than the forecast from the research arm of OPEC) there is room for Saudi Arabia to increase supply gradually and not collapse oil prices — if there is no dramatic increase in non-OPEC supply (which we do not expect) and the other members of OPEC+ do not grossly exceed their quotas.

Oil prices have been negatively affected most of the year because of concerns about the strength of the global economy – and especially so with respect to China’s economy. At the end of last week, China moved forward with a stimulus plan that included lower interest rates and the issuing of 2.0 trillion yuan (around US$285 billion) of special sovereign bonds. Additionally, China’s central bank reduced the reserve requirement ratio by 50 basis points, which will add 1.0 trillion yuan (around US$142 billion) to the banking system. There are also expectations that China will announce more measures to boost economic growth during the upcoming week.

We are also monitoring the situation in Libya. Libya’s oil production and exports continue to be affected because of the fighting between the faction controlling the eastern part of Libya and the faction controlling the western part of Libya. Talks to resolve the differences were reinitiated last Wednesday.

Last week, we saw some signs that the oil traders are becoming less negative with oil traders of WTI increasing their net long positions (for the second consecutive week) by adding to their long positions while reducing their short positions. Traders of Brent crude also increased their net long positions in similar fashion by adding to their long positions while reducing their long positions. Additionally, net long positions associated with Brent crude moved back to being positive after several weeks when short positions exceeded long positions.

For the upcoming week, we are expecting that oil prices will drift upwards.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Momentum AI’s Neural Networks Find the Signal in All That Drilling Noise

2025-02-11 - Oklahoma-based Momentum AI says its model helps drillers avoid fracture-driven interactions.

PrePad Tosses Spreadsheets for Drilling Completions Simulation Models

2025-02-18 - Startup PrePad’s discrete-event simulation model condenses the dozens of variables in a drilling operation to optimize the economics of drilling and completions. Big names such as Devon Energy, Chevron Technology Ventures and Coterra Energy have taken notice.

Halliburton Secures Drilling Contract from Petrobras Offshore Brazil

2025-01-30 - Halliburton Co. said the contract expands its drilling services footprint in the presalt and post-salt areas for both development and exploration wells.

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-16 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

Digital Twins ‘Fad’ Takes on New Life as Tool to Advance Long-Term Goals

2025-02-13 - As top E&P players such as BP, Chevron and Shell adopt the use of digital twins, the technology has gone from what engineers thought of as a ‘fad’ to a useful tool to solve business problems and hit long-term goals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.