The price of Brent crude ended the week at $71.47 after closing the previous week at $76.93. The price of WTI ended the week at $68.16 after closing the previous week at $73.55. The price of DME Oman crude ended the week at $71.55 after closing the previous week at $76.37.

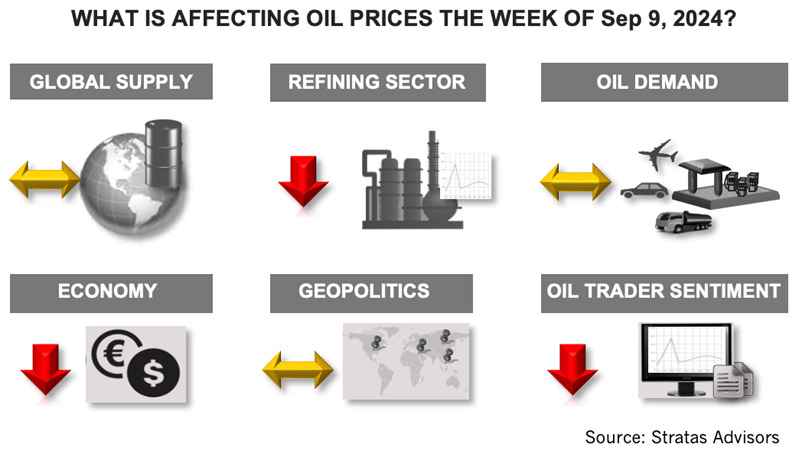

While there has been a range of geopolitical developments that could affect the oil market, the impact has been muted because the flow of oil has continued, for the most part, unabated. Consequently, the oil market is currently dismissing the risk associated with the conflicts in the Middle East and between Russia and Ukraine. Additionally, oil exports from Libya are returning to the market—which is removing another geopolitical concern, at least for now.

While the latest EIA report indicated that U.S. crude inventories decreased by 6.87 MMbbl, crude inventories are similar to the level of the previous year (418 MMbbl vs. 416 MMbbl and to the inventory levels in 2019 (418 MMbbl vs. 423 MMbbl).

As such, the disappointing news about the major economies and concerns about oil demand have moved to the forefront and the latest round of economic data did not provide much cause for optimism. The August jobs report for the U.S. shows that the U.S. added 142,000 jobs in August, which compares to only 89,000 jobs in July. Additionally, the unemployment rate decreased to 4.2% from 4.3%. While an improvement over July, the number of jobs added in August is well below the average monthly job gains of 202,000 over the previous 12 months. The underlying data are not robust with private sector jobs increasing by only 74,000 while full-time jobs decreased by 438,000 and part-time jobs increasing by 527,000.

Additionally, the number of manufacturing jobs decreased by 24,000. The loss of manufacturing jobs is consistent with the latest PMI from the Institute for Supply Management (ISM) which came in at 47.2. While the latest reading is an increase from 46.8 in July, the reading is still below 50 (for the fifth consecutive month), which indicates contraction.

Furthermore, there has not been a rebound in the manufacturing sector, despite the passing of the Inflation Reduction Act, with essentially no increase in the number of people working in the manufacturing sector since September 2022—and even with the post-COVID rebound—the number of people working in the manufacturing sector is no more than in November 2019. As has been the case, China’s economic data continues to cause concern. The manufacturing sector, according to China’s National Bureau of Statistics, is at its lowest level since February and has been in contraction for the last four months. China’s service sector is also showing weakness with growth slowing in August.

Within the context of lower oil prices and disappointing economic data, members of OPEC+ have decided to delay the unwinding of voluntary cuts of 2.2 MMbbl/d (out of the total cuts of 5.86 MMbbl/d), which were scheduled to start unwinding in September. On Sept. 5, OPEC+ announced that cuts are now planned to start being phased out in December and continue until November 2025.

With the extension of the cuts by OPEC+ and our outlook for non-OPEC supply, coupled with our more optimistic outlook for demand (in comparison with IEA), we think the fundamentals will be improving for the oil market during the next few months, which result in higher oil prices—once the sentiment of oil traders improves. Given all the negative news, the sentiment of oil traders has become very bearish. Last week, traders of WTI decreased their net long positions by reducing their long positions and increasing their short positions. Net long positions have decreased in five of the last seven weeks. During this period, net long positions have decreased by 53%. Traders of Brent crude also decreased their net long positions by reducing their long positions while increasing their short positions. The net long positions are exceptionally low.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Trump Says 25% Canada, Mexico Tariffs to Take Effect March 4

2025-03-03 - Financial markets fell on news that President Donald Trump would enact 25% tariffs on Mexico and Canada and both countries promised to respond.

US Tariffs on Canada, Mexico Hit an Interconnected Crude System

2025-03-04 - Canadian producers and U.S. refiners are likely to continue at current business levels despite a brewing trade war, analysts say.

Oil Prices Fall into Negative Territory as Trump Announces New Tariffs

2025-04-02 - U.S. futures rose by a dollar and then turned negative over the course of Trump's press conference on April 2 in which he announced tariffs on trading partners including the European Union, China and South Korea.

Trump to Host Top US Oil Chief Executives as Trade Wars Loom

2025-03-19 - U.S. President Donald Trump will host top oil executives at the White House on March 19 as he charts plans to boost domestic energy production in the midst of falling crude prices and looming trade wars.

Trump Fires Off Energy Executive Orders on Alaska, LNG, EVs

2025-01-21 - President Donald Trump opened his term with a flurry of executive orders, many reversing the Biden administration’s policies on LNG permitting, the Paris Agreement and drilling in Alaska.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.