To keep the system operational, Williams must request a temporary certificate from the FERC while the agency reviews the court’s decision. (Source: Shutterstock/ Williams Cos.)

After a D.C. court vacated a permit for a pipeline project running through five mid-Atlantic states, Williams Cos. filed with the Federal Energy Regulatory Commission (FERC) on Sept. 6 for a temporary emergency certificate to keep the system running.

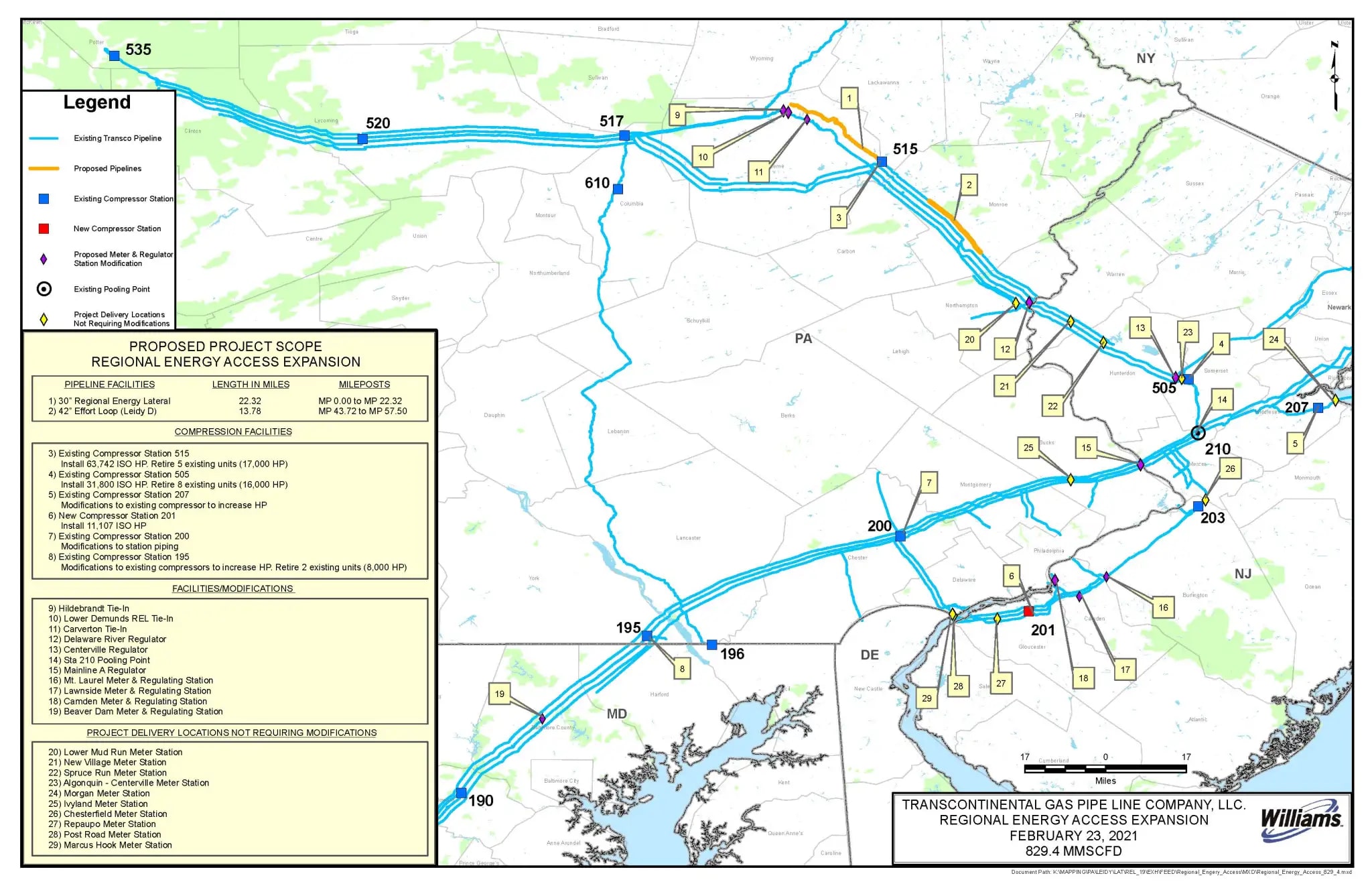

In July, the Court of Appeals, D.C. Circuit, invalidated a FERC permit from Transcontinental Gas Pipe Line Co., a subsidiary of Williams, for the Regional Energy Access (REA) project. The REA is a $950 million expansion project adding about 829,000 dekatherms of energy capacity a day to an already existing pipeline system, able to serve 4.4 million homes.

To keep the system operational, Williams must request a temporary certificate from the FERC while the agency reviews the court’s decision.

“We anticipate FERC will issue a temporary certificate prior to the date the mandate is issued by the court,” a Williams spokesperson wrote in a statement to Hart Energy. According to the request filed by Williams, the FERC has until Sept. 20 to issue the temporary permit.

Transco warned that taking the REA offline would affect the overall system, thereby cutting natural gas delivery into the area by 22.6% and posing risks to customers trying to provide heat during a potential winter storm.

In July, the three-judge appeals court panel ruled that, in awarding the permits, the FERC “failed to adequately explain its decision to not make a significance determination regarding greenhouse gas emissions and failed to discuss possible mitigation measures.”

The decision was part of a set of rulings the court has made against the FERC dating back to the start of the summer. All of the rulings include a demand that the FERC reconsider its decisions regarding a project’s potential effect on greenhouse gas emissions.

In each case, environmental groups brought the lawsuits, which have primarily focused on FERC permits for LNG facilities. On Aug. 6, the court vacated the permits for two South Texas LNG projects, Rio Grande LNG and Texas LNG.

Analysts for Arbo, a company following the political process for energy policy, predicted that Williams will be able to continue operating the REA for the time being.

“We think it is likely that the commission will grant the temporary certificate for at least enough time to consider its merit and potentially longer after it has completed its analysis,” Arbo wrote in an analysis of the Williams’ petition. The analysis added that the FERC will consider the effect of shutting down the project and disrupting service to the area.

The primary question facing commissioners may hinge on whether or not there are enough energy alternatives available to customers in the mid-Atlantic.

In its request, Williams cited an earlier case in which a temporary permit had been awarded. In the Spire STL Pipeline case in 2021, the commission noted that shutting down the line would deny service to more than 100,000 customers.

Williams requested the FERC follow the same reasoning, noting that shutting down the REA would cut off 2 Bcf/d of natural gas from the area.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

BP Pledges Strategy Reset as Annual Profit Falls by a Third

2025-02-11 - BP CEO Murray Auchincloss pledged on Feb. 11 to fundamentally reset the company's strategy as it reported a 35% fall in annual profits, missing analysts' expectations.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.